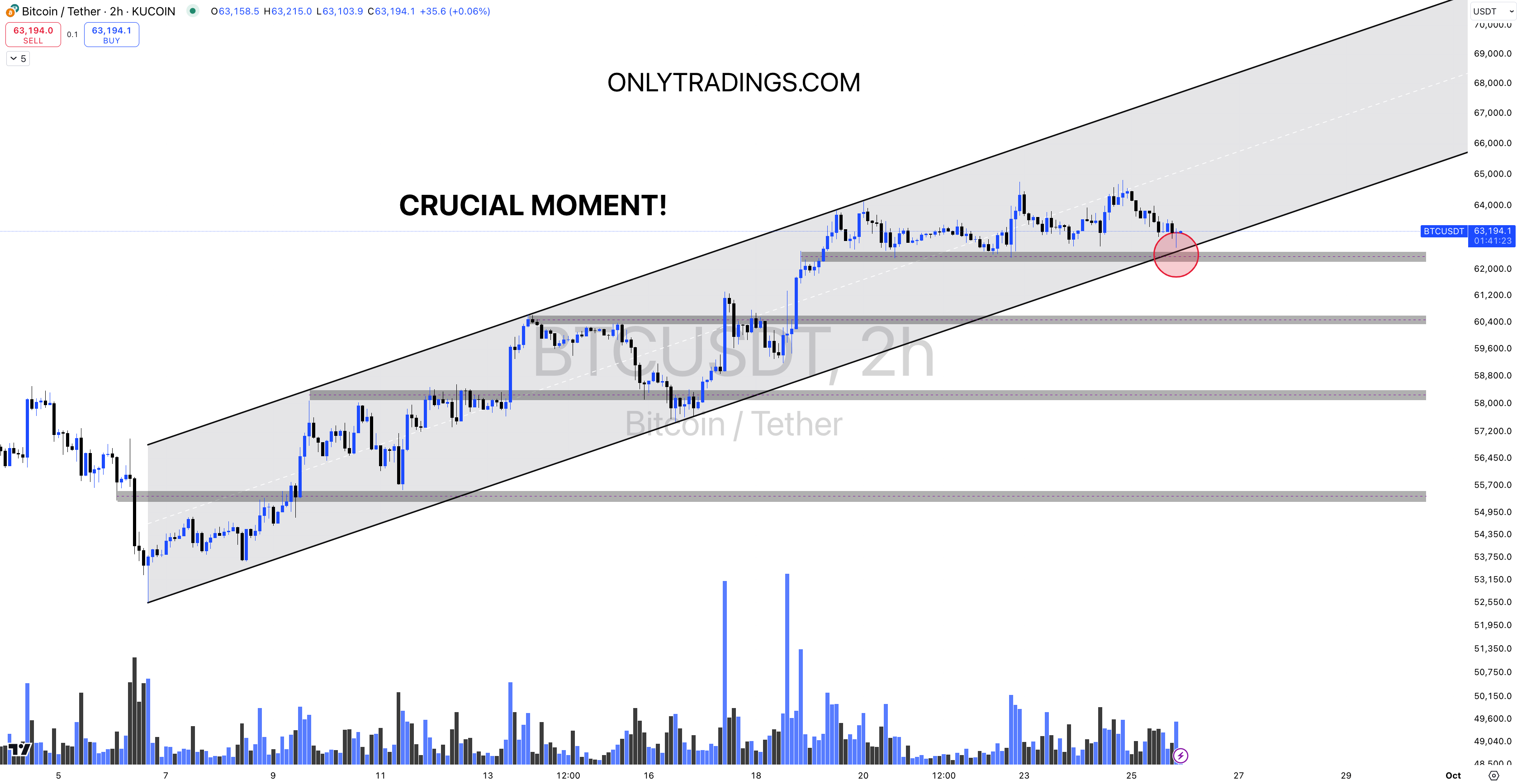

BTC/USDT at a Crucial Turning Point:

Will the Support Hold or Break?

Instrument: BTC/USDT

Time Frame: 2 hour

Exchange: KuCoin

Trading Type: Swing Trading

Key Observations:

#1. Ascending Channel:

- The price action is contained within a well-defined ascending channel. The upper and lower bounds of this channel are acting as dynamic resistance and support, respectively.

- Bitcoin is currently testing the lower boundary of this ascending channel, which is a critical support level.

#2. Crucial Moment:

- The text "CRUCIAL MOMENT!" highlights the significance of this point, indicating that the price is at a make-or-break level. A bounce from this level would confirm the continuation of the uptrend within the channel, while a break below would suggest a potential shift in momentum.

#3. Support Levels:

- There are several horizontal support zones marked in the chart, with the current price testing one of these zones around $62,400 to $63,000. This region could act as strong support.

- Additional support levels lie below at approximately $60,000, $58,450, and $57,000, providing potential areas where the price might find buyers if it breaks below the current support.

#4. Potential Scenarios:

- Bullish Scenario: If Bitcoin respects the lower boundary of the channel and the support zone, we could see a bounce back toward the midline or the upper channel boundary, targeting levels around $66,000 to $70,000.

- Bearish Scenario: A decisive break below the lower channel boundary and the immediate support zone (red circle) would invalidate the ascending channel pattern, leading to a possible correction toward lower support zones around $60,000 or even $57,000.

Conclusion:

Bitcoin is at a pivotal moment within its ascending channel. Traders should watch closely for confirmation of either a bounce or a break below the support zone. A sustained move above the lower channel boundary could reinforce the bullish trend, while a break below would signal a potential shift to a bearish trend. Risk management is essential when trading around these critical levels, as volatility could increase in this "crucial moment."