Stellar (XLM) Coin Analysis Report

1. Overview

Stellar (XLM) is the native cryptocurrency of the Stellar network, an open-source blockchain designed to facilitate fast, low-cost, and cross-border financial transactions. Launched in 2014 by Jed McCaleb, the co-founder of Ripple, and the Stellar Development Foundation (SDF), Stellar aims to connect financial institutions, payment systems, and individuals, making it easier to transfer money across borders with minimal fees and delays.

Stellar distinguishes itself with a focus on improving financial inclusion, particularly in underbanked and unbanked regions, by bridging the gap between traditional banking systems and blockchain technology.

2. Technical Features

2.1 Stellar Consensus Protocol (SCP)

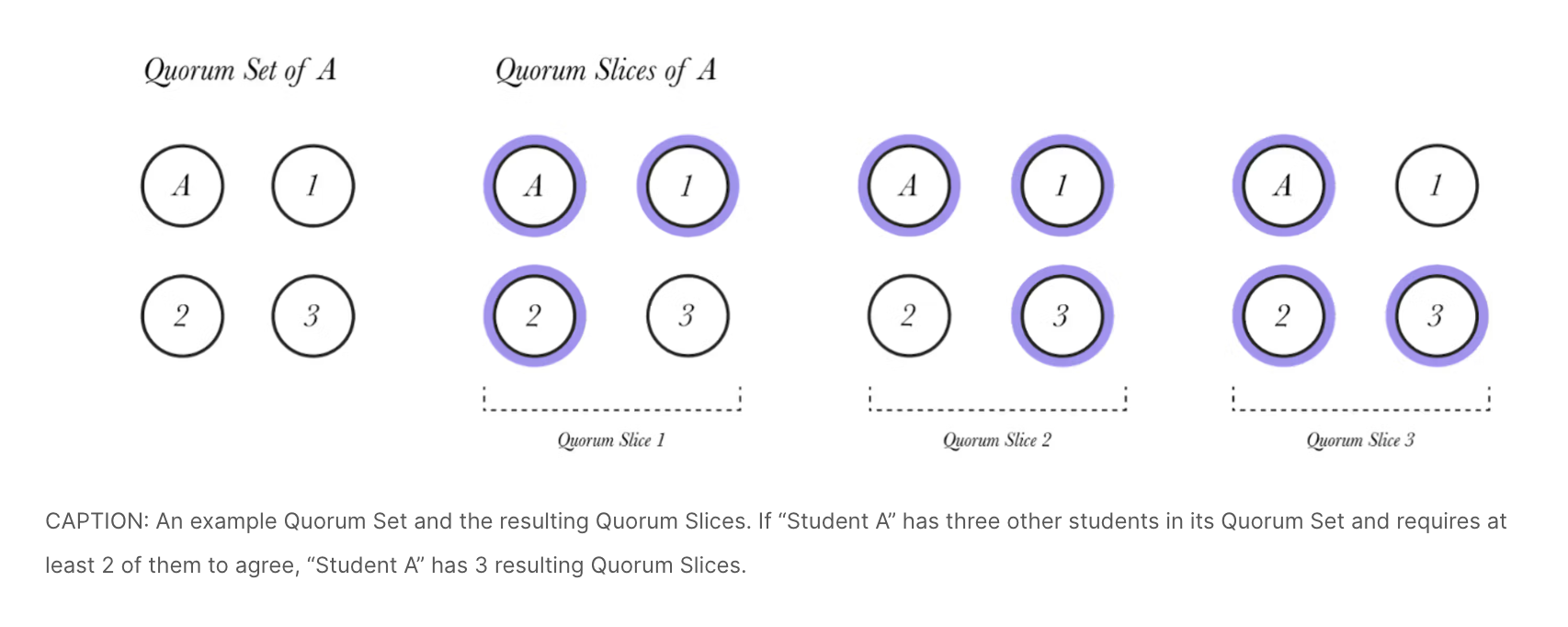

- Unlike traditional proof-of-work (PoW) or proof-of-stake (PoS) mechanisms, Stellar employs the Stellar Consensus Protocol (SCP), which uses a federated byzantine agreement model.

- SCP allows the network to achieve fast and efficient consensus, with transactions being settled in 3-5 seconds.

- The protocol is energy-efficient, making Stellar an eco-friendly blockchain solution.

2.2 Low Transaction Costs

- Stellar offers transaction fees as low as 0.00001 XLM per transaction, making it a cost-effective solution for micropayments and remittances.

