Navigating Market and Political Shifts: Opportunities Amidst Volatility

Key Takeaways

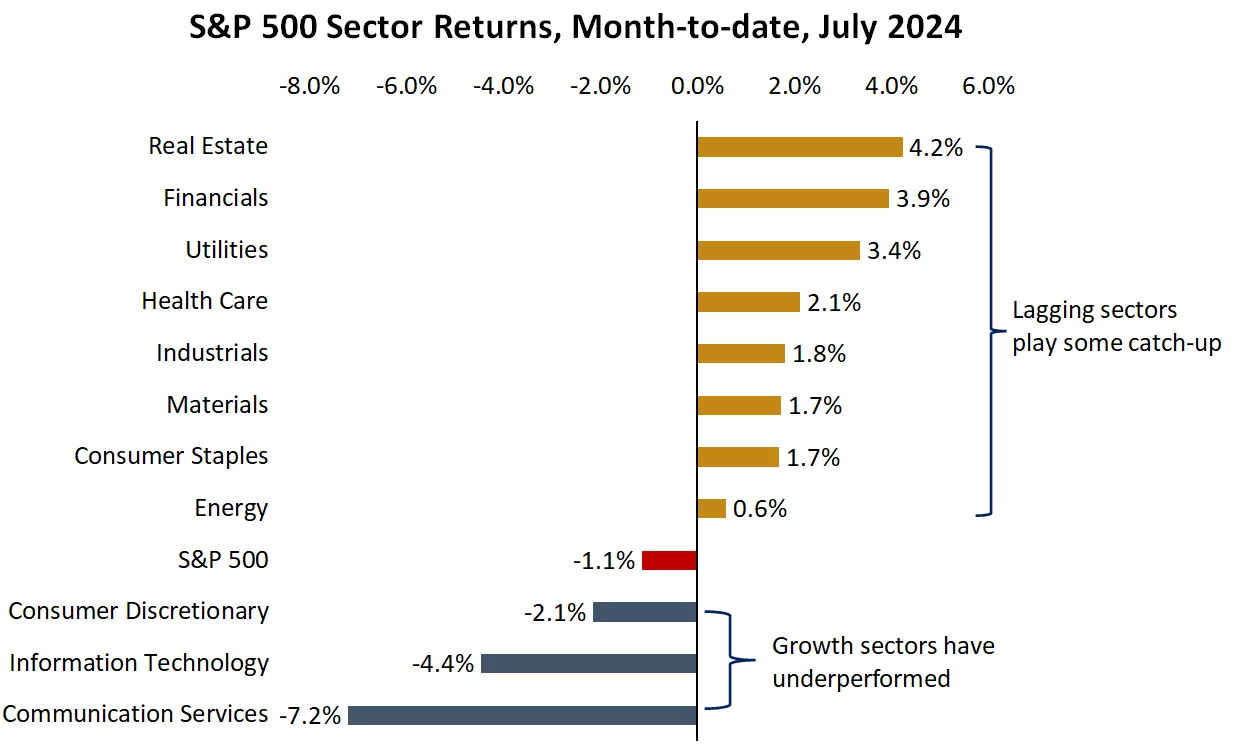

- Recent weeks have seen notable shifts in both equity markets and the political arena. Mega-cap technology stocks, once investor favorites, have recently underperformed, while value and cyclical sectors, including small- and mid-cap stocks, have shown strong performance. This rotation seems likely to continue, despite potential volatility. The overall trend is a broadening of market leadership across both tech and non-tech sectors, expected to persist through the latter half of the year.

