Leveraging SMT Divergence for High-Probability Trade Setups Across Key Quarters

(Even in the Crypto Market)

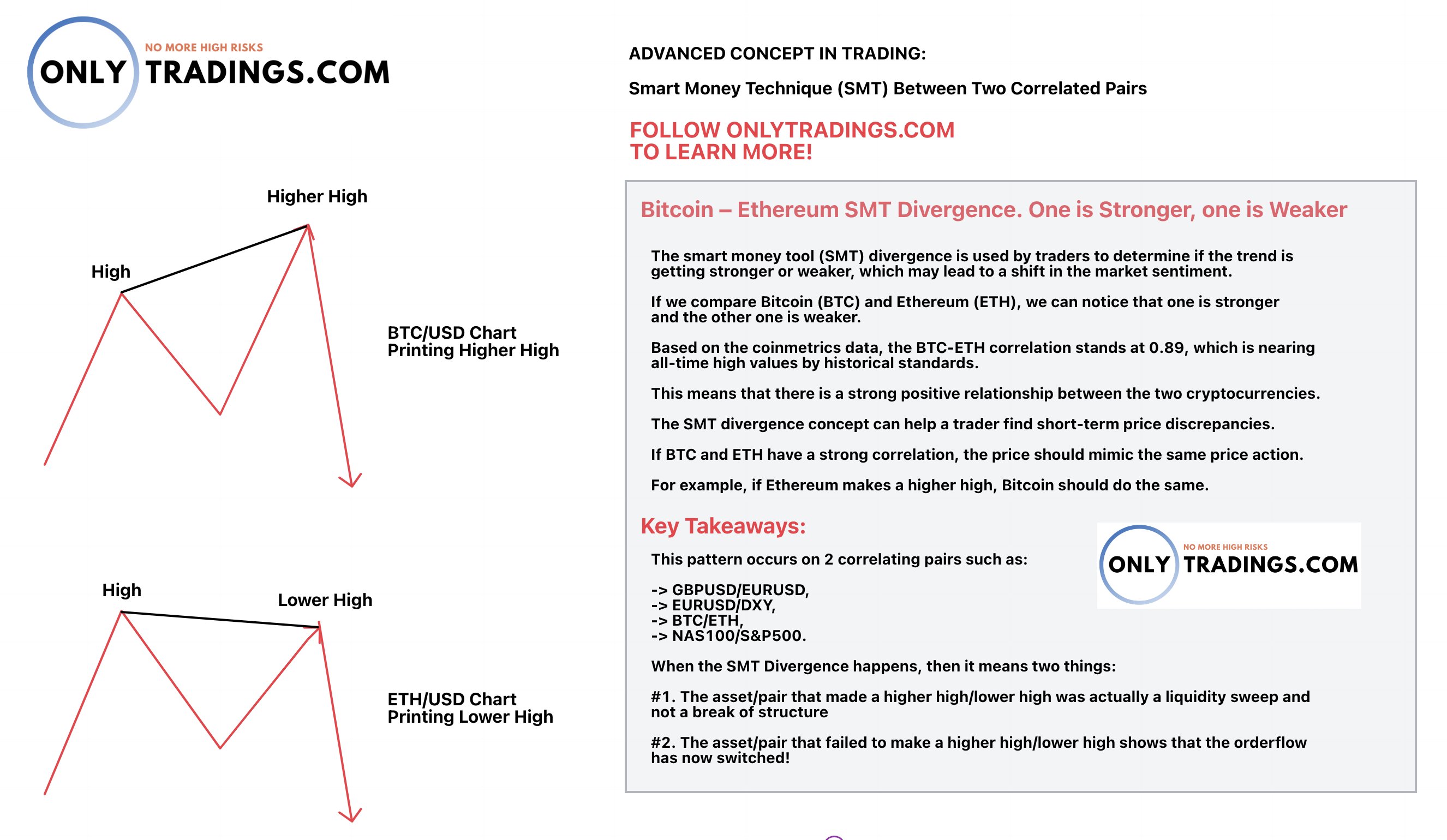

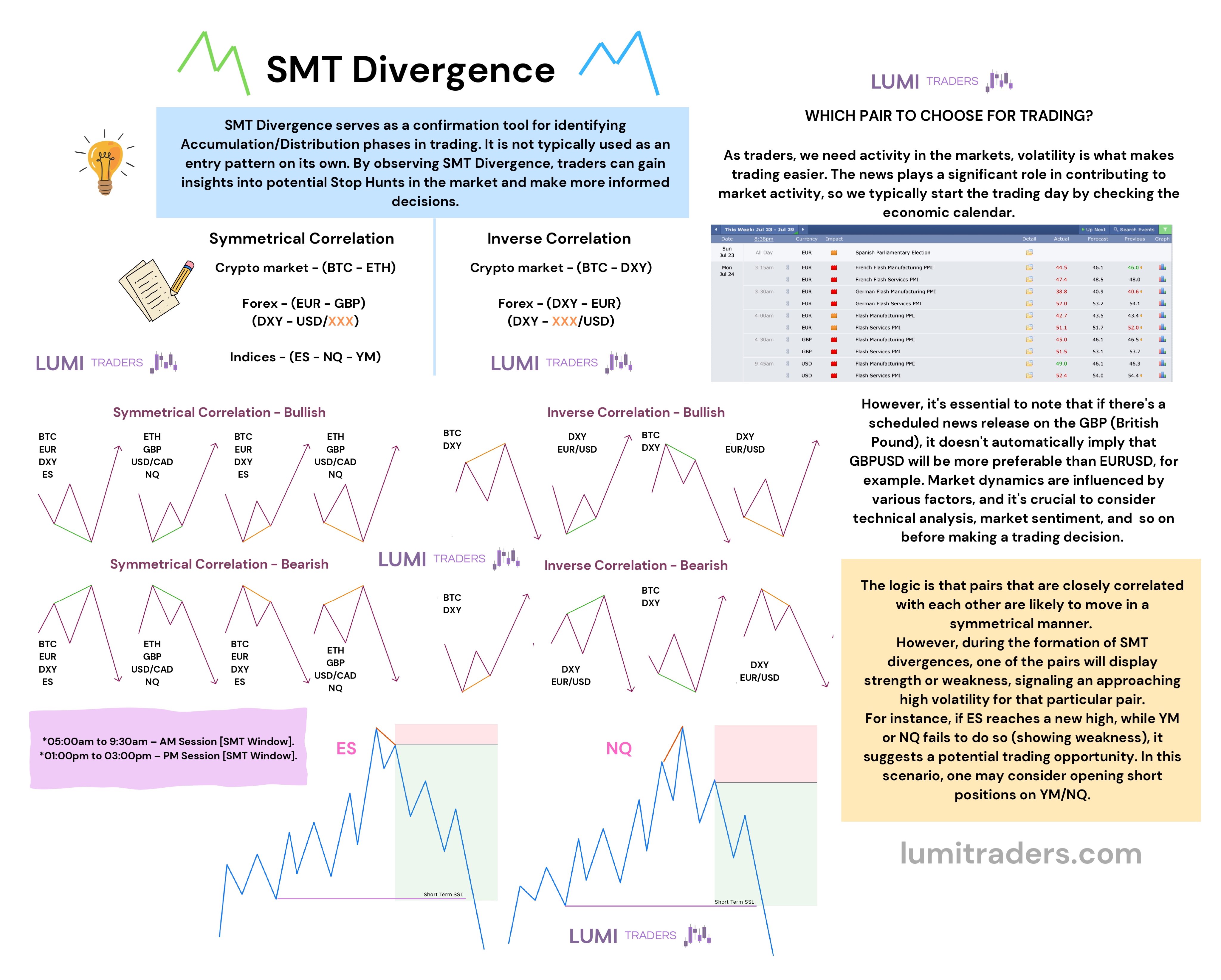

SMT (Smart Money Tool) Divergence is a highly effective method for identifying potential reversals in the forex market, particularly with correlated currency pairs like EUR/USD and GBP/USD. The logic behind SMT Divergence is based on understanding the relationships between correlated markets and the behavior of institutional traders who move the market based on liquidity imbalances. Interestingly, SMT Divergence can also be adapted for use in the crypto market, with popular pairs like BTC (Bitcoin) and ETH (Ethereum) offering similar opportunities for identifying divergences and key reversals.

In this article, I’ll explain why SMT Divergence is such a powerful tool, how it applies not only to forex but also to cryptocurrencies like BTC and ETH, and highlight an example of how SMT Divergence played out with EUR/USD and GBP/USD across key market quarters. The principles of liquidity and institutional behavior that govern forex markets are just as applicable to the fast-moving world of crypto.

Image Credit to "Lumi Trader"

Understanding the Core of SMT Divergence

1. Correlated Market Logic:

SMT Divergence is grounded in the idea that certain markets tend to move in tandem due to economic or structural relationships. In the forex market, for example, pairs like EUR/USD and GBP/USD share a strong correlation because both are heavily influenced by the U.S. dollar. When one pair makes a higher high while the other stalls or even makes a lower high, this suggests that one of the moves is unsustainable. This divergence offers clues that institutional traders may be positioning themselves for a market reversal.

