Fed's 50bps Rate Cut: A Turning Point for Markets and the Path to a Soft Landing

S&P 500 Reaches Record High Amidst 50bps Rate Cut and Fed’s Soft Landing Focus

The S&P 500 achieved an all-time high this week, driven by the Federal Reserve's significant 50 basis point (bps) rate cut. This substantial cut signals the Fed's focus on achieving a soft landing for the economy, aiming to navigate through potential recessionary pressures while keeping inflation in check. Key events to watch in the upcoming week include the US PCE inflation data, European PMI, and the Japanese election, as these indicators will influence the likelihood of further rate cuts by the ECB and shape the future policy trajectory of the Bank of Japan (BoJ).

Federal Reserve Rate Cut: Implications for Economic Stability

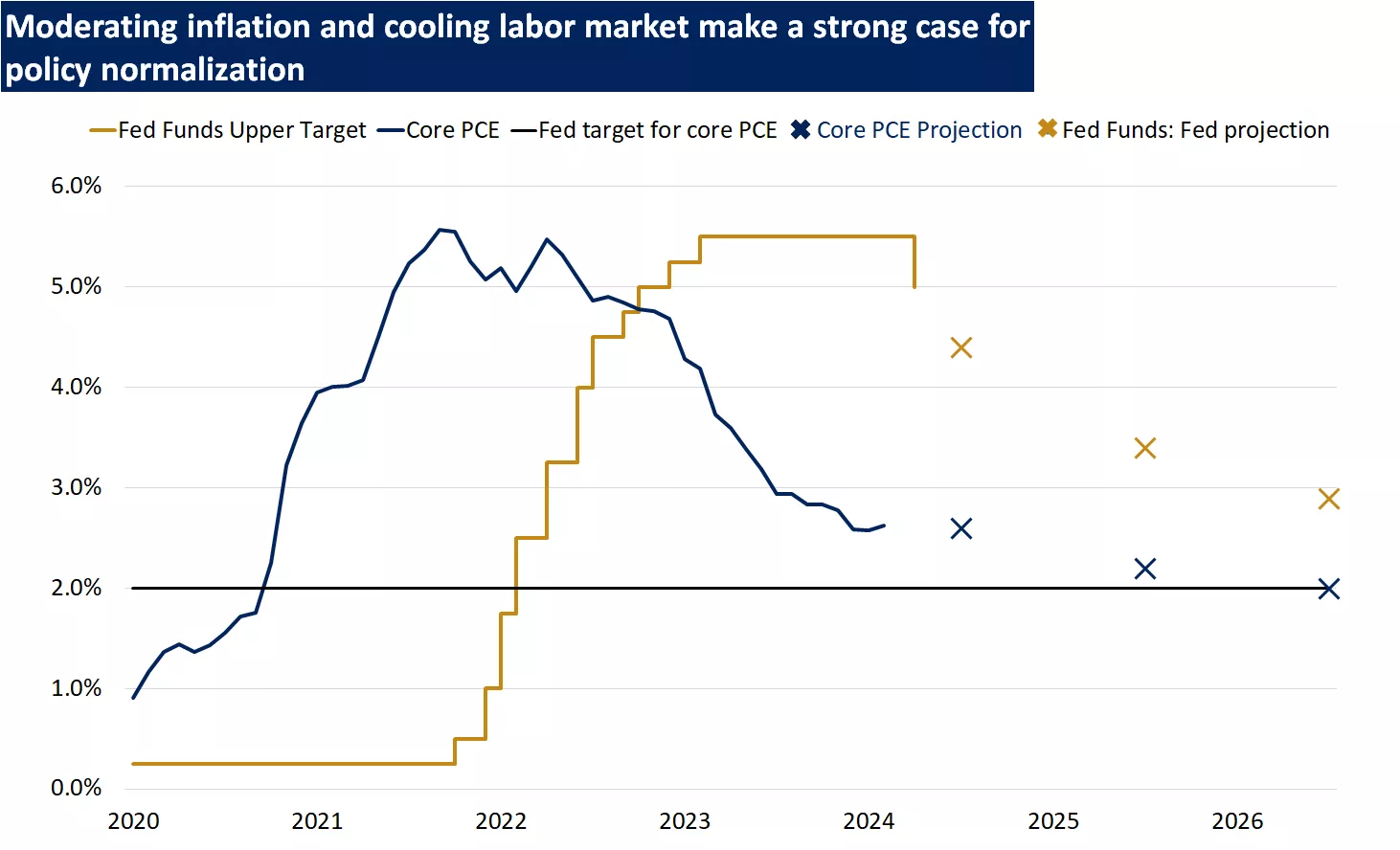

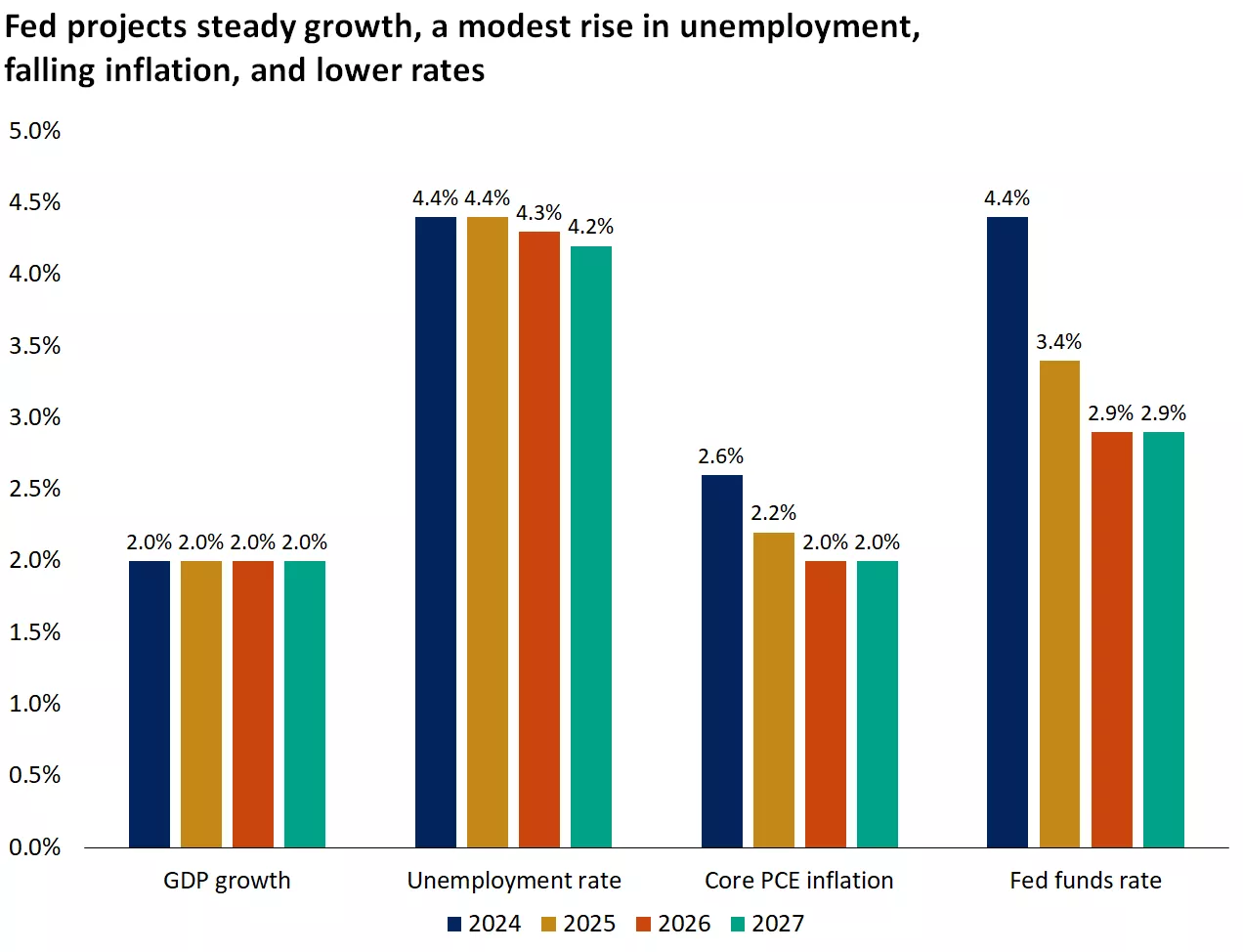

The recent 50bps cut is designed to sustain the labor market and reinforce economic stability. In the Fed's dot plot forecast, the projected additional rate cuts suggest a further 50bps reduction this year (compared to the market's expectation of 70bps), followed by 100bps in 2025, and 50bps in 2026, ultimately aiming for a long-term rate of 2.875%.

