Mastering Buy-Side and Sell-Side Liquidities in ICT Trading: Identifying Market Structure Shifts and Swing Highs/Lows

Introduction

In the realm of Institutional Concepts Trading (ICT), understanding liquidity dynamics is a cornerstone to profitable trading. By accurately identifying buy-side and sell-side liquidity, traders can anticipate potential price moves and take advantage of market structure shifts (MSS). This article delves into the core of buy-side and sell-side liquidity, the significance of swing highs and lows, and how to recognize MSS to trade more effectively.

Understanding Buy-Side and Sell-Side Liquidity

Liquidity, in its essence, refers to areas on the chart where orders reside. Institutions typically accumulate their orders in two distinct types of liquidity:

#1. Buy-Side Liquidity (BSL): These are levels where buy orders (usually stop orders) accumulate. Retail traders tend to place their stop-loss orders above obvious swing highs, creating a pool of buy orders. Smart Money aims to target these zones to trigger stop orders, creating liquidity for their positions.

#2. Sell-Side Liquidity (SSL): Opposite to buy-side liquidity, sell-side liquidity represents areas where sell orders (stop losses) are stacked, often below swing lows. These zones serve as prime areas for institutions to induce selling pressure and capture liquidity for long positions.

Key Identification of Liquidity Zones:

Look for clusters of swing highs or lows where retail traders are likely placing stop losses.

Horizontal consolidation zones and areas where price makes strong impulsive moves are common liquidity zones.

Expectation for Price Movement:

Buy-Side Liquidity: When price approaches a swing high, expect it to reach for liquidity above the high before reversing or continuing depending on overall market direction.

Sell-Side Liquidity: When price nears a swing low, anticipate a sweep below this level to capture sell orders before resuming upward or continuing downward.

Identifying Swing Highs and Lows

Swing highs and swing lows are critical components of price action analysis in ICT.

- Swing High: A high point flanked by two lower highs on either side. It typically represents a temporary peak in price before a reversal or pullback.

- Swing Low: A low point with two higher lows on either side, signaling a potential support area.

These swing points mark areas of liquidity where retail traders place stop orders.

How to Identify:

- Swing highs often serve as targets for buy-side liquidity.

- Swing lows act as markers for sell-side liquidity.

- Swing highs and lows are important for tracking the trend direction, anticipating MSS, and identifying key zones for liquidity grabs.

Market Structure Shift (MSS)

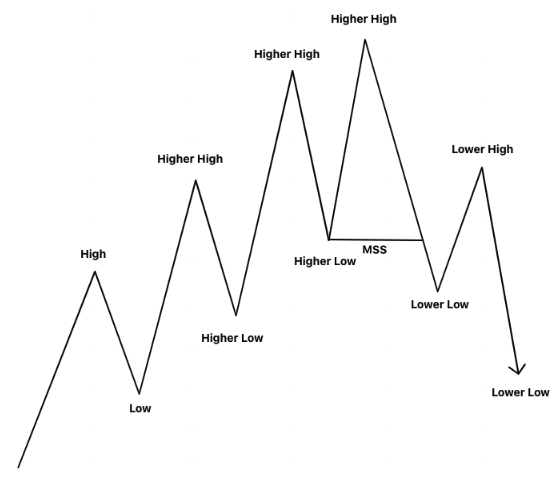

One of the critical aspects of ICT trading is understanding Market Structure Shifts (MSS), which occur when price action breaks from an established trend.

Bullish Market Structure Shift:

Identified when a market previously in a downtrend forms a new higher high (breaking above a previous swing high) and then creates a higher low. This shift indicates that the market is moving from a bearish trend to a bullish trend.

Bearish Market Structure Shift:

Occurs when a market in an uptrend forms a lower low (breaking below a previous swing low) and then creates a lower high.This signals a transition from bullish to bearish market conditions.