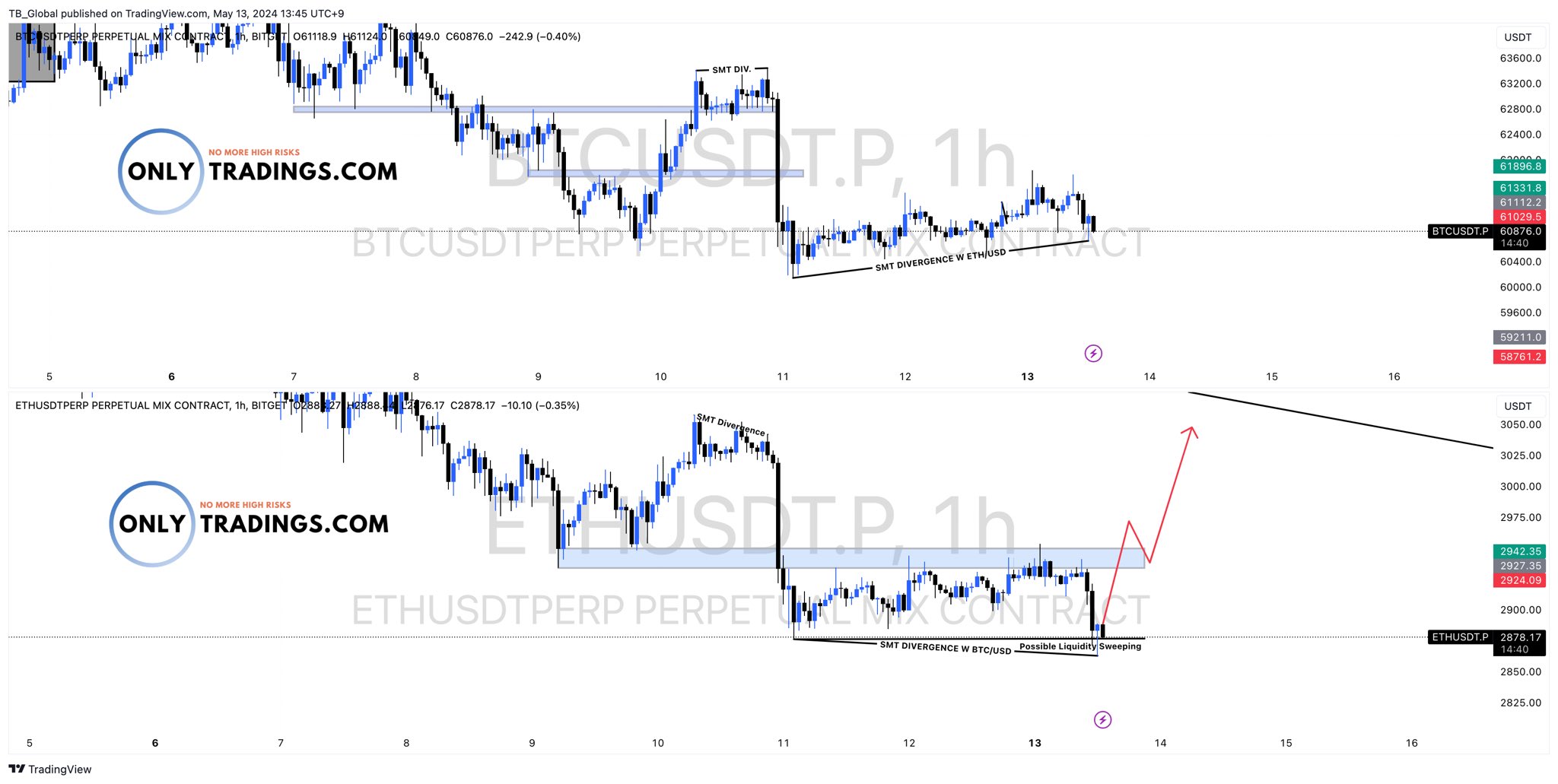

In the crypto market, a similar dynamic plays out with assets like BTC and ETH. Bitcoin and Ethereum are two of the most closely watched and traded cryptocurrencies, and they often move in sync with each other. However, there are times when these correlations break down. For instance, BTC might make a new high, but ETH fails to do the same. This divergence can indicate that Bitcoin’s move is driven by short-term liquidity rather than genuine buying interest, suggesting a reversal is near.

2. Institutional Players and Liquidity Dynamics:

In both the forex and crypto markets, institutional traders and large investors use liquidity sweeps to build positions. SMT Divergence occurs when one market, such as EUR/USD or BTC, sweeps liquidity (for example, by making a new low) while its correlated market, such as GBP/USD or ETH, does not. This discrepancy can be a clue that smart money is preparing for a reversal.

