Market Turbulence:

Unprecedented Volatility, Labor Market Shifts, and Crypto Resurgence

Key Takeaways:

US Equities

- US equities experienced a downturn this week, largely driven by disappointing tech earnings and signs of slowing economic growth. The sell-off led to a significant increase in market volatility, with the VIX reaching 27, the highest level of the year.

US Jobs

- The unemployment rate in the US rose to 4.3%, exceeding expectations of 4.1%. Additionally, payroll growth was lower than anticipated, with only 114,000 jobs added compared to the expected 175,000. This disappointing job data resulted in a decline in yields.

Federal Reserve (Fed)

- The Federal Reserve maintained its interest rate at the July meeting. However, Fed officials indicated that a rate cut in September is likely, emphasizing that the job data reflects normalization rather than economic weakening. Markets are pricing in a 25 basis point cut by the end of the year.

Bank of Japan (BoJ)

- The Bank of Japan increased its interest rate by 25 basis points to 0.25% this week and announced plans to reduce half of its monthly bond purchases by early 2026. Markets expect the next move to be a 25 basis point cut in January 2025. The yen surged by 4.4% this week.

Key Insights From The Street:

Equity Markets

UBS: The US equity market had been experiencing an unusually smooth rally until mid-July this year. The S&P 500 had gone over 250 trading sessions without a decline of more than 2%. We anticipate increased volatility in the coming days due to the start of the rate-cut cycle and uncertainty regarding the payoff in heavy AI investments.

J.P. Morgan: We expect 8 out of 11 sectors to contribute positively to EPS growth, led by technology with aggressive AI-related capital expenditures. Financials are next, driven by margin expansion supported by increased investment banking and trading activities. The energy sector is expected to have the largest negative impact due to declining refining margins.

Fixed Income

UBS: Global momentum toward lower rates continued to build this week. The Bank of England announced its first cut of the cycle, and the Fed also clearly signaled that a cut is coming. Markets are starting to expect a deeper rate-cut cycle, and we anticipate price appreciation in fixed income, particularly for high-quality corporate and government bonds.

Morgan Stanley: Although fixed income has outperformed over this business cycle, we remain vigilant. The chances for policy mistakes are increasing as we exit the Fed pause phase and enter the rate-cutting period. The change of administration is also a risk that cannot be ignored.