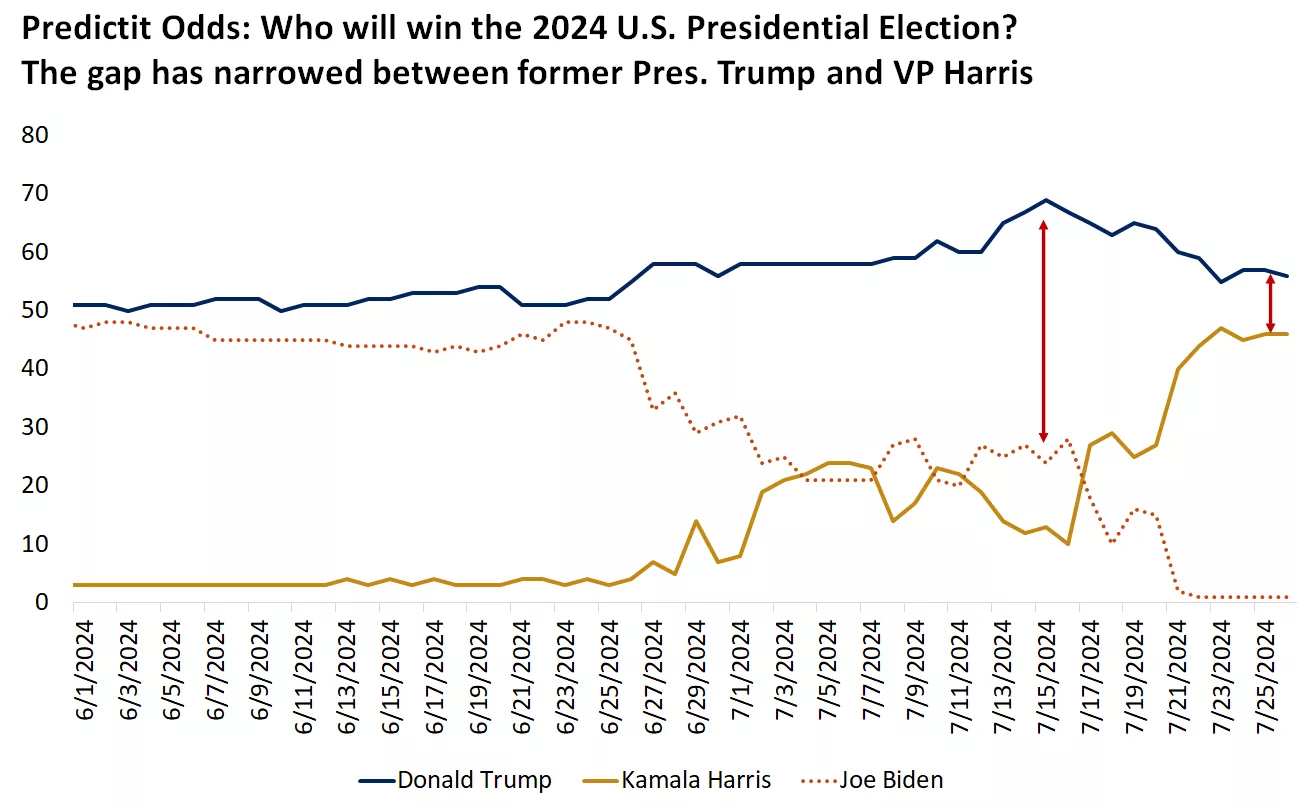

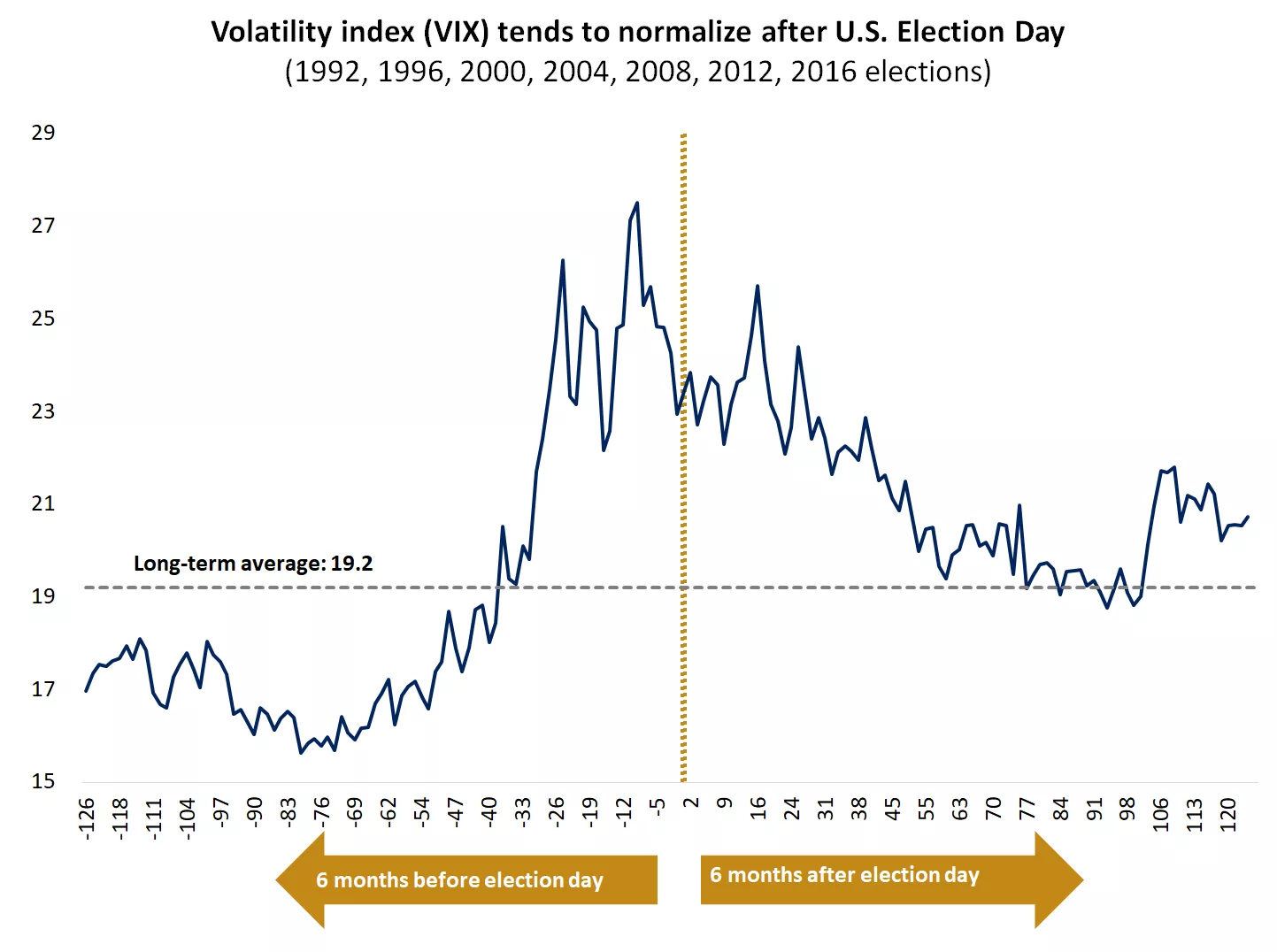

- In politics, President Biden's decision to withdraw from the race has altered the election landscape. Vice President Kamala Harris, now set to be the Democratic nominee, has closed the gap with frontrunner former President Donald Trump. This early-stage shift introduces uncertainty into the election outcome, which could heighten market volatility leading up to November. However, historically, such pre-election volatility tends to diminish after the election.

- Overall, the investment climate remains positive for equity investors. Economic growth is slowing but remains positive, inflation is decreasing, and the Federal Reserve is likely to reduce interest rates later this year. This scenario provides opportunities for investors to diversify or enhance their portfolios amid market or political changes.

Stock Market Rotation: Current Trends and Prospects

The ongoing rotation in equity markets sees small-cap stocks and value and cyclical sectors outperforming mega-cap technology and growth sectors. This follows over a year and a half of dominance by large-cap growth sectors and the "Magnificent 7." Several key factors are driving this rotation:

-

Lower-than-expected inflation: The July 11 CPI report showed inflation lower than expected for the second consecutive month, with headline inflation at 3.0% year-over-year. This disinflation trend is likely to persist, driven by decreasing shelter and rent costs and softer wage increases. Markets now expect several Fed rate cuts by year-end, supported by better inflation trends and a cooling labor market.