This concept is just as important in crypto, where whales (large holders of assets like Bitcoin and Ethereum) often manipulate the market to sweep liquidity and trigger stop orders from smaller traders. For example, when Bitcoin sweeps a key liquidity level, and Ethereum does not follow, this divergence suggests that the Bitcoin move may not be sustainable, and a reversal could be imminent.

3. Avoiding False Signals:

As with any trading strategy, SMT Divergence is not foolproof. During periods of low liquidity or when major news events impact the market, false signals can arise. To minimize these, traders should focus on key levels of support and resistance, such as:

- Previous Daily Highs/Lows (PDH/PDL)

- Order Blocks

- Liquidity Zones

These levels are where institutional traders are most likely to be active, and they often coincide with SMT Divergence signals. In crypto, it’s especially useful to watch key round number levels and previous swing highs/lows, as these often act as liquidity targets in assets like Bitcoin and Ethereum.

Applying SMT Divergence Across Market Quarters in Both Forex and Crypto

Breaking the trading day into quarters helps traders identify high-probability setups in both the forex and crypto markets. Q2 and Q3 are particularly important because they represent periods of high liquidity and institutional participation.

Quarter Breakdown (in UTC-4 NY Time Zone):

- Q1: 00:00 - 06:00 (Asian and quiet NY session overlap)

- Q2: 06:00 - 12:00 (London session, early part)

- Q3: 12:00 - 18:00 (London and New York overlap)

- Q4: 18:00 - 00:00 (New York to Asian session overlap)

The Q2 and Q3 overlap is often the most active trading window in both the forex and crypto markets. In forex, this period captures the London and New York session overlap, while in crypto, it coincides with increased global activity as markets transition from the European to North American trading hours. During this time, institutional traders are most active, and SMT Divergence signals are more likely to lead to significant market movements due to the higher volume and liquidity.

SMT Divergence in the Crypto Market: BTC vs. ETH

The concept of SMT Divergence can be adapted seamlessly for crypto trading. BTC and ETH are highly correlated due to their dominance in the market and shared investor base. However, divergences occur when one asset makes a new high or low, and the other does not follow.

Example (Bullish SMT Divergence in BTC/ETH):

- BTC makes a lower low, taking out a key liquidity level (such as the previous daily low (PDL)), while ETH fails to make a new low.

- This divergence signals that Bitcoin's move lower could be a liquidity grab, with institutional traders likely absorbing BTC at lower prices.

- The failure of ETH to follow BTC lower indicates relative strength in ETH, suggesting a potential reversal in BTC.

By observing this divergence during high-liquidity periods, such as Q2-Q3, traders can anticipate a reversal and position themselves for a bounce in BTC, with ETH leading the move higher.

Example (Bearish SMT Divergence in BTC/ETH):

- BTC makes a higher high, breaking through a previous swing high, while ETH fails to make a corresponding new high.

- This bearish divergence suggests that the Bitcoin move may be driven by short-term liquidity or retail buying, while institutional traders are positioning for a sell-off.

- The weaker ETH performance signals a potential BTC reversal, providing an opportunity to short Bitcoin with ETH confirming the bearish bias.

Real-World Application: EUR/USD and GBP/USD SMT Divergence Example

Returning to the forex example you provided, we saw SMT Divergence play out between EUR/USD and GBP/USD across Q2 and Q3, offering a prime setup:

Liquidity Sweep on EUR/USD:

- EUR/USD swept the Previous Daily Low (PDL), triggering liquidity and offering institutional traders a chance to enter long positions.

- This occurred during Q2, signaling a liquidity grab.

SMT Divergence with GBP/USD:

- While EUR/USD made a new low, GBP/USD did not follow, creating a classic SMT Divergence.

- The failure of GBP/USD to break lower suggested that EUR/USD’s move was a liquidity-driven false breakout.

High-Liquidity Window:

- The divergence took place during the Q2-Q3 overlap, a period of high institutional activity, further confirming the setup’s validity.

Conclusion: SMT Divergence Across Markets

As a proponent of SMT Divergence, I believe that this concept provides traders with a powerful edge in both the forex and crypto markets. By focusing on correlated markets, liquidity sweeps, and institutional activity, SMT Divergence allows traders to identify high-probability reversal setups that others might miss.

Whether trading EUR/USD and GBP/USD in the forex market or BTC and ETH in the crypto market, SMT Divergence offers a logical, evidence-based approach to understanding market dynamics. By combining this tool with key levels (such as PDH/PDL) and focusing on high-volume periods (like the Q2-Q3 overlap), traders can significantly improve their chances of success.

The logic of SMT Divergence holds true across different asset classes, and in the fast-moving world of crypto, where institutional players and whales often manipulate price action around liquidity levels, SMT Divergence can be especially powerful.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.