Economy

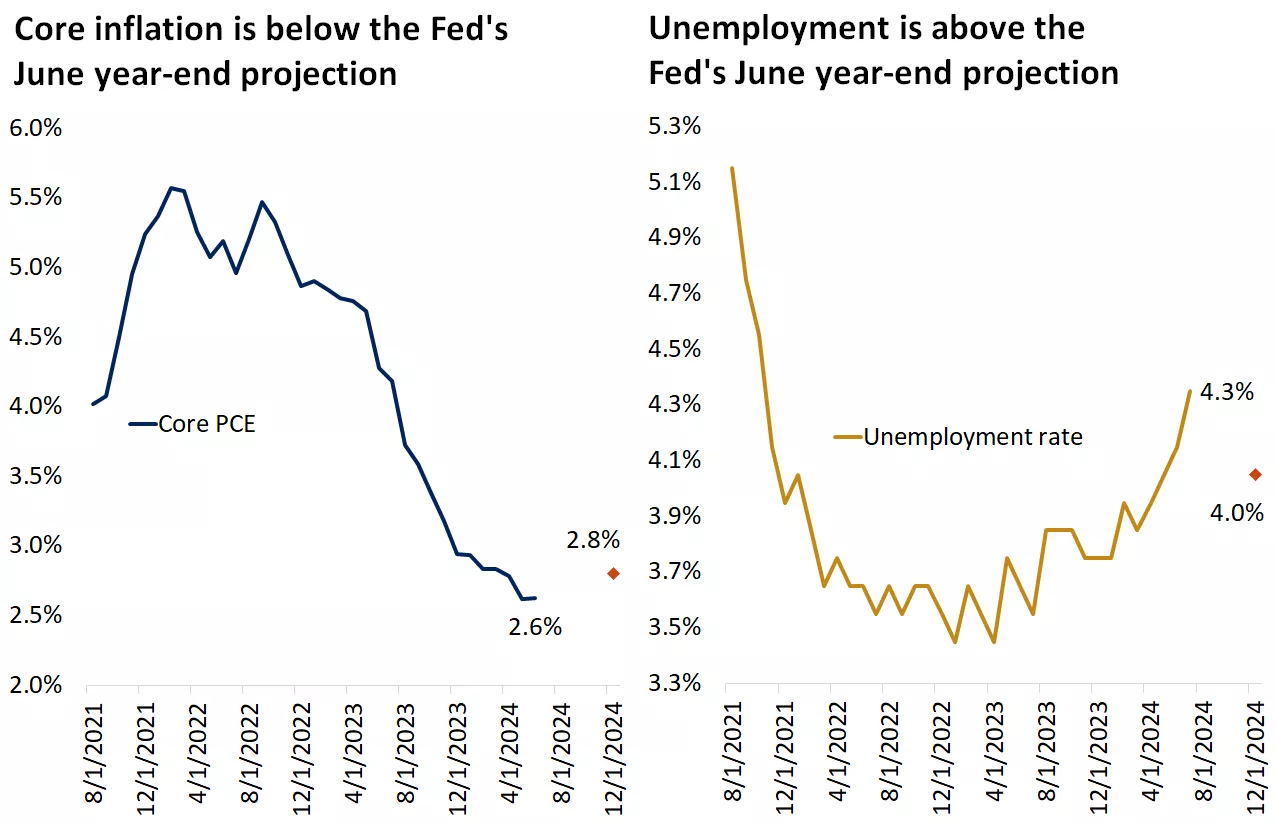

Standard Chartered: The US economy is slowing, inflation is cooling across a broader range of products and services, and unemployment is increasing. This recent backdrop would support the Fed in cutting rates twice by year-end.

Goldman Sachs: The July labor report indicated a worse-than-expected job market in the US. Concerns over consumer spending have intensified. We expect consumer spending and corporate sales growth to weaken, with risks to consumer stocks skewed to the downside.

Five Turning Points & Their Implications

#1. Fed Policy: Shift Towards Easing

- With inflation trending in the right direction, Fed officials are increasingly sensitive to downside risks in the labor market. The unexpected rise in July's unemployment rate likely cements expectations for a September rate cut, potentially followed by one or two more cuts later in the year.