BoE and BoJ Hold Rates Steady, Markets Anticipate Future Actions

The Bank of England (BoE) maintained its interest rate at 5%, citing consumer price index data aligning with expectations. However, markets are pricing in potential 25bps hikes in both November and December. Meanwhile, the BoJ held its rates steady, influenced by Japan’s expanding trade deficit and weaker export growth. Market participants are expecting a 25bps hike by year-end to manage inflation.

Equity Markets: Insight from UBS and J.P. Morgan

UBS emphasizes that US election outcomes could impact policies across various sectors, especially consumer discretionary and renewable energy. J.P. Morgan notes that while tech companies initially thrived due to AI enthusiasm, other sectors have been showing resilience. The S&P 500 excluding the “Magnificent 7” has experienced gains, suggesting that a soft landing could benefit a broader range of companies beyond mega tech firms.

Fixed Income Perspectives:

Morgan Stanley indicates that fixed-income investors have benefited from the rate cuts and price gains linked to the current turning point in the cycle. However, they caution against expecting the same level of performance in Q4, as rates might bounce back. UBS suggests that the Fed's larger cuts will diminish returns on cash holdings, recommending a shift towards assets such as medium-duration bonds and investment-grade bonds to capture more stable returns.

Economic Outlook and Analysis:

Barclays highlights downward pressure on China’s economic growth, anticipating more reactive easing policies, particularly in housing and monetary policy, to counteract this trend. Bank of America underscores that while job market data has recently disappointed, further deterioration is unlikely. With strong consumer spending, corporate profits, investments, and GDP growth, they believe the economy is on track for a soft landing.

Week in Review: Cryptocurrency and Market Dynamics

MicroStrategy’s stock surged by 8% following the acquisition of an additional 18.3K BTC for $1.1 billion, marking its largest purchase since 2021. Meanwhile, US spot Bitcoin ETFs saw their highest daily inflows in nearly two months, as BTC approached the $60,000 mark. In contrast, FTX's Sam Bankman-Fried is appealing his fraud conviction, seeking a new trial.

Tether made notable moves by onboarding PayPal’s former head of government affairs, while Hong Kong explores new regulations for OTC crypto trading. Amid this backdrop, an English court declared Tether as personal property.

Technical Analysis & Macro Overview

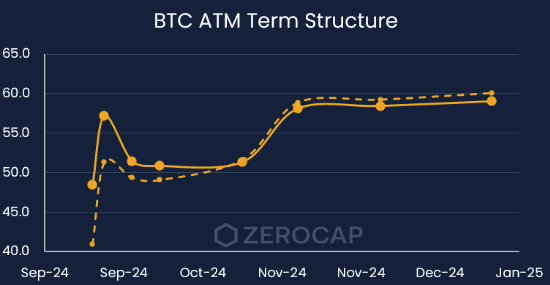

BTCUSD: Key levels: 53,000 / 55,000 / 60,300 / 66,000 / 72,000 / 73,794 (ATH)

Bitcoin rallied to $60,000 after inflation data (CPI and PPI) came within expectations. The shift in Fed Funds Futures—now pricing in a 59% chance of a 50bps cut—adds to market volatility. With the Fed leaning towards a rate-cutting cycle, risk assets like Bitcoin could see support into the year-end.

S&P and Nasdaq Performance: Both indices neared all-time highs, with BTC and ETH following suit, albeit facing reversion to the range. Michael Saylor's $1.1 billion BTC purchase has buoyed prices, yet uncertainties surrounding the upcoming US election could impact sentiment.

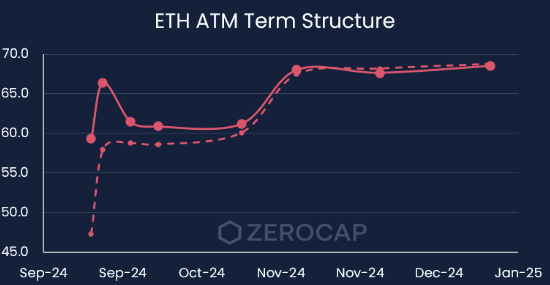

ETHUSD: Key levels: 2,100 / 2,800 / 3,600 / 4,000

Ethereum has shown continued weakness against Bitcoin, hitting multi-year lows. Despite the bearish momentum, fundamentals favor BTC. A longer-term outlook suggests ETH might further underperform against BTC.

Spot Desk Observations:

The Australian Dollar (AUD) experienced volatility, closing at 0.6705 against the USD. A moderate rebound was noted towards the end of the week, propelled by a recovery in global stock markets and a decline in the USD. Major cryptocurrencies like BTC and SOL remained preferred choices among investors, while alts exhibited subdued demand.

