TRU/USDT on the Brink: Boom or Crash?

Key Insights:

- Bullish Potential: A breakout above $0.1560 could trigger a significant rally towards higher resistance levels.

- Bearish Risk: Failure to break resistance might lead to a crash down to the support zone of $0.0617.

- Fundamental Strength: Strong market interest and a unique DeFi proposition bolster long-term prospects.

- Volatile Landscape: Mixed technical signals call for cautious trading amidst high volatility.

Technical Analysis

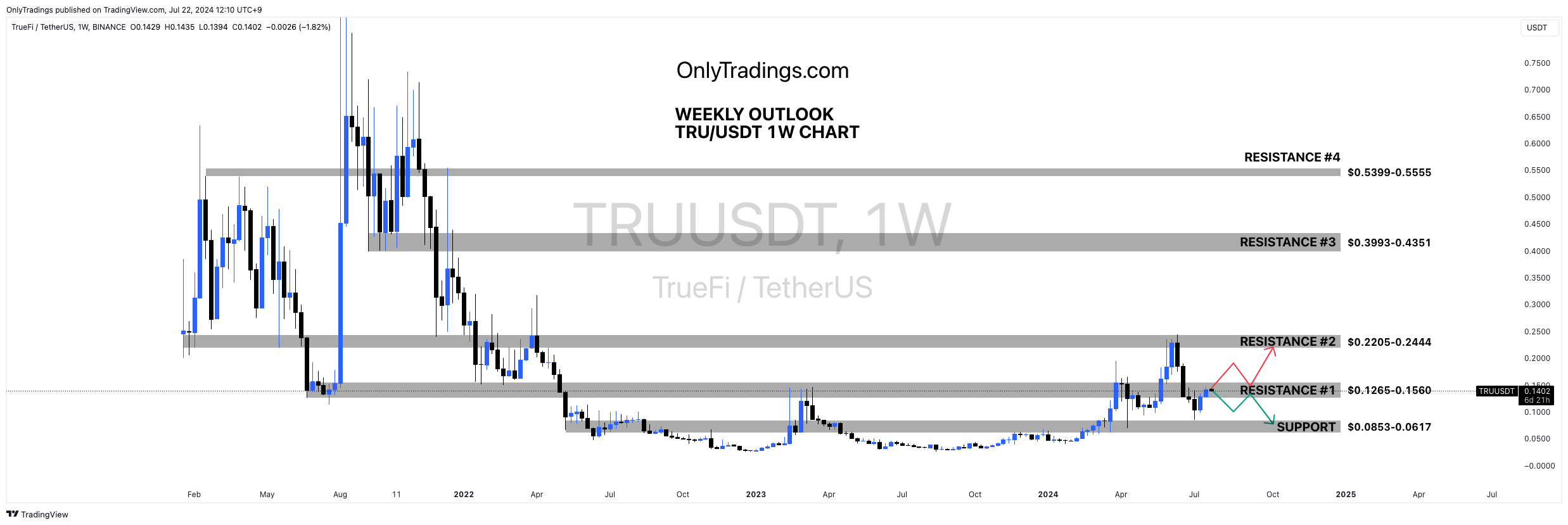

The attached weekly chart for TRU/USDT provides a comprehensive view of the key support and resistance levels, alongside potential bullish and bearish scenarios. The chart highlights the following key points:

-

Resistance Levels:

- Resistance #1: $0.1265 - $0.1560

- Resistance #2: $0.2205 - $0.2444

- Resistance #3: $0.3993 - $0.4351

- Resistance #4: $0.5399 - $0.5555

-

Support Level:

- Support: $0.0853 - $0.0617

Two scenarios are depicted:

- Bullish Scenario (Red Arrow): If TRU/USDT successfully breaks through the first resistance level ($0.1265 - $0.1560), it could potentially rise towards higher resistance levels.

- Bearish Scenario (Green Arrow): Failure to break through the first resistance level may lead to a decline towards the support zone ($0.0853 - $0.0617).

Fundamental Analysis

TrueFi (TRU) is a DeFi protocol that enables uncollateralized lending, providing a unique niche in the crypto lending space. Here are some key fundamental aspects:

-

Market Capitalization and Circulation:

- TRU has a circulating supply of approximately 1 billion coins and is ranked #225 based on market capitalization, which stands at around $155 million (CoinLore).

-

Use Case:

- TrueFi focuses on uncollateralized lending, offering an attractive value proposition for borrowers who prefer not to lock collateral, thus potentially increasing its adoption in the DeFi space.

-

Performance Metrics:

- The coin has shown significant growth, with its price increasing by over 300% in the last year. Despite this growth, it has experienced typical crypto market volatility (CoinLore).

-

Recent Developments:

- TrueFi has been actively developing its platform, integrating more lending opportunities and partnerships, which can drive its long-term value.

- As the DeFi sector continues to grow, TrueFi's unique approach to uncollateralized lending could become more attractive to both borrowers and lenders.

-

Community and Engagement:

- TrueFi has a growing community and is frequently mentioned in top cryptocurrency searches, indicating a strong interest and engagement from investors and traders (CoinLore).

Conclusion

While TRU/USDT shows promising potential, its future price movement will heavily depend on its ability to break through the first resistance level. The bullish scenario suggests significant upside potential if it can sustain above $0.1560, while the bearish scenario warns of a potential drop to the $0.0853 - $0.0617 support zone if it fails to breach this resistance.

Investors should consider both technical and fundamental factors when making decisions. The unique value proposition of TrueFi in the DeFi space, combined with its recent performance and market interest, suggests that it remains a noteworthy cryptocurrency to watch.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.