#2. Labor Market: Cooling, But Stable

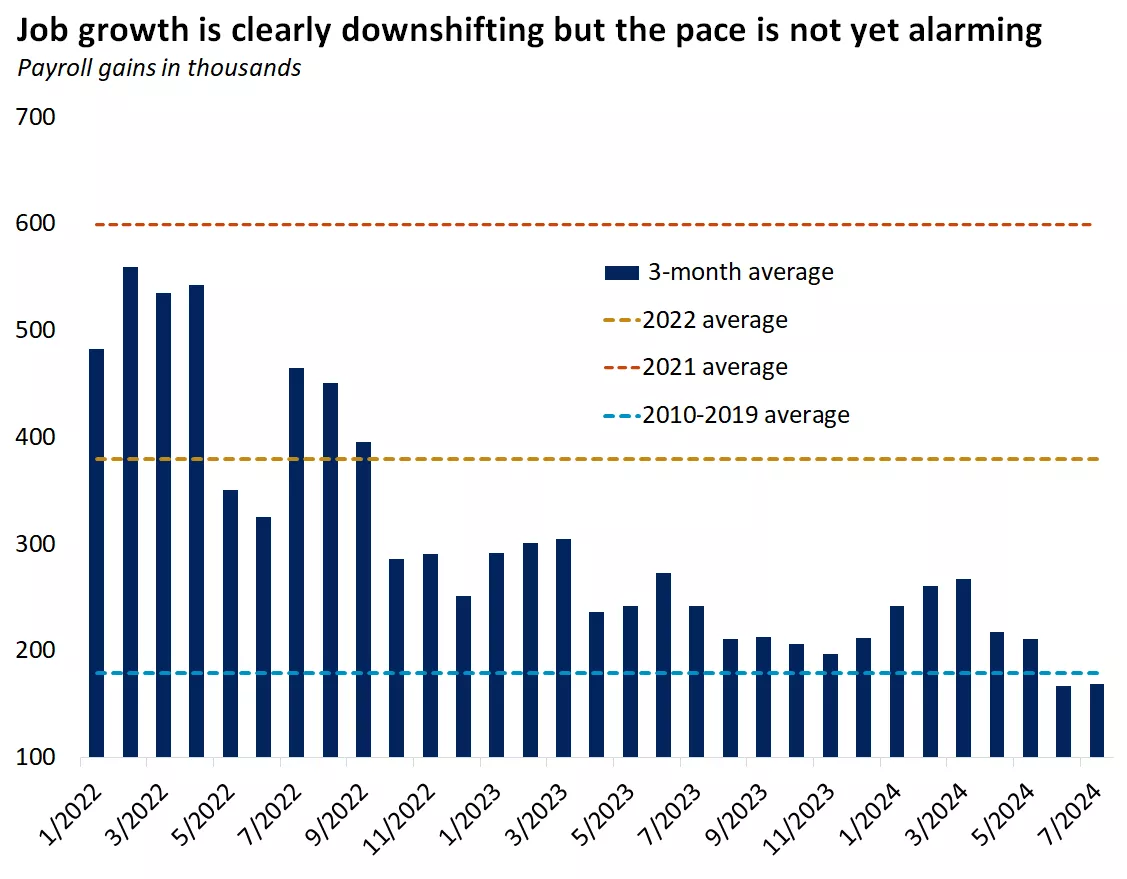

- For several months, the US labor market has been cooling, but this deceleration has been seen as a normalization from overheated conditions. However, the weak July payrolls report, which showed the addition of only 114,000 jobs versus the expected 175,000, raises questions. The unemployment rate rose to 4.3%, with wage growth increasing by just 3.6%, the smallest gain in over three years. Despite these concerns, the labor market remains relatively healthy:

- Over the past three months, payroll gains have averaged 170,000, aligning with the 180,000 monthly average during the last economic expansion from 2010 to 2019.

- The unemployment rate, at 4.3%, remains historically low, lower than 90% of the time since 1949.

- The rise in unemployment is mainly due to an increased labor force rather than a drop in employment. While job openings have decreased from 12 million in 2022 to 8.2 million, they still comfortably exceed the 7.2 million unemployed individuals.

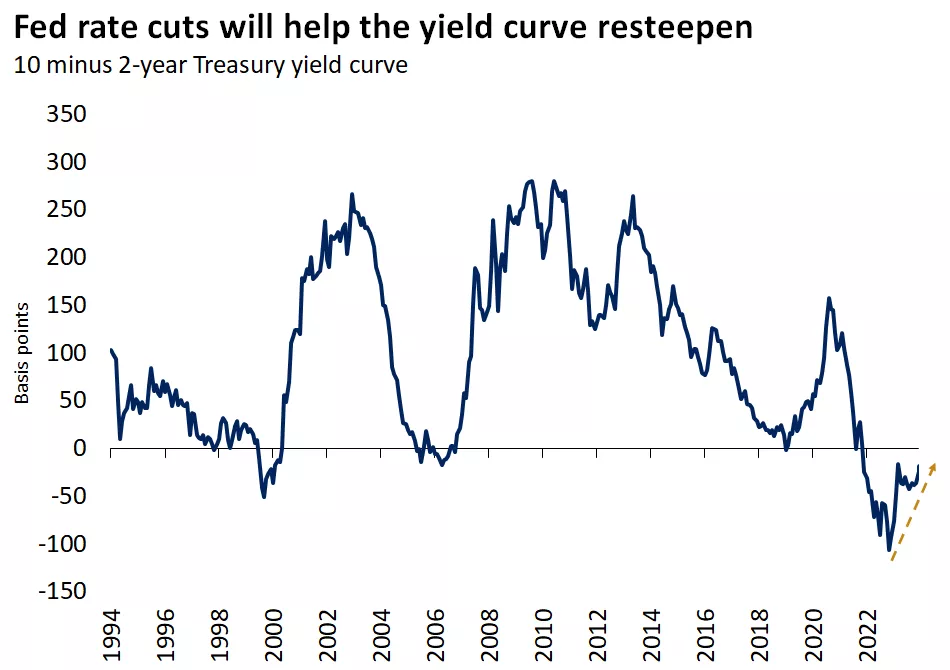

#3. Yield Curve: Ending the Inversion

- For more than two years, the yield curve has been inverted, signaling that short-term bond yields are higher than long-term yields, which historically indicates restrictive Fed policy. With the Fed hinting at easing interest rates and recent data highlighting downside economic risks, the bond market has begun to price in a more aggressive easing cycle, causing a sharp rally in bond prices and a drop in yields. The policy-sensitive 2-year yield fell below 4.0% for the first time since May 2023, while the 10-year yield dipped below 3.90%, down from April's high of 4.70%. We anticipate short-term yields to fall faster than long-term yields, helping the yield curve normalize.