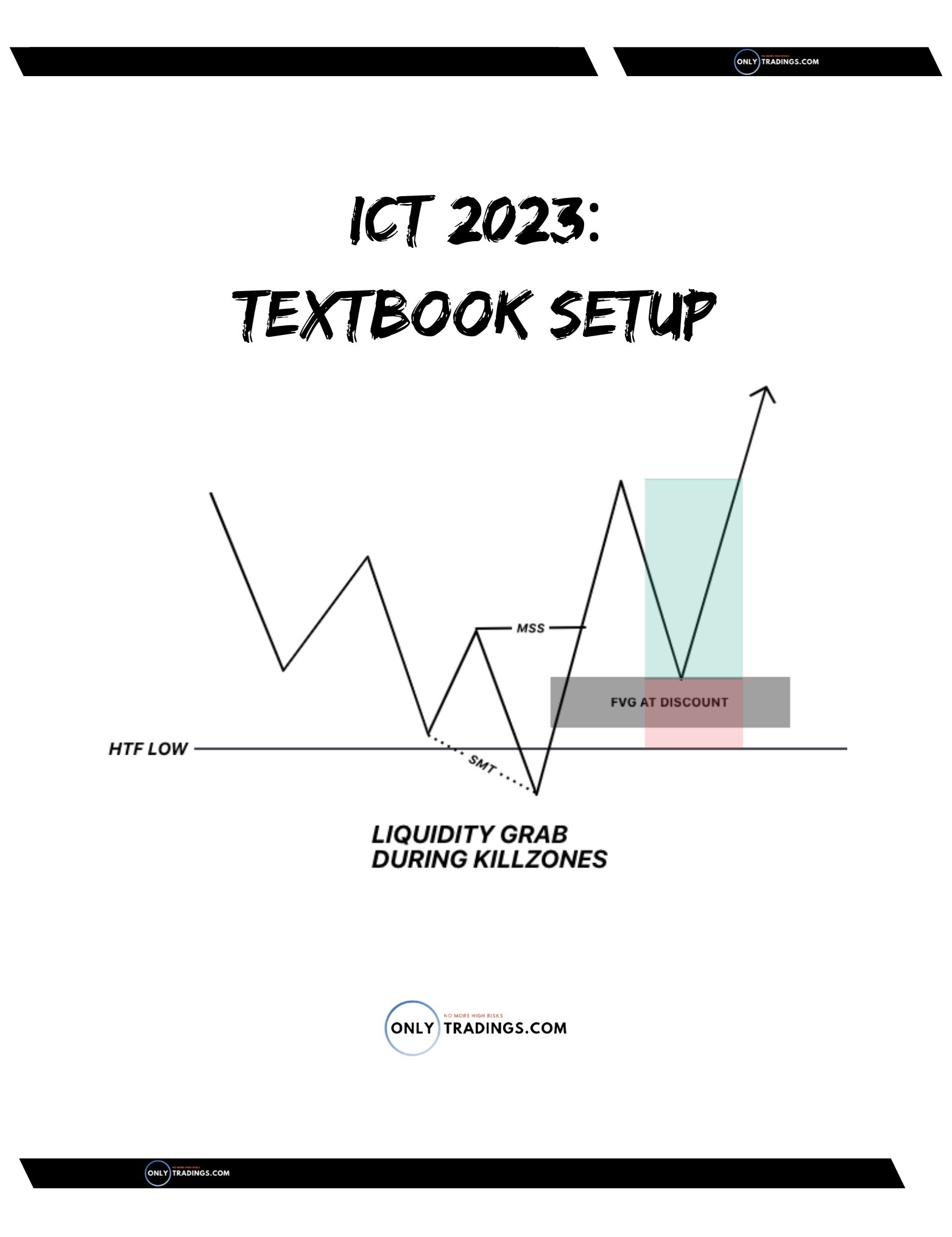

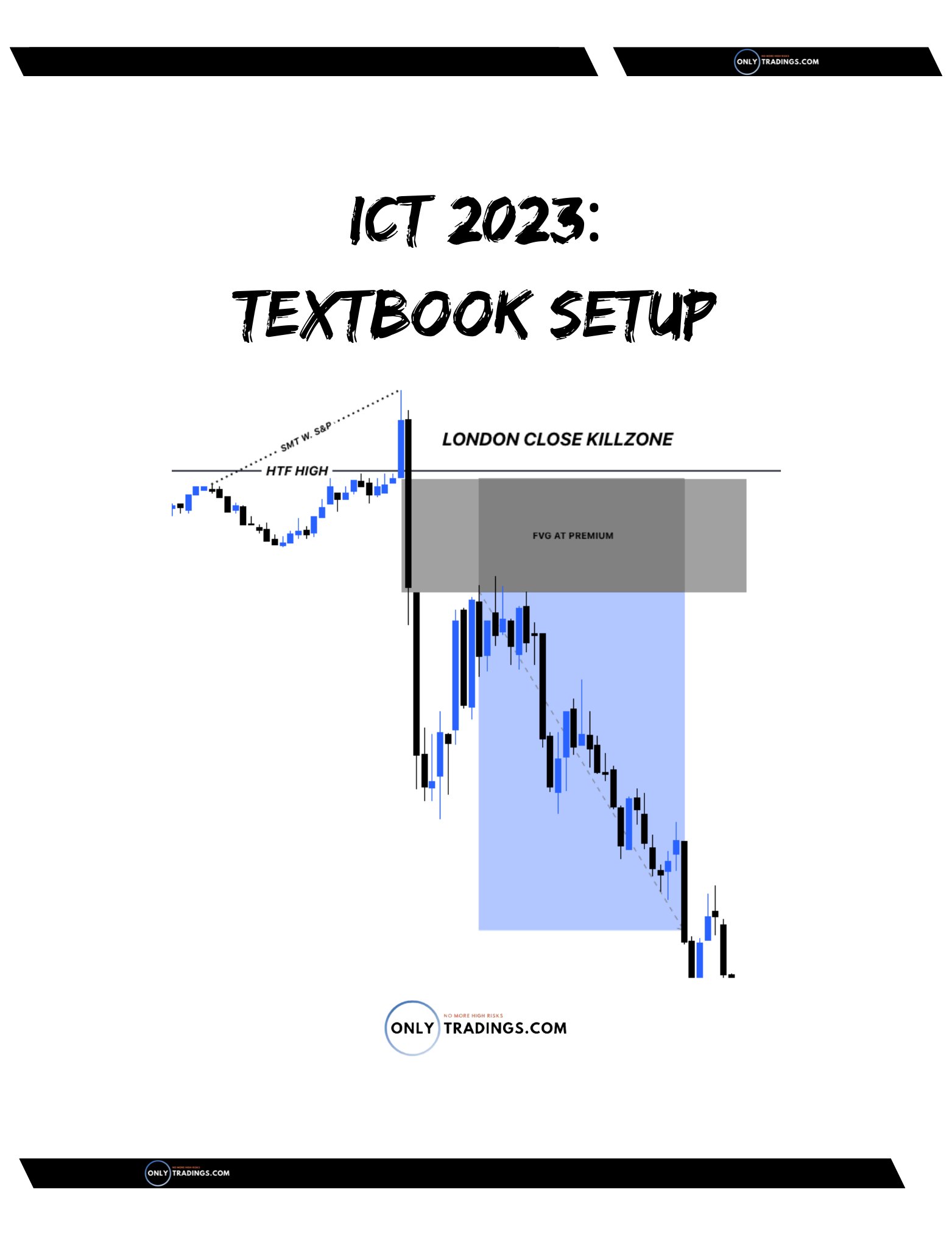

Recognizing MSS with Liquidity

When MSS occurs in combination with liquidity grabs, it can give highly reliable trade setups:

- Liquidity Grab + MSS: When price grabs liquidity above or below a swing high/low and reverses, breaking the previous structure, it often signals a shift in market sentiment. For example, price may break above a buy-side liquidity zone, only to reverse and break below a swing low, indicating a market structure shift to bearish.

Conclusion

Mastering ICT trading involves a deep understanding of buy-side and sell-side liquidity, identifying swing highs and lows, and recognizing market structure shifts. Liquidity grabs are often a precursor to significant price movements, and by spotting them, traders can anticipate price reversals or trend continuations. Combine this knowledge with market structure shifts, and you have a powerful strategy that aligns with institutional trading behavior.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.