-

Broadening earnings growth: As second-quarter earnings reports come in, S&P 500 companies have shown a 9.7% year-over-year growth, surpassing expectations. The largest earnings surprises have been in the financial, energy, and health care sectors. Looking ahead to the fourth quarter, earnings growth is expected to exceed 16%, with value and cyclical sectors contributing more than AI and technology sectors. This supports the rotation and broadening of market leadership.

-

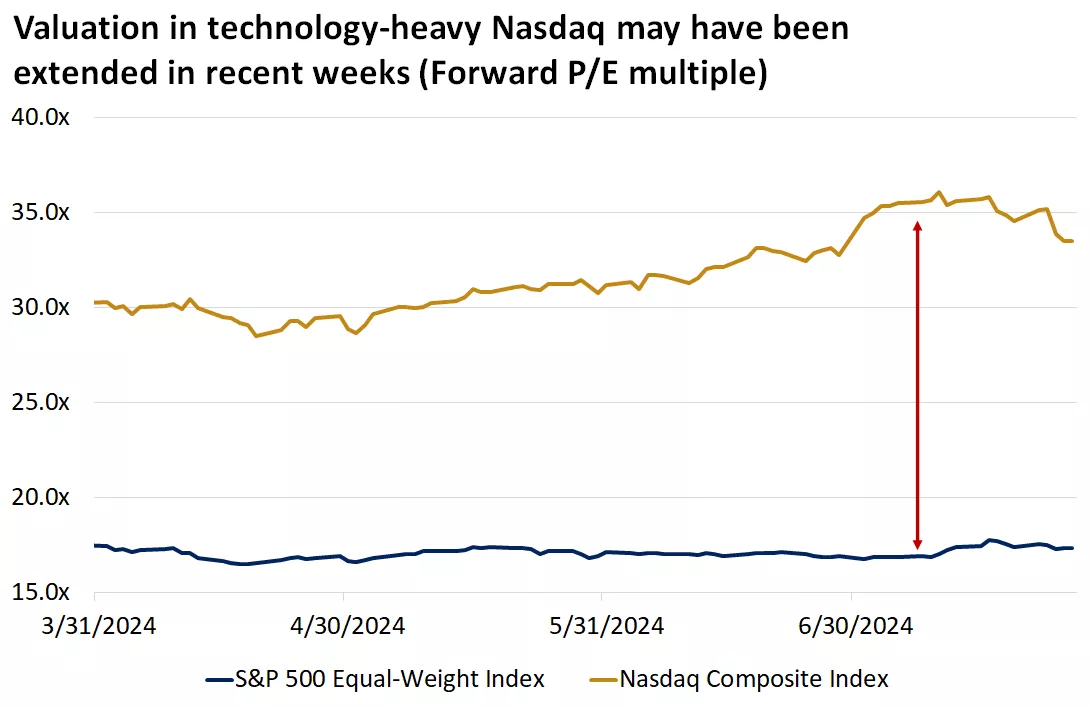

Valuation rotation: The valuation gap between mega-cap technology stocks and the broader market had widened excessively. For example, the Nasdaq's forward P/E ratio was about 35 times, compared to 16.5 times for the S&P 500 equal-weight index. Investors are now seeking investments with more room for valuation expansion, benefiting from lower interest rates. This valuation shift supports the broader market trend.

Although economic growth is expected to slow, cooling inflation and potential Fed rate cuts could boost consumption and growth. If economic growth remains positive, the "soft landing" narrative supports the broadening of market leadership.

Despite high valuations and potential corrections in tech sectors, large-cap technology companies continue to show solid earnings growth and strong balance sheets. They may benefit from lower rates and increased consumption. Investors may shift towards both growth and value sectors, emphasizing portfolio diversification.