- We reiterate our beginning-of-the-year call to slightly overweight duration (increase a portfolio's interest-rate sensitivity) relative to an investment-grade bond benchmark, favoring intermediate and long-term bonds (prefer seven- to 10-year Treasuries over longer maturity). Although CD and money-market rates may remain attractive from a historical perspective in the short term, yields will gradually come down as the Fed embarks on a rate-cutting cycle. Therefore, now is a good time for investors to consider the reinvestment risk of having an overweight allocation to cash during a period of falling rates.

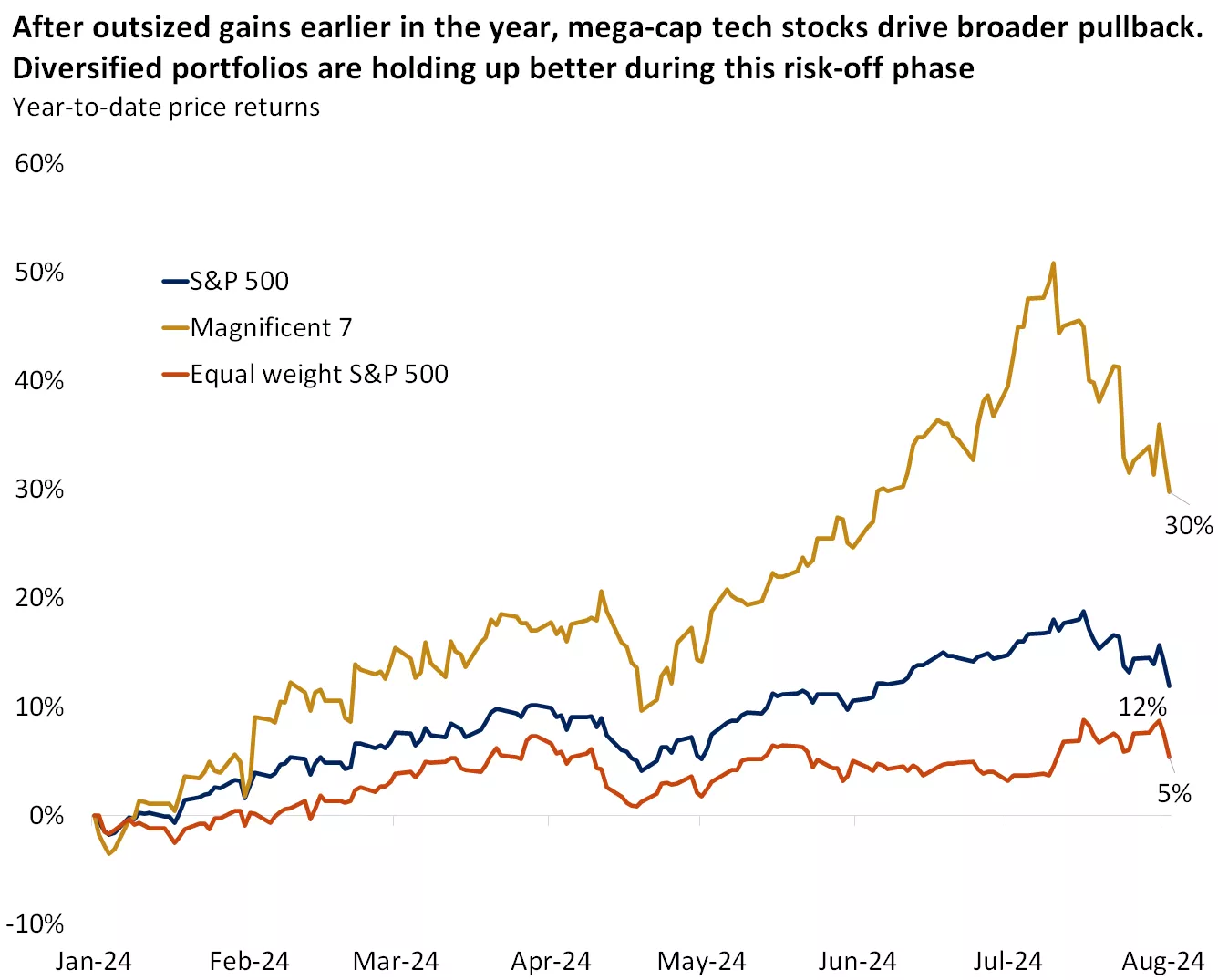

#4. Market Leadership: Diversification Needed

- While AI remains a significant growth driver, tech is no longer the only focus. Recent rotations out of growth stocks highlight a broadening of market leadership. The tech-heavy Nasdaq entered correction territory, down 10% from its peak, as investors grow impatient for the heavy spending on AI to translate into returns. However, AI is poised for rapid growth over the next five to ten years and can continue to drive earnings for companies investing in its development.