2.3 Token Issuance

- Stellar supports the issuance of custom tokens, enabling businesses to create stablecoins or other digital assets on its network.

- USDC (USD Coin) is natively supported on Stellar, making it a preferred choice for fiat-backed stablecoin transactions.

2.4 Anchors and Bridging

- Anchors act as intermediaries on the Stellar network, connecting blockchain with traditional financial systems by issuing digital representations of fiat currencies.

3. Use Cases

3.1 Cross-Border Payments

- Stellar enables seamless cross-border transactions by bridging different currencies, providing a fast and affordable alternative to traditional remittance services like SWIFT.

3.2 Financial Inclusion

- Stellar is actively used in regions with limited banking infrastructure, allowing individuals to send, receive, and hold digital assets without the need for a traditional bank account.

3.3 Tokenized Assets

- Businesses can tokenize fiat currencies, commodities, or other assets to operate on the Stellar network, creating digital representations of real-world assets.

3.4 Micropayments

- Low transaction fees make Stellar ideal for small, frequent transactions, such as subscription payments or rewards systems.

3.5 Stablecoins

- Stellar is widely used for stablecoin issuance, including USDC, which facilitates transparent and secure digital payments.

4. Tokenomics

4.1 XLM Token

- Utility: XLM serves multiple purposes, including paying transaction fees, bridging different fiat currencies, and providing liquidity for cross-border payments.

- Supply: Stellar initially issued 100 billion XLM tokens but later reduced it to 50 billion in a network-wide token burn in 2019 to enhance scarcity and value.