Derivatives Desk Insights (Wholesale Investors Only):

The basis rates remain steady, with BTC’s 90-day annualized rate at 7.25% and ETH’s at 5.29%. Implied volatility (IV) has trended downward, although slight spikes were observed ahead of the FOMC decision.

Five Key Takeaways from the Fed’s Rate Cut Decision:

#1. Supersized Rate Cut Signals a Critical Turning Point:

Last week, the Fed reduced its policy rate by 0.5%, a more aggressive cut than the usual 0.25%, marking the first rate cut in four years. This decision shifts the monetary-policy cycle toward easing, after the most aggressive tightening campaign in 40 years. While this cut wasn't entirely anticipated, bond markets had priced in about a 60% chance of such a move before the decision. The cut was larger to avoid falling behind in responding to changing economic conditions, showing the Fed’s proactive approach. It wasn't unanimous—Governor Bowman dissented, preferring a smaller cut—indicating differing views within the Fed. Chair Powell clarified that future cuts are likely to be smaller, underscoring the 0.5% move as an exception, not a trend.

#2. Preemptive Action to Support a Soft Landing:

Unlike the previous times the Fed made a single 0.5% cut during easing cycles (2020, 2008, and 2001), this rate cut wasn’t driven by recessionary conditions. Instead, it serves as an insurance measure against an unexpected slowdown in employment, aiming to sustain the ongoing economic expansion. Chair Powell expressed confidence in the current strength of the US economy, emphasizing that this cut is intended to "keep it there." The Fed's updated projections forecast a peak unemployment rate of 4.4%, a figure suggesting only a mild cooling in the labor market while maintaining close-to-full employment. This stance increases the likelihood of a soft landing, as the easing of interest rates aims to gradually stimulate growth without inducing a recession.

#3. Not a One-and-Done: The Fed's Multiyear Easing Path:

The recent cut marks the beginning of what is expected to be a multiyear rate-cutting cycle. According to the updated "dot plot," the Fed anticipates another 50bps in cuts this year, followed by four additional cuts in 2025, and two more in 2026, ultimately aiming to reach a neutral policy rate of around 2.9%. This projected path means the Fed is targeting a gradual easing that will lower borrowing costs, helping economic growth to regain momentum by 2025 after a potential slowdown in the coming quarters. While deviations are expected based on evolving economic data, the intention is clear: to transition toward a more accommodative monetary environment over the next few years.

