Navigating Market Volatility: Bitcoin Holds Strong Amid Rate Cut Speculation and Inflation Uncertainty

Key Developments

Ripple Co-Founder Endorses Kamala Harris: Ripple's co-founder has publicly endorsed U.S. Vice President Kamala Harris as a potential future president, a notable endorsement within the crypto community.

CFTC vs. Kalshi: The U.S. Commodity Futures Trading Commission (CFTC) has filed an emergency motion to block prediction market platform Kalshi from listing election contracts for a two-week period, citing regulatory concerns.

Stablecoin Market Growth: Stablecoin supply has surged to $162 billion, driven by increasing institutional demand. This underscores the growing role of digital assets in institutional portfolios.

Magic Eden’s NFT Volume Surge: Magic Eden, a multi-chain NFT marketplace, has seen a significant increase in trading volume, reflecting renewed interest in NFTs.

Bitcoin and Ethereum ETFs Slump: U.S. Bitcoin and Ethereum ETFs faced a tough week, with Bitcoin ETFs experiencing $211 million in outflows as both assets dropped to new lows amid a bearish market sentiment.

Coinbase Lawsuit: Coinbase is facing a shareholder lawsuit over risks associated with its dealings with the U.S. Securities and Exchange Commission (SEC), adding to the company's ongoing regulatory challenges.

Binance Compliance Head Detained in Nigeria: Binance’s head of financial compliance has been imprisoned in Nigeria since February, involved in a legal dispute with the Nigerian government. A decision on his bail is expected next month.

Technical Analysis & Macro Trends

Bitcoin (BTCUSD): Bitcoin showed resilience, bouncing back to $55,000 after dipping to $52,550. It remains technically well-supported, trading within an ascending channel since October 2023, with the next key support levels at $55,000 and $53,000. Market sentiment continues to favor Bitcoin holding above $50,000 due to strong institutional adoption, a stablecoin market cap of $162 billion, and macroeconomic uncertainty, particularly in the lead-up to the U.S. elections.

The U.S. Federal Reserve’s September FOMC meeting looms large, with markets pricing in a 25%–35% probability of a 50 basis point (bps) rate cut. Recent weak U.S. jobs data has sparked debate over whether the Fed will pursue more aggressive cuts to cement its stance. Traders will focus on upcoming U.S. CPI and PPI data, as elevated inflation figures could unsettle markets and potentially push risk assets, including Bitcoin, lower. However, lower-than-expected inflation data could drive BTCUSD into the high $50,000s or even toward $60,000.

Key BTCUSD levels to watch:

Support: 53,000, 55,000

Resistance: 66,000, 72,000, 73,794 (All-Time High)

Ethereum (ETHUSD):

ETHUSD has struggled, nearly hitting the target of $2,100 last week. Despite ETHBTC sitting at multi-year lows, the environment remains favorable for Bitcoin due to its scarcity, especially as the U.S. election approaches. While ETH staking rewards improve risk-adjusted returns, Bitcoin's overall structure remains more attractive for investors seeking long-term gains.

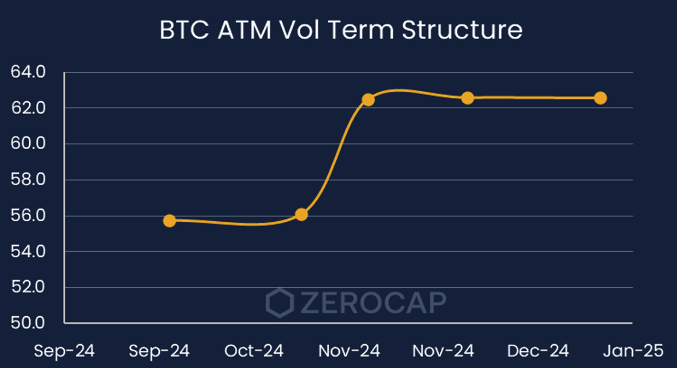

Implied Volatility Ahead of U.S. Election:

Options markets are pricing significant volatility around early November, tied to the U.S. election. Investors looking to capitalize on this may consider discount notes, which allow them to buy Bitcoin at a discount if BTC is below a predefined price cap at expiry. If BTC is above the cap, investors receive a fixed USD return.

Market Flows & Trends

Spot Market (AUD/USD):

The Australian dollar retreated last week as the U.S. dollar rallied following disappointing U.S. unemployment data. This drove demand for AUD off-ramping. Majors saw balanced flows, with a notable buy skew toward SOL (Solana). Altcoins generally underperformed, reflecting a growing investor preference for higher-quality digital assets.

Mid-week CPI data in the U.S. will be a significant catalyst for volume, as traders anticipate the Fed's rate cut decision. The desk is strategically positioned to offer competitive pricing for stablecoin/AUD and USD pairs, along with same-day settlement.

Derivatives Desk – Wholesale Investors

As the U.S. election nears, options markets are anticipating a surge in volatility in November. ETHUSD remains under pressure, though staking rewards offer a marginally better risk-adjusted outlook. The market's focus on Bitcoin’s scarcity value could drive further divergence between BTC and ETH. Investors may look to election-driven volatility to capitalize on market opportunities.

What to Watch:

Chinese CPI and PPI Data (Monday): Could provide early signals on inflationary pressures from the world’s second-largest economy.

U.S. CPI Data (Wednesday): Key driver for Fed rate expectations.

U.S. PPI & Unemployment Data (Thursday): Important for gauging economic momentum ahead of the Fed's September meeting.