4.2 Distribution

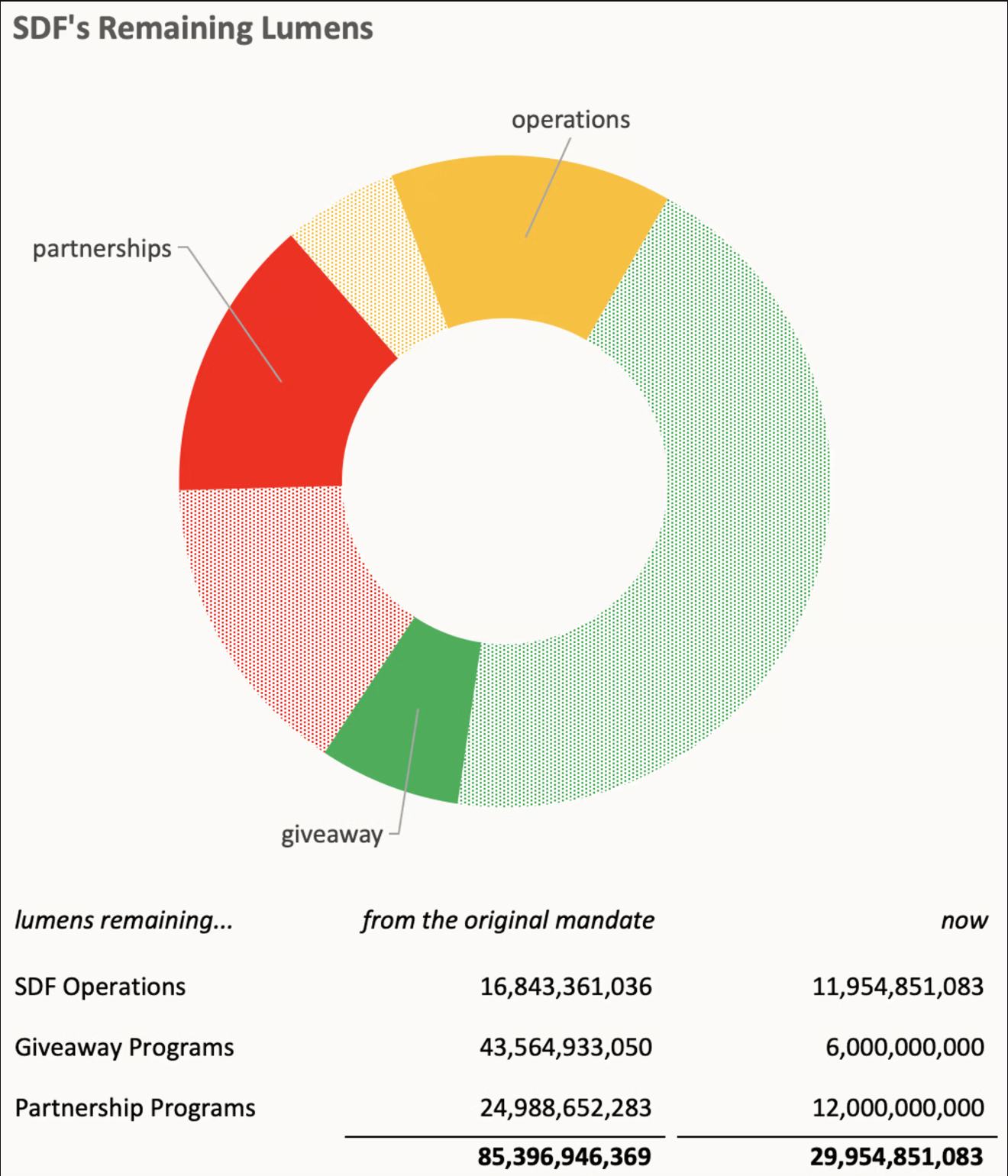

- Approximately 20 billion XLM are currently in circulation, with the Stellar Development Foundation holding the remaining supply for network development and grants.

4.3 Market Performance

- All-Time High: $0.94 (January 2018).

- Market Cap: Stellar consistently ranks among the top 30 cryptocurrencies by market capitalization.

5. Competitive Analysis

| Category | Stellar (XLM) | Ripple (XRP) | Ethereum (ETH) | Solana (SOL) |

|---|---|---|---|---|

| Consensus Mechanism | SCP | Ripple Consensus | PoW → PoS | PoH + PoS |

| Transaction Speed | ~3-5 seconds | ~3-5 seconds | ~15 seconds | ~1 second |

| Transaction Fees | Very Low | Very Low | High | Low |

| Primary Use Cases | Payments, Remittance | Bank Transfers | DeFi, NFTs, dApps | DeFi, NFTs |

| Eco-Friendliness | High | Medium | Medium | High |

6. Strengths and Risks

6.1 Strengths

- Fast and Affordable Transactions: Stellar’s transaction speed and low fees make it ideal for cross-border payments and micropayments.

- Financial Inclusion: The network’s focus on underbanked populations positions it as a leader in global financial accessibility.

- Stablecoin Integration: Native support for USDC and other tokens enhances its utility for payments and remittances.

- Eco-Friendly Design: Stellar’s consensus mechanism is energy-efficient, aligning with global sustainability goals.

6.2 Risks

- Competition: Stellar faces strong competition from Ripple (XRP) in cross-border payment solutions and from other blockchain networks in token issuance and DeFi.

- Regulatory Risks: Like all blockchain projects, Stellar is subject to evolving global regulations, particularly around cross-border financial services.

- Limited Ecosystem: Stellar’s ecosystem is less diverse compared to platforms like Ethereum and Solana, which support extensive DeFi and NFT applications.

- Centralized Perception: The Stellar Development Foundation holds a significant portion of XLM, raising concerns about decentralization.

7. Ecosystem and Partnerships

7.1 Ecosystem Growth

- Stellar hosts projects across remittances, tokenized assets, and payment gateways, including MoneyGram’s cross-border payment system using USDC on Stellar.

- Anchors like Tempo and Cowrie enable fiat on- and off-ramps for the Stellar network.

7.2 Partnerships

- MoneyGram: Integration with Stellar allows seamless USDC-based cross-border payments.

- Circle: USDC is natively supported on Stellar, enhancing its stablecoin capabilities.

- UNHCR: Stellar has been used in pilot programs to provide financial aid to refugees via blockchain-based digital wallets.

8. Future Outlook

Stellar’s focus on cross-border payments, financial inclusion, and tokenization positions it as a key player in blockchain-driven financial services. The network’s ongoing partnerships with major institutions and adoption in developing markets highlight its potential for growth.

Potential Developments

- Stablecoin Expansion: Increasing stablecoin adoption could drive more usage of Stellar’s network.

- Institutional Partnerships: Collaborations with financial institutions will enhance its global presence.

- DeFi Expansion: Although currently limited, Stellar could expand into DeFi by leveraging its fast and low-cost infrastructure.

9. Conclusion

Stellar (XLM) stands out as a blockchain solution focused on bridging traditional financial systems with blockchain technology. With its speed, low fees, and focus on financial inclusion, Stellar has carved a niche in the global payments and remittance sector. However, its success depends on continued ecosystem growth, partnerships, and the ability to compete in an increasingly crowded blockchain landscape.

References:

- Stellar Development Foundation Official Website

- Market Data from CoinGecko and CoinMarketCap

- Reports on Blockchain and Financial Inclusion

- Research on Cross-Border Payment Solutions