NASDAQ:

The End of the Rally? High-Probability Short Opportunity Using ICT Concepts (PO3, FVG)

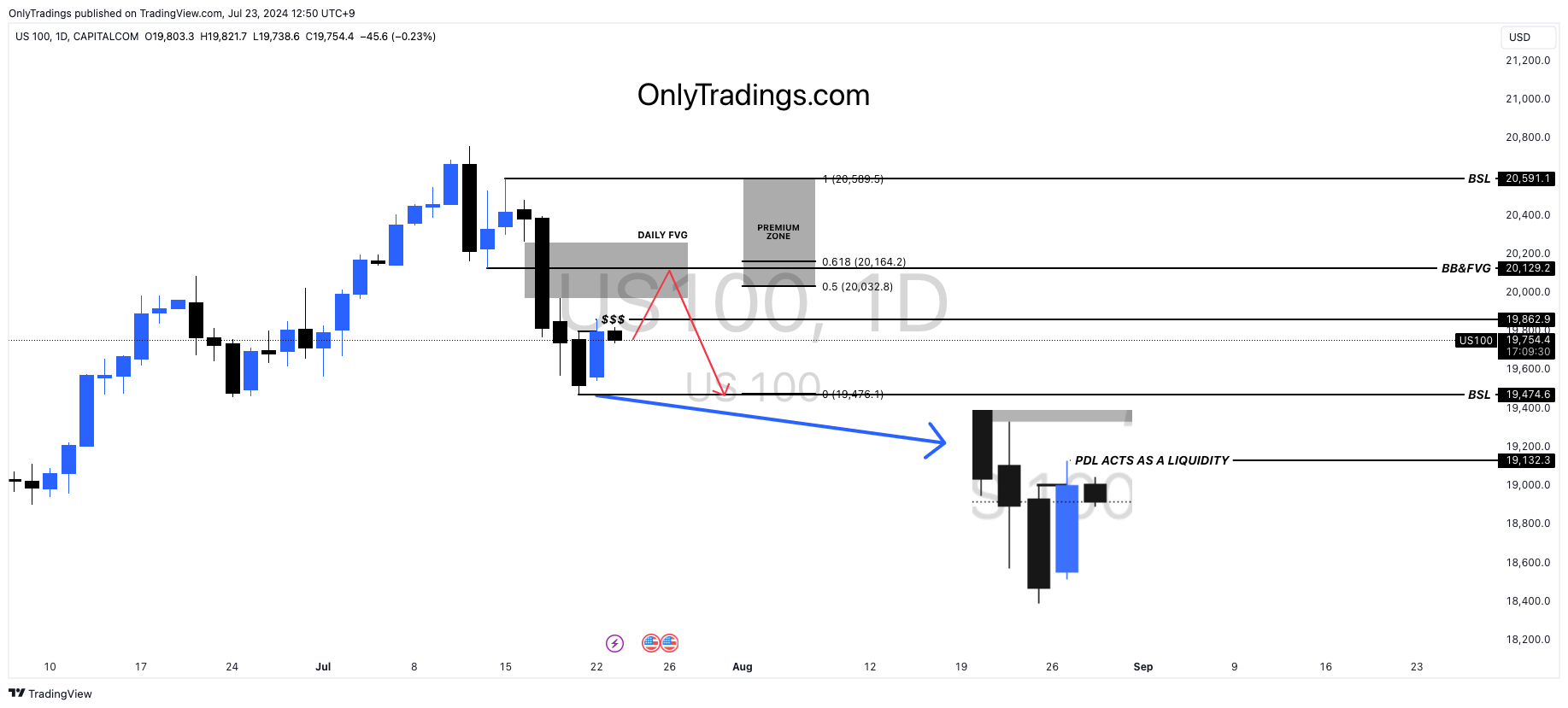

The candle closed above the previous daily high, indicating strength in the current price action. Given this, today's candle is likely to at least take out the Previous Day Low (PDL).

Additionally, the presence of a daily Fair Value Gap (FVG) in the premium zone, located above the PDL and acting as a liquidity pool, suggests a good selling opportunity.

To capitalize on this setup, look for shorts after the PDL is taken out and the price reaches the daily bearish FVG.

This analysis is based on the daily timeframe, so refine your FVG and identify entry triggers on the 1H and 4H charts, executing entries on the 5M chart. Aligning the 1H/4H FVG with the daily FVG increases the probability of the setup.