Global Market Highlights:

Equities:

The S&P 500 and Nasdaq surged last week, driven by gains in technology and semiconductor sectors. Markets are closely watching the Fed’s next move, with speculation rising about a potential 50 bps rate cut at the upcoming meeting. Investors continue to weigh the impact of controlled inflation and a cooling labor market.

Fixed Income:

Goldman Sachs projects higher bond yields as the Fed's rate-cutting cycle progresses, with the nominal 10-year Treasury yield expected to hover around 4%. UBS, meanwhile, notes that investors are scaling back the likelihood of aggressive cuts, reflected in the higher yields on 2-year Treasuries.

Central Banks:

The European Central Bank (ECB) cut rates by 25 bps, with further cuts expected by year-end. Meanwhile, the Bank of England (BoE) and Bank of Japan (BoJ) are expected to hold steady in upcoming meetings, with potential moves forecasted for later this year or early 2025.

Oil:

Oil prices have dropped due to weaker economic data and anticipated increases in supply from Libya as political tensions ease.

Market Outlook

While risk assets, including cryptocurrencies, face short-term headwinds due to macroeconomic uncertainty, the long-term outlook remains constructive, particularly for Bitcoin. Institutional adoption continues to drive demand, and the upcoming U.S. election adds an additional layer of volatility and opportunity for investors. The focus this week will be on inflation data and its implications for the Fed’s next move. Expect a volatile week ahead.

Based on the current market environment and key data points from the previous week, the following predictions can be made for the coming weeks:

Cryptocurrency Market:

#1. Bitcoin (BTCUSD):

Short-Term Outlook: Bitcoin is expected to maintain its current range, with key support around $53,000 and resistance at $55,000. The upcoming U.S. CPI and PPI data, coupled with the Federal Reserve’s rate decision, will be critical in determining Bitcoin's next move. Should inflation come in lower than expected, a rally toward $60,000 is likely, driven by renewed risk-on sentiment. Elevated inflation could, however, trigger a short-term sell-off, pushing BTCUSD below $53,000.

Medium-Term Outlook: Given the institutional adoption trends and macroeconomic uncertainty, Bitcoin is poised to retain its value above the $50,000 level in the medium term. The scarcity premium will play a pivotal role in driving demand as we approach the U.S. election, which historically increases volatility. If the Fed opts for a surprise 50 bps cut, we could see Bitcoin rapidly retest highs near $66,000.

#2. Ethereum (ETHUSD):

Short-Term Outlook: Ethereum is likely to continue underperforming relative to Bitcoin, with ETHBTC sitting at multi-year lows. However, should Bitcoin rally, ETH may follow suit and attempt to breach the $2,100 level. Investors should remain cautious, as ETH’s upside is limited in comparison to Bitcoin’s scarcity-driven growth.

Medium-Term Outlook: Ethereum’s risk-adjusted performance could improve, particularly if inflation subsides and the market becomes more favorable toward altcoins. However, Bitcoin’s scarcity advantage and institutional preference for BTC as a store of value may continue to overshadow Ethereum in the medium term.

#3. Altcoins & Stablecoins:

Altcoins are unlikely to experience significant recovery in the short term, as investor interest remains skewed towards quality assets like Bitcoin and Ethereum. However, institutional demand for stablecoins, now at $162 billion, suggests that quality altcoins could see renewed interest if macroeconomic conditions stabilize.

Traditional Markets:

#1. Equities:

The S&P 500 and Nasdaq have experienced significant gains driven by technology and semiconductor sectors. If U.S. CPI and PPI data come in lower than expected, equities could extend their gains, especially if the Federal Reserve signals a more dovish stance. However, a surprise upside in inflation could lead to market confusion, triggering a short-term sell-off in risk assets, including equities.

#2. Bonds:

Treasury yields may continue to rise, particularly if the Fed opts for a cautious rate cut or delays the decision. The 10-year Treasury yield is expected to stay around 4%, with further upside if the Fed adopts a more measured approach to cutting rates. A 50 bps cut could lead to lower yields in the short term, but resilient economic data will likely cap any significant declines.

#3. Oil:

Oil prices are likely to stabilize as weak demand pressures are offset by a potential supply increase from Libya. The medium-term outlook suggests range-bound trading, with geopolitical factors and economic data from major consumers like China influencing price movements.

Global Economic Outlook:

#1. Interest Rates & Central Banks:

Markets are increasingly pricing in a 50 bps cut from the Federal Reserve, but the final decision will depend on the upcoming inflation data. Lower-than-expected CPI and PPI figures would cement the 50 bps cut, driving risk assets higher. However, elevated inflation could cause the Fed to adopt a more hawkish stance, delaying deeper rate cuts.

The European Central Bank’s recent 25 bps rate cut suggests more easing is on the horizon in Europe. The Bank of England and Bank of Japan are expected to hold rates steady for now, but potential rate adjustments are likely in the coming months.

#2. Macro Risks:

Volatility is expected to increase ahead of the U.S. presidential election. Political uncertainty, combined with fluctuating economic data, will contribute to heightened market sensitivity. Traders should prepare for sharp movements in both traditional and crypto markets, particularly in November as election risk becomes a primary market driver.

Conclusion:

In the short term, markets are bracing for volatility tied to inflation data and the Federal Reserve’s upcoming decision. Lower inflation numbers would likely fuel a risk-on rally in both traditional and crypto markets, with Bitcoin potentially testing $60,000 and equities pushing higher. Conversely, higher inflation could bring a temporary pullback in both asset classes. Medium to long term, Bitcoin’s scarcity and institutional demand will continue to support its value, while equities may benefit from a more accommodative Fed, particularly in tech and financial sectors.