Understanding Accumulation, Manipulation, and Distribution (AMD) in Trading

Dear traders,

In the world of trading, mastering the flow of market movements often boils down to understanding three key phases: Accumulation, Manipulation, and Distribution (AMD). These three stages describe how price movements unfold over time, helping traders to identify and capitalize on patterns. While many traders focus on price action, a deeper comprehension reveals that timing plays an equally—if not more—important role in AMD. Let’s break it down.

What is AMD?

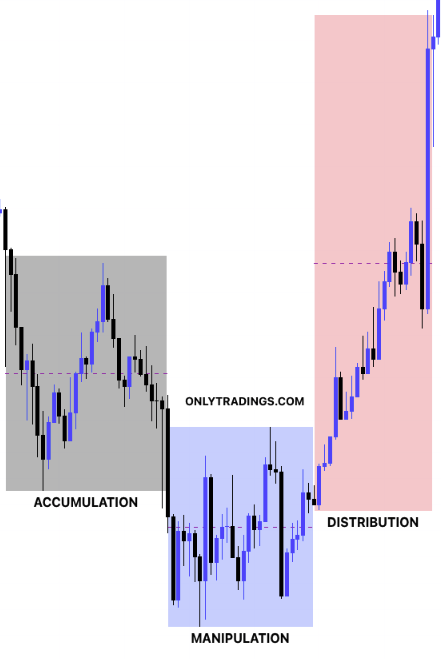

Simply put, AMD represents the three critical phases of market behavior:

- Accumulation occurs when the market is consolidating, gathering orders, and positioning for a future move.

- Manipulation refers to a temporary price move designed to "trap" traders in the wrong direction, often followed by a reversal.

- Distribution happens when the market moves in the anticipated direction after accumulation and manipulation, fulfilling the original intent of the price action.

Incorporating "time" into the AMD model brings a whole new perspective to this understanding.

The Role of Time in AMD

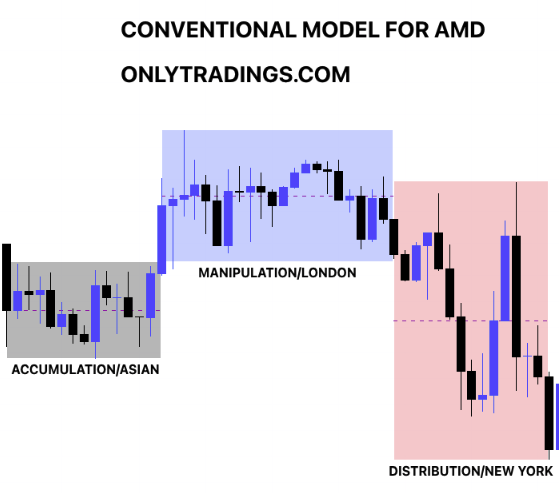

The trick to successfully identifying AMD patterns lies in understanding the specific sessions of the global market. Each major session—Asian, London, and New York—has a unique character that contributes to how the AMD phases unfold.

- Asian Session: This is where accumulation often takes place. The market consolidates, creating a base from which price action can be manipulated later.

- London Session: Typically, this is where manipulation occurs. The market may attempt to trap traders by sweeping stops and creating false breakouts based on the earlier accumulation.

- New York Session: Distribution tends to occur during this session. After manipulation, the price finally moves in the intended direction, reaching new levels as traders exit their positions.

However, this typical structure isn't always the case. There are exceptions, and when these exceptions occur, understanding them can be pivotal for traders.

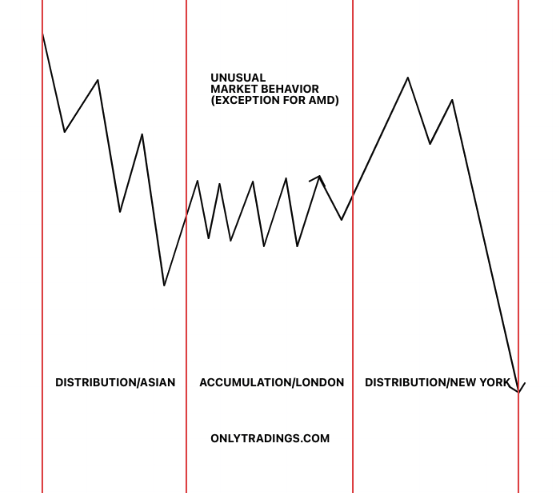

The Exception to the Rule

There are moments when accumulation does not follow the traditional pattern of happening during the Asian session. Instead, distribution may occur during the Asian session, and when this happens, it disrupts the conventional sequence. As a result:

- London will often accumulate rather than manipulate.