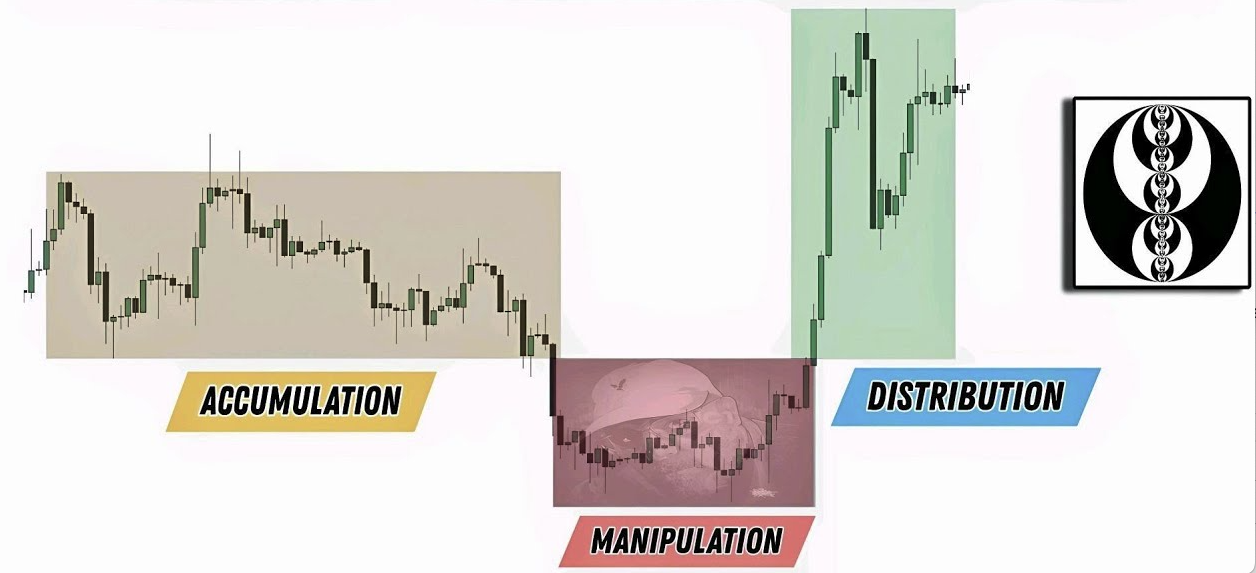

This scenario aligns with the concept of the Power of 3 (PO3, also known as Accumulation, Manipulation, and Distribution by ICT).

See the image below to learn more about the PO3 / AMD.

ICT PO3/AMD CONCEPT:

Analysis: Impact of NASDAQ Index Drops on Bitcoin Prices

- The relationship between the NASDAQ index and Bitcoin prices has been a topic of interest for traders and analysts. Here’s an analysis of what typically happens to the price of Bitcoin when the NASDAQ index drops:

- Correlation Between NASDAQ and Bitcoin:

-

- Historically, Bitcoin has shown a varying degree of correlation with traditional financial markets, including the NASDAQ. While Bitcoin is often seen as a hedge against traditional assets, in recent years, it has exhibited some correlation with equity markets.

-

- During periods of heightened market stress or significant drops in the NASDAQ, Bitcoin has sometimes mirrored these movements, experiencing declines as well.

- Risk-Off Sentiment:

-

- When the NASDAQ drops significantly, it often signals a broader market risk-off sentiment. Investors typically move away from riskier assets, including equities and cryptocurrencies, and seek safer havens like bonds, gold, or cash.

-

- Bitcoin, being a relatively volatile and speculative asset, may also see selling pressure during these times as investors liquidate positions to cover losses elsewhere or to reduce overall risk exposure.

-

Liquidity and Market Dynamics:

-

The liquidity in the Bitcoin market can also influence its price during NASDAQ drops. If major institutional investors or funds holding Bitcoin need to free up cash, they might sell their Bitcoin holdings, leading to a price decline.

-

- Conversely, during NASDAQ drops, some investors might seek Bitcoin as an alternative investment, potentially providing some support to its price.

-

-

Market Sentiment and Speculation:

- Market sentiment plays a crucial role. If the sentiment is overwhelmingly bearish in traditional markets, it can spill over into the cryptocurrency market, causing panic selling and further drops in Bitcoin’s price.

- Speculative trading can amplify these moves, as traders react to both the NASDAQ drop and the subsequent movements in Bitcoin, leading to increased volatility.

- Market sentiment plays a crucial role. If the sentiment is overwhelmingly bearish in traditional markets, it can spill over into the cryptocurrency market, causing panic selling and further drops in Bitcoin’s price.

Summary:

The price of Bitcoin tends to be influenced by significant drops in the NASDAQ index due to correlated market behaviors, risk-off sentiments, liquidity needs, and overall market sentiment. While the degree of correlation can vary, a sharp decline in the NASDAQ often leads to increased volatility and potential price drops in Bitcoin. Traders should consider these dynamics when making trading decisions and manage their risk accordingly.

Combining this with the multi-timeframe trading strategy, traders should monitor macroeconomic indicators and major market indices like the NASDAQ to gauge potential impacts on Bitcoin. This comprehensive approach ensures a well-rounded analysis and enhances trading decisions.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.