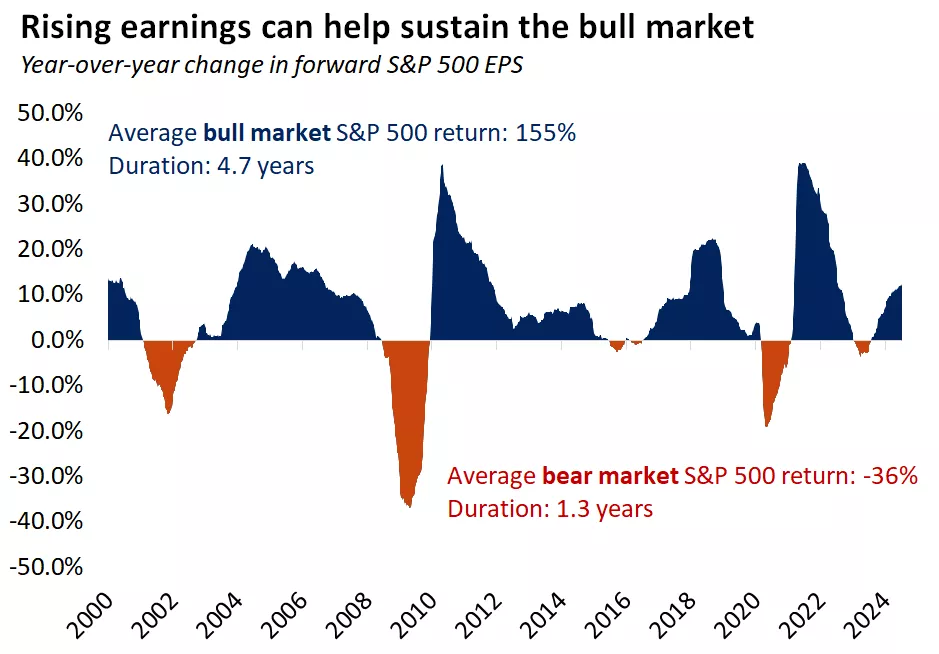

- Beyond tech, the outlook for earnings remains positive, with S&P 500 earnings growth expected to accelerate from 6% in the first quarter to about 11% in the second quarter. The biggest upside surprises are coming from a combination of cyclical and defensive sectors, such as financials and healthcare, rather than the growth sectors. These shifts align with our expectation that leadership will broaden as we approach the start of the Fed rate-cutting cycle. Defensive sectors that tend to move inversely with bond yields could provide portfolio stability. More broadly, as the bull market continues with some bumps along the way, we expect more back and forth between tech, cyclicals, and defensives, highlighting the importance of appropriate diversification for the remainder of the year.

#5. Volatility: A New Era of Fluctuations

- Volatility was subdued in the first half of the year, with the VIX index, a proxy for stock-market fluctuations, hovering around 14, 30% below its long-term average. However, the first weeks of the second half are sending a different vibe. Last Thursday, stocks experienced the biggest intraday swings since late 2022. The S&P 500 was up 0.8% in the morning but then fell as much as 2% at its low before recovering some of its losses later in the day, with selling continuing on Friday after the jobs report. Is this a sign of more challenging conditions ahead?