- New York will distribute, as usual.

Understanding this variation requires a focus on what the Asian session did. If the Asian session deviates from its typical accumulation phase, the entire flow of AMD shifts. By recognizing this, traders can adjust their expectations for the subsequent sessions and avoid falling into traps set by conventional thinking.

The Importance of Timing Over Price

Most traders emphasize price action as the key to understanding market movements. However, when you begin to focus on the time—specifically the time during each session—you start to unlock new insights. Recognizing whether the market is in an accumulation, manipulation, or distribution phase at specific times of day can give you a substantial edge.

It all comes down to understanding the Asian session and its influence on subsequent sessions. Many traders overlook this, but once you realize the importance of time, you begin to see the market in a clearer, more strategic way.

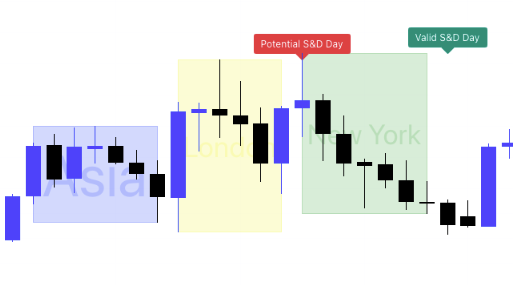

The "Seek and Destroy" Pattern

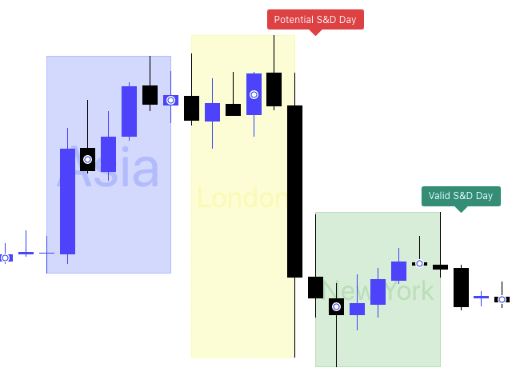

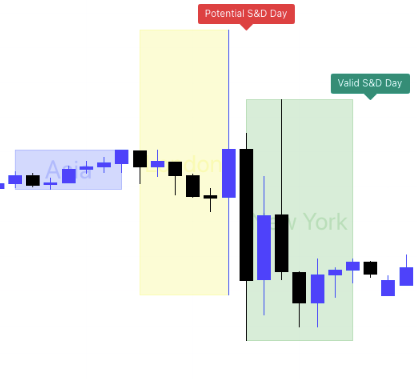

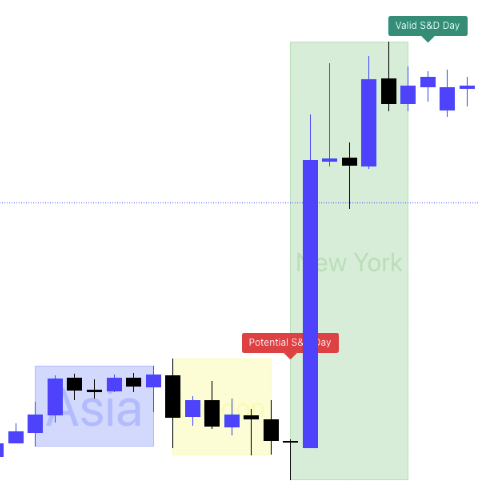

Besides the exception we discussed, another significant pattern to understand is the Seek and Destroy pattern. In this setup:

- The London session manipulates both the high and the low points of the Asian session.

- The New York session then sweeps both the high and the low points set during the London session.

This pattern serves as a second exception to the standard AMD flow, and recognizing it can be highly profitable for traders who understand the interplay between different sessions.

Here are more examples of SEEK AND DESTROY PATTERN:

Key Takeaways

In conclusion, successfully navigating the markets can be simplified into understanding three core concepts:

- Accumulation, Manipulation, and Distribution (AMD): Recognizing these phases across market sessions.

- The Role of Time: Focusing on the session timing, particularly the behavior of the Asian session, rather than price alone.

- Seek and Destroy Pattern: A secondary pattern where London manipulates both sides of the Asian session, and New York sweeps both sides of the London session.

While there are various market profiles and techniques available, keeping your strategy simple and focusing on these three foundational aspects can lead to trading success. Many seasoned traders agree that simplicity is key to mastering the markets.

For more advanced concepts like market structure shifts, the true opening of the market, and the Change in State of Delivery (CISD), stay tuned for upcoming articles on OnlyTradings.com. We aim to provide reliable, actionable insights to cut through the misinformation often found online.