Political Rotations: Impact on Portfolios

- President Biden's withdrawal from the election and endorsement of Vice President Kamala Harris has changed the race's dynamics. Early polling shows a closer race between Harris and former President Trump than with Biden as the candidate, with Trump maintaining a slight lead. This political shift introduces uncertainty into the election outcome, potentially increasing market volatility, which is common in election years.

- From a market perspective, while these political changes haven't altered the macroeconomic backdrop, they have increased uncertainty around the election outcome. Historically, market volatility tends to rise before election day and subside afterward, as uncertainty resolves.

Bottom Line: Fundamentals Remain Supportive

- Despite recent market and political volatility, the fundamentals remain supportive of continued equity growth. The economy has shown resilience, with second-quarter GDP growth exceeding expectations at 2.8%, driven by strong consumption growth. While economic growth is expected to cool, it should remain positive, around 1.5% - 2.0%.

- This environment of cooling but positive economic growth, easing inflation, and anticipated Fed rate cuts supports equity markets broadly. Investors should use upcoming volatility to diversify, rebalance, and add quality investments at better prices. Favoring large-cap and mid-cap U.S. equities, particularly in sectors like industrials and utilities, aligns with the broadening market leadership. Investors should avoid excessive exposure to cash-like instruments, as lower interest rates loom. The coming months offer opportunities to strategically allocate investments in equities and bonds, ensuring long-term financial goals remain on track.

Highlights

- US Equities: The decline driven by the unwind of AI trades and disappointing luxury earnings continues. Rotation from large caps to small caps persists, with the Russell 2000 outperforming the S&P 500.

- GDP: US GDP growth at 2.8% exceeds expectations, reducing pressure on yields and supporting potential Fed rate cuts.

- Yen: The Japanese yen strengthens amid expectations of a BoJ rate hike and reduced government bond purchases.

- Europe: Weaker-than-expected PMIs raise concerns about European growth, particularly in light of potential US tariffs.

View from the Street

- Equity: Morgan Stanley recommends large-cap quality cyclical stocks over small caps due to better potential growth and earnings. Goldman Sachs highlights a significant drop in the tech-heavy Nasdaq, driven by concerns over AI investments.

- Fixed Income: UBS advises deploying excess cash into high-quality bonds, while Morgan Stanley remains underweight in bond duration due to potential inflation pressures.

- Economy: J.P. Morgan notes a rebound in IPO activity, while Goldman Sachs observes easing policies by central banks in major economies.

Spot Desk

- BTC continues its bullish momentum, closing the week with a 12.71% gain, setting a positive trend for the broader crypto market. Solana stood out, ending the week up 25.79%.

- For the second week, USDT traded above parity, reaching as high as 9 pips above. This suggests investors are moving from stablecoins to other crypto assets. The desk observed significant stablecoin flows into AUD, with AUD/USD experiencing its first dip in six weeks, offering favorable rates for bidders. Balanced flows were seen for BTC and ETH, with increased altcoin trading activity in SOL, XRP, AERO, TRX, OM, and FIL.