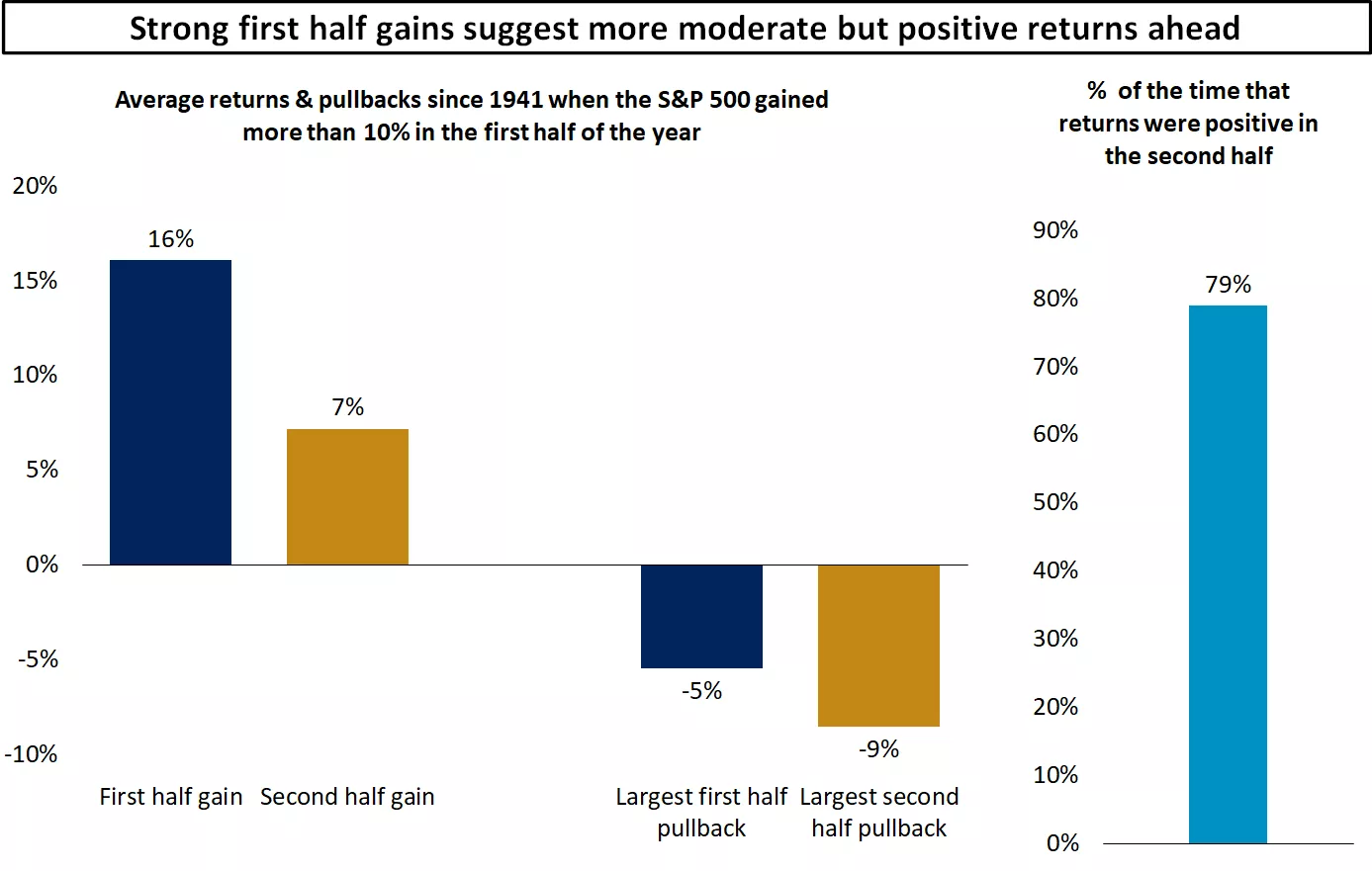

- Concerns that the Fed may be behind the curve by cutting rates too late, coupled with election-related uncertainty, could be catalysts for volatility, especially as we enter a seasonally weaker part of the year. Historically, the three-month stretch between August and October has been the worst for stocks in terms of lower returns and higher volatility. However, this negative seasonality has been more pronounced when stocks were in a downtrend, rather than when they were in a strong uptrend, as they are this year. Going back to 1941, whenever the S&P 500 rose by 10% or more in the first six months of the year, it has risen by 7% on average in the second half, with positive returns in 80% of such instances.

- From a fundamental standpoint, while we see a potential turning point in volatility, we do not expect any short-term pullbacks (which, no doubt, are uncomfortable) to change the relatively positive outlook. Inflation is moving closer to the target, providing breathing room for the Fed to start easing; the economy continues to expand but at a slowing pace; productivity is on the upswing; and corporate earnings are rising. As a result, we do not believe the bull market (which started back in October 2022) is over, and we would use any pullbacks, such as the one experienced last week, as opportunities to rebalance, diversify, and deploy fresh capital.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.