Market Analysis: Post-Election Impact and Current Trends

Key Insights and Market Behavior Post-Elections