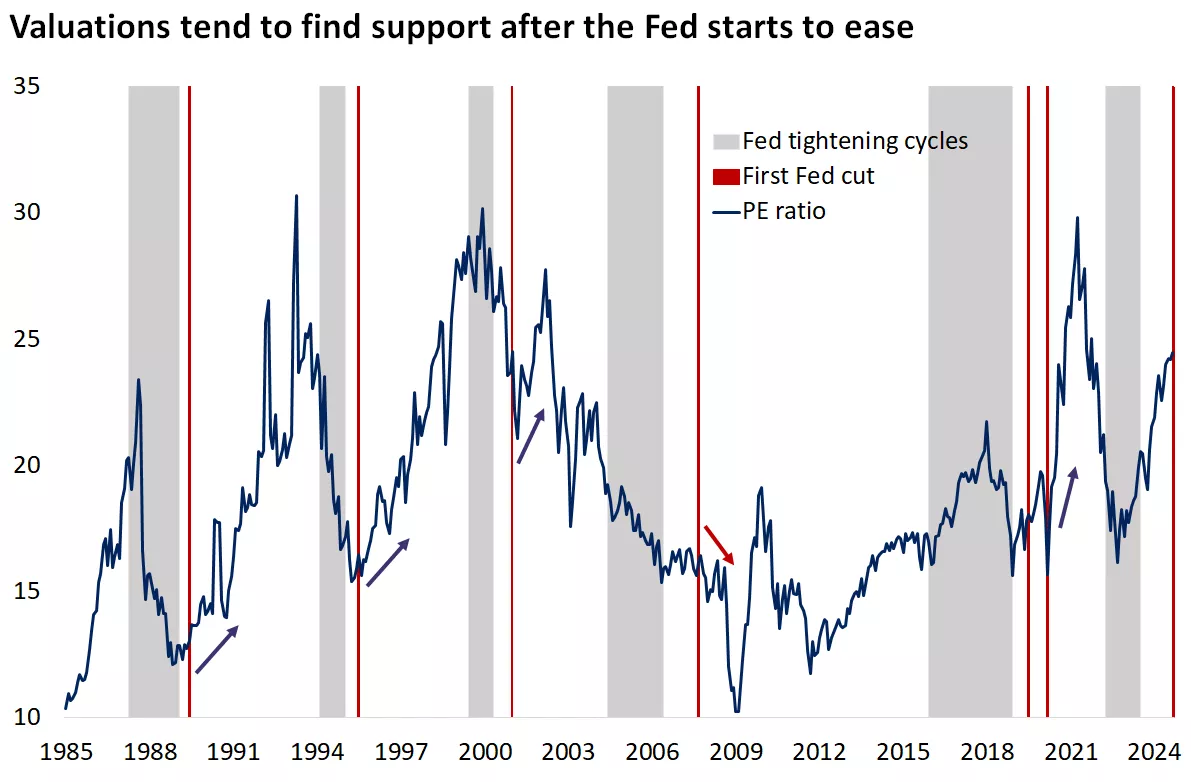

#4. Positive Outlook for Equities If Recession Is Avoided:

