Psychological Mastery in Trading: The Power of Rule-Based Discipline with the ICT Unicorn Model

#1: Why I Decided to Stay Out of Trading Today

Today, I was anticipating the emergence of a Unicorn model after observing the Liquidity Sweep followed by a Market Structure Break. However, the expected conditions, specifically the Fair Value Gap (FVG) overlapping with the Breaker Block, which are the essential components of a textbook Unicorn model, didn’t materialize as clearly as I wanted. Due to this, I’ve decided to step back and not trade today. This decision aligns with my trading principle of only engaging when my preferred setup is fully realized. This approach helps me maintain a disciplined and consistent trading strategy, preventing emotional or impulsive decisions that often lead to unfavorable outcomes.

#2: Breakdown of the ICT Unicorn Model

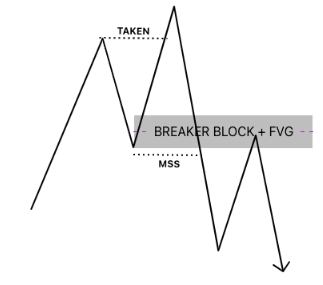

In reference to the image, the reason why this specific setup isn’t a complete Unicorn model is because the overlap between the Breaker Block and the Fair Value Gap (FVG) is not clearly visible. In the ideal Unicorn model, these two elements should coincide perfectly, providing a stronger indication of a high-probability trade entry. The absence of this overlap in the current setup means it doesn't meet the stringent criteria I adhere to when executing the Unicorn model.

#3: Yesterday's US30 (Dow Jones 30) Short Position Analysis

Yesterday, I identified and executed a short position on the US30 (Dow Jones 30) based on the following criteria:

*NOTE: The short position on the US30 was my personal trade, so I apologize for the discrepancy in the chart setup you might be accustomed to.

A) Previous Day High (PDH) – Draw on Liquidity for Today's Trading Setup: I anticipated that today's candle would reach the previous day's high. This expectation was grounded in the idea that liquidity tends to reside around the highs and lows of the previous day, making them significant points of interest for price movement.

B) Power of 3 Concept: I confirmed that the current price was positioned above today's opening price. The "Power of 3" principle suggests that when price is above the open, it's an optimal selling region, signaling potential bearish activity.

C) Market Structure Shift + Breaker Block: I observed a Market Structure Shift and identified that the Breaker Block overlapped with the Fair Value Gap created by the shift in the market structure. This confluence indicated a strong likelihood of a bearish move.

D) SMT Divergence with S&P 500 and NASDAQ 100: I validated the trade setup by identifying Smart Money Technique (SMT) divergence between the US30 and other correlated indices like the S&P 500 and NASDAQ 100, further confirming the bearish bias.

E) Target Setting: I anticipated a bearish candle formation and set my target just above the previous day's opening, where liquidity was likely to be collected.

As a result, this setup aligned perfectly with the Unicorn model criteria, which is why I confidently took the short position.

Comparison with Bitcoin Today

Today, I noticed Bitcoin showing a similar pattern, but it didn’t fulfill the Unicorn model requirements as precisely as the US30 setup did yesterday. Hence, based on my criteria and discipline, I've opted not to trade today.

Why It's Important to Follow Rule-Based Trading and Maintain Psychological Stability

It's crucial to adhere strictly to a rule-based trading system to ensure long-term profitability and success in trading. Trading is a psychological battle as much as it is a technical one. By sticking to a predetermined set of rules and conditions, such as the Unicorn model criteria, you remove the influence of emotions from your trading decisions. This disciplined approach prevents you from taking impulsive trades that could lead to unnecessary losses, helping you maintain consistency and confidence in your strategy over time.

Additionally, remaining psychologically stable is fundamental for sustaining a successful trading career. When you only trade setups that meet your precise criteria, you minimize stress and avoid the psychological pitfalls that come with overtrading or chasing the market. This mindset allows you to approach each trading day with a calm and composed attitude, knowing that you're adhering to a proven system that maximizes your chances of long-term success.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.