Is the U.S. stock market starting Q3 2024 with a decline in Google's value??

Hello, this is onlytradings.com.

As with any market, the third quarter has begun for the U.S. stock market. Today, we will focus on Google and Chat GPT to explore the fundamentals of the U.S. stock market in Q3 and examine a simple chart to understand the direction of the Nasdaq for this quarter.

What do you think about Google's search engine capabilities? Google's search engine is an incredible feature that has been fundamental to the company's success.

However, did you know that this powerful search engine could potentially be replaced by another company's technology?

What could be the alternative, then??

It's none other than Open AI's Chat GPT.

Despite being on the market for less than two years, GPT has demonstrated remarkable performance, to the extent that many people believe there is a significant difference between the world before and after GPT.

Why, then, are people turning to GPT and getting excited about it?

Perhaps it is due to GPT's high level of flexibility. To effectively use Google's search engine, one needs to employ somewhat standardized keywords. Even with precise keywords, if the desired information does not appear immediately, users might have to try numerous search terms and visit many sites to find what they need.

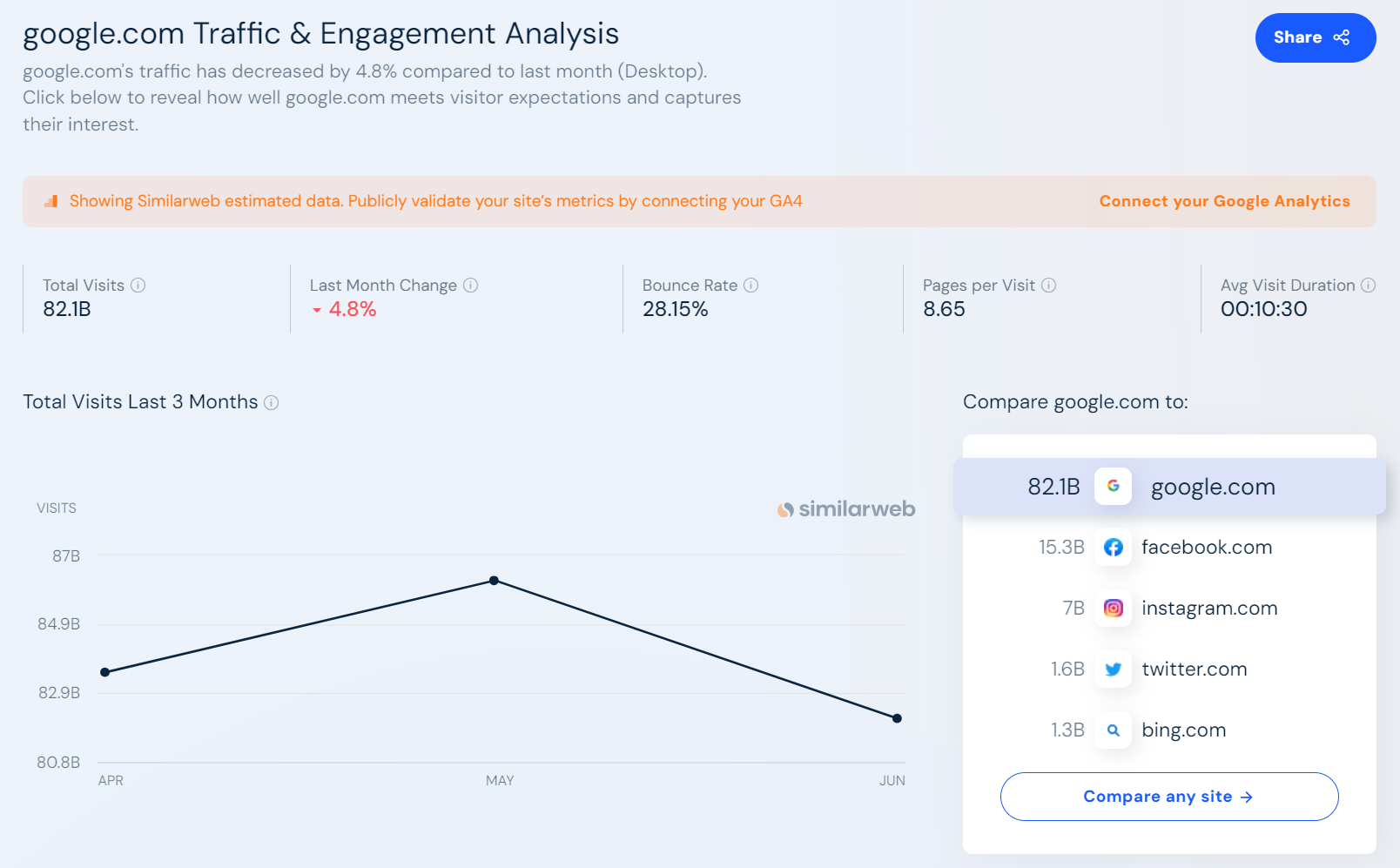

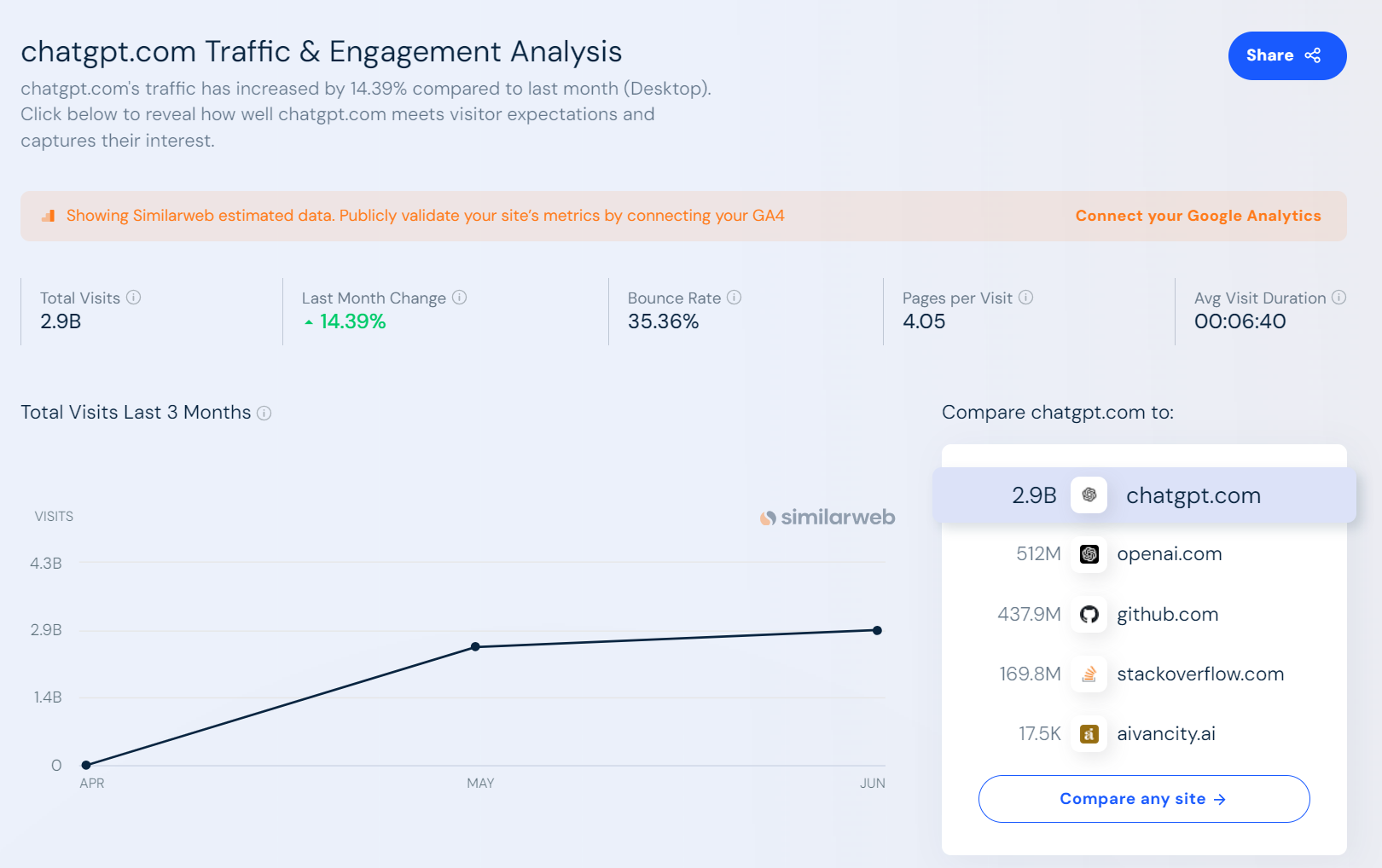

(Image source: Similarweb.)