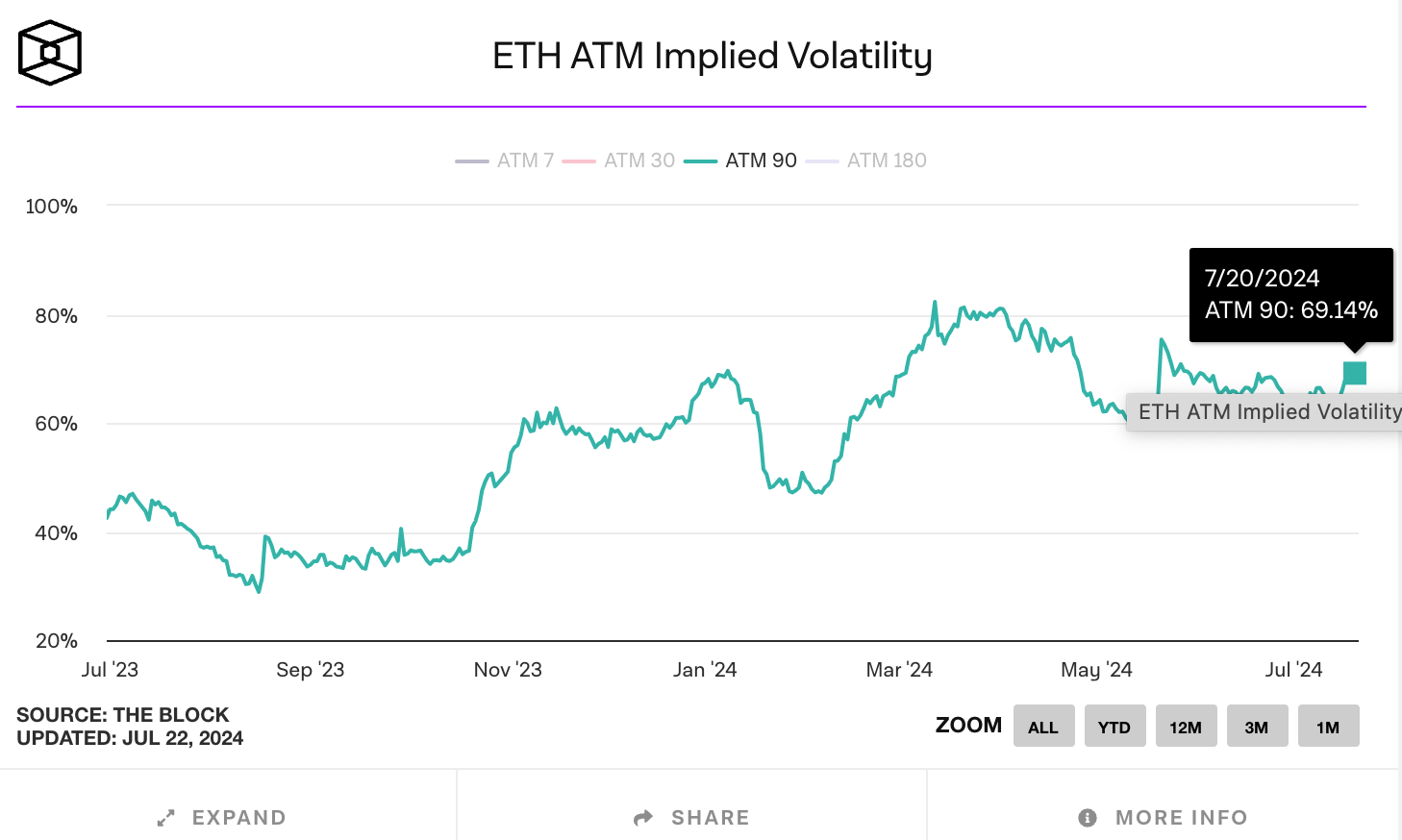

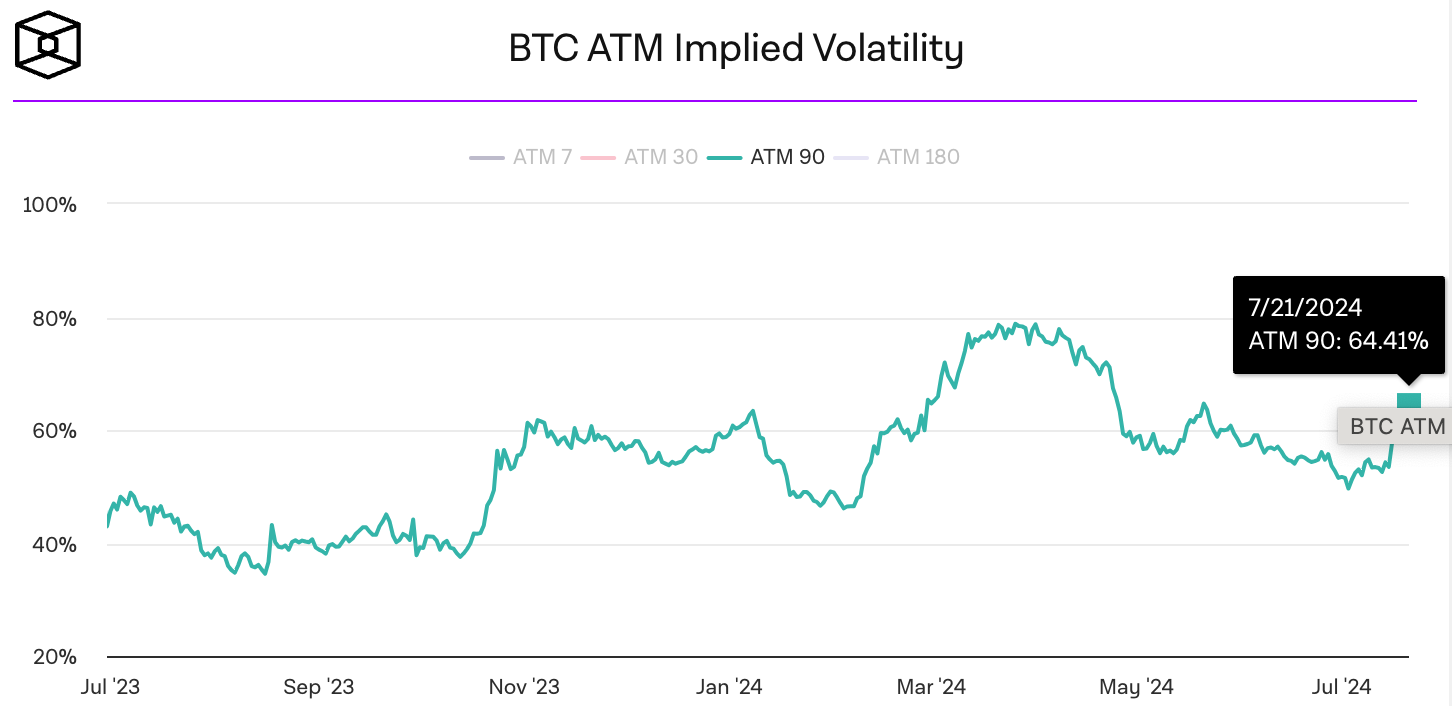

- The options market grew more volatile, with BTC's 3-month ATM volatility rising from 52.77% to 64.48%. This indicates further volume increases across major cryptocurrencies, particularly in the Ethereum ecosystem, ahead of the anticipated Ethereum ETF.

Derivatives Desk (Wholesale Investors Only)

- Following last week, the ETH/BTC ATM IV spread compressed to 69.14% / 64.415%. While some trade potential remains until the ETH ETF launch, keep an eye on any IV expansion and consult the derivatives desk for trade ideas.

Week in Review

- President Biden exits the election, endorsing VP Kamala Harris.

- Global IT chaos caused by a CrowdStrike software bug.

- Record inflows into digital asset investment products.

- Significant movements in the cryptocurrency market, with Bitcoin and Ethereum leading gains.

- Trump's potential appointment of JPMorgan CEO Jamie Dimon as Treasury Secretary.

- Fed Chair Powell confident in inflation data retreating.

- British pound hits a one-year high against the US dollar.

Technicals & Macro

- BTCUSD: Bullish momentum continues, with key levels at 59,000, 66,000, 72,000, and 73,794 (ATH).

- ETHUSD: Ethereum remains strong, with key levels at 2,700, 3,350, 3,600, and 4,000.

What to Watch

- Key economic indicators, including PMIs, GDP, unemployment claims, and the PCE price index, will be released this week.

Despite recent rotations and volatility, the economic and market fundamentals remain strong, offering opportunities for strategic investment and diversification.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.