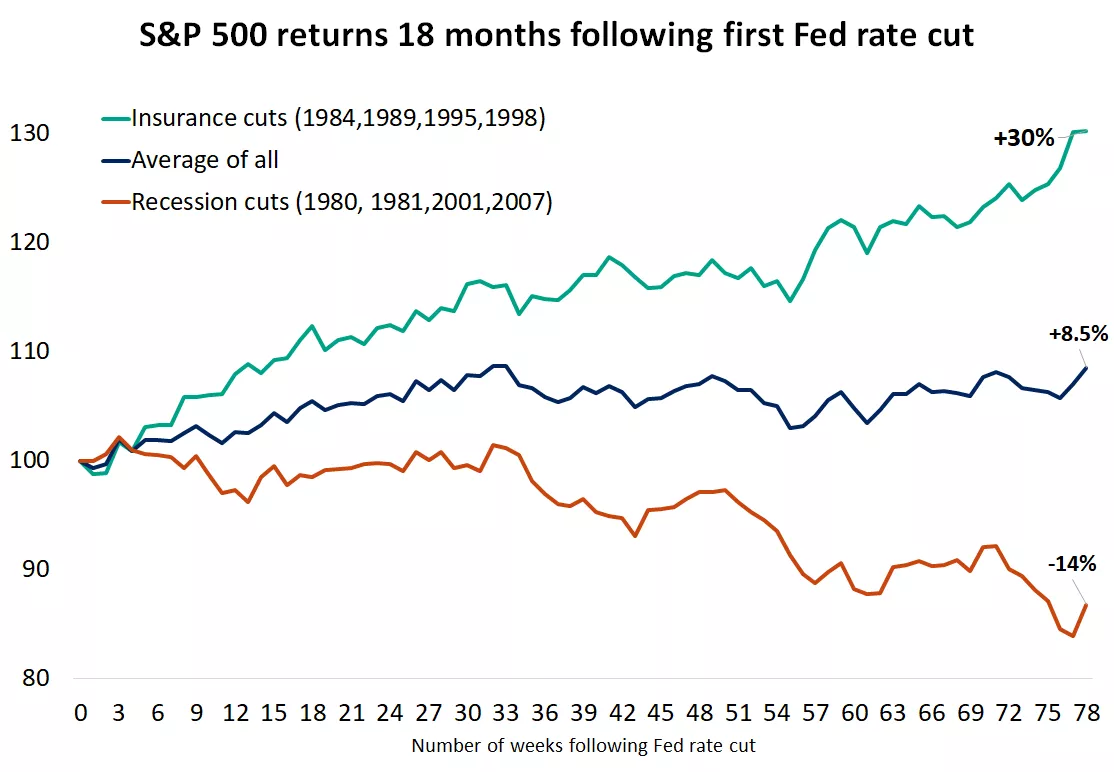

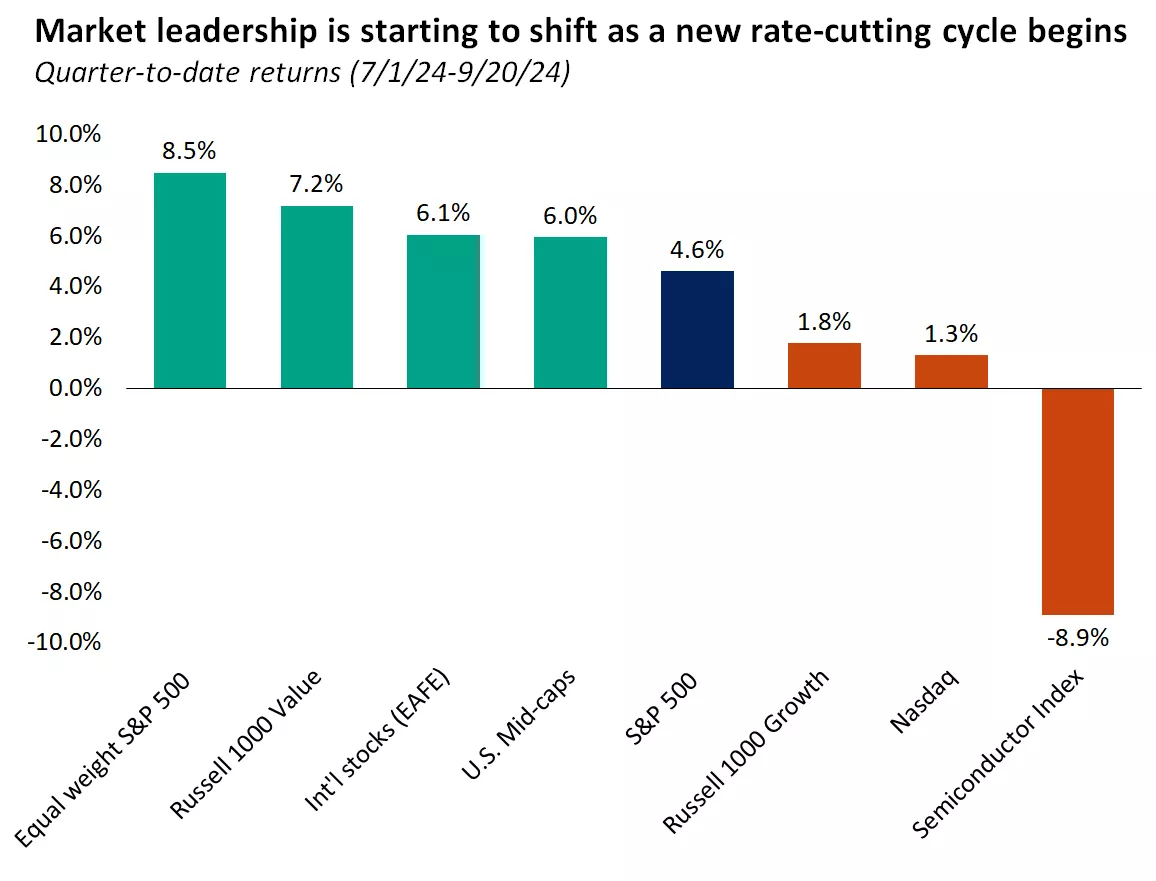

Historically, the start of a rate-cutting cycle that doesn’t coincide with a recession has led to strong equity returns, with previous instances (1984, 1989, 1995, and 1998) yielding robust gains. The current economic conditions suggest the Fed's rate cuts might mirror these past non-recessionary cycles, rather than those tied to downturns (1981, 2001, and 2007). Notably, the last time the Fed initiated a rate cut when stocks were at record highs was in 1995, which saw the S&P 500 rise by 23% over the subsequent 12 months. However, because current valuations are elevated compared to historical levels, future equity gains may be more moderate. Investors should watch for shifts toward sectors like cyclicals, mid-cap, and high-quality dividend stocks, as they could outperform relative to mega-cap tech.

#5. Opportunities and Risks with Rate Cuts: Market Rotation and Cash Allocation:

The move towards easing interest rates opens up opportunities for sector rotation, especially for industries hit hardest by previous rate hikes. This shift could benefit defensive and cyclical sectors (real estate, utilities, financials, and industrials), potentially closing the performance gap with technology and communication services. For fixed-income investors, the rate cuts present a chance to capitalize on long-term bonds, as yields are likely to trend lower. The reduction in Fed policy rates also brings risks associated with holding excessive cash investments, as reinvestment rates could be significantly lower when short-term instruments mature. Investors are encouraged to diversify into intermediate- and long-term bonds to mitigate the risk of reinvesting at reduced yields over time.

Conclusion:

These expanded insights reflect the potential impact of the Fed's recent rate cut across different asset classes, highlighting both opportunities and risks in the evolving economic landscape. The proactive and preemptive nature of the Fed's decision underscores the possibility of a soft landing, providing cautious optimism for investors moving forward.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.