Indeed, we can see that traffic to google.com is gradually decreasing, possibly due to these emerging alternatives.

However, in contrast, traffic to ChatGPT.com is steadily increasing.

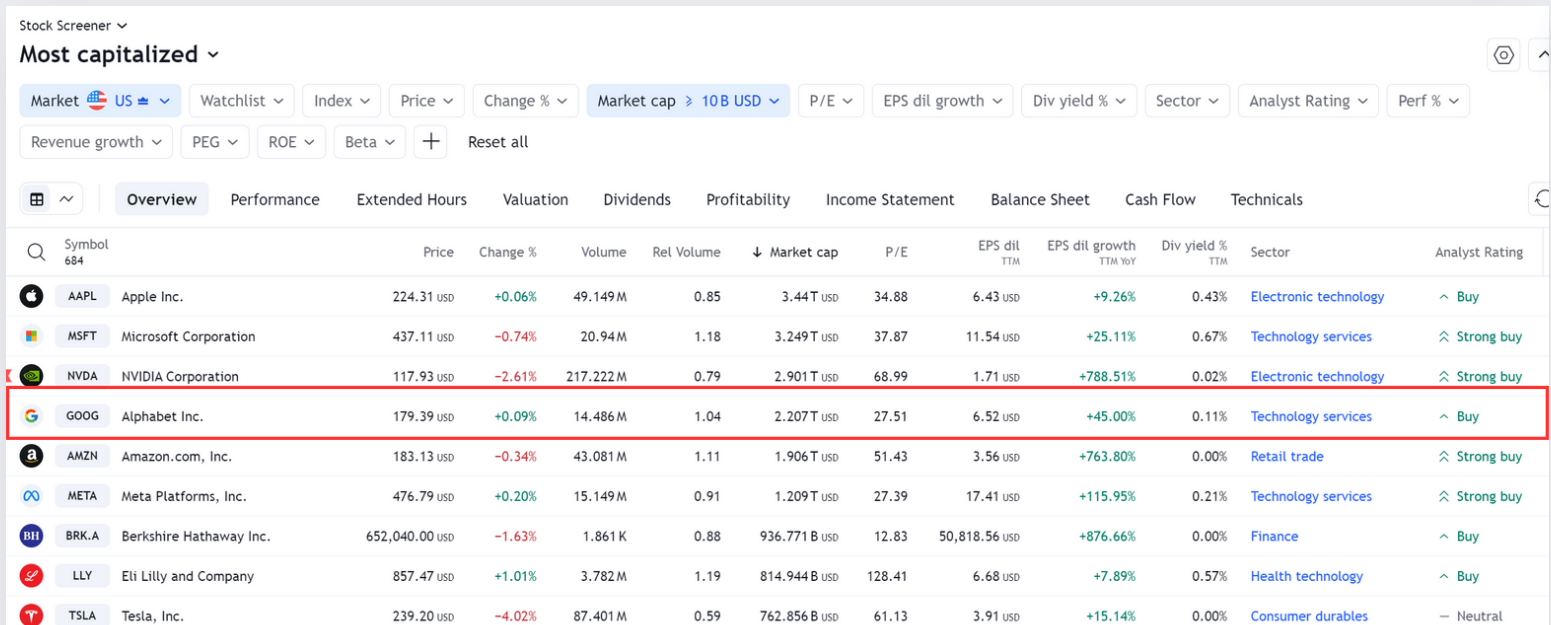

Let's take a look at Google's current stock price.

Indeed, when we look at Google's current stock price on a daily candlestick chart, we can see that the short-term trend Google was maintaining has been broken.

(Image source: TradingView.)

As we can see, Google is currently the fourth largest company in the U.S. by market cap. If Google's value were to decline, even temporarily, what impact would this have on the Nasdaq?

Let's also take a look at the Nasdaq chart.

By looking at the 4-hour chart of the Nasdaq, you can see that the short-term trend is also on the verge of breaking down, indicating a potential decline.

As explained above, by examining both the fundamentals and the actual price charts, we can anticipate that the U.S. stock market in Q3 might not be very favorable.

OnlyTradings.com does not definitively state that the stock market will decline.

However, we believe that with adequate preparation and foresight, you can achieve lower risks and higher returns.

We sincerely hope that by exploring the wealth of knowledge and resources available through OnlyTradings.com's The Market content, you can enjoy a safer and more enjoyable trading experience.

We will conclude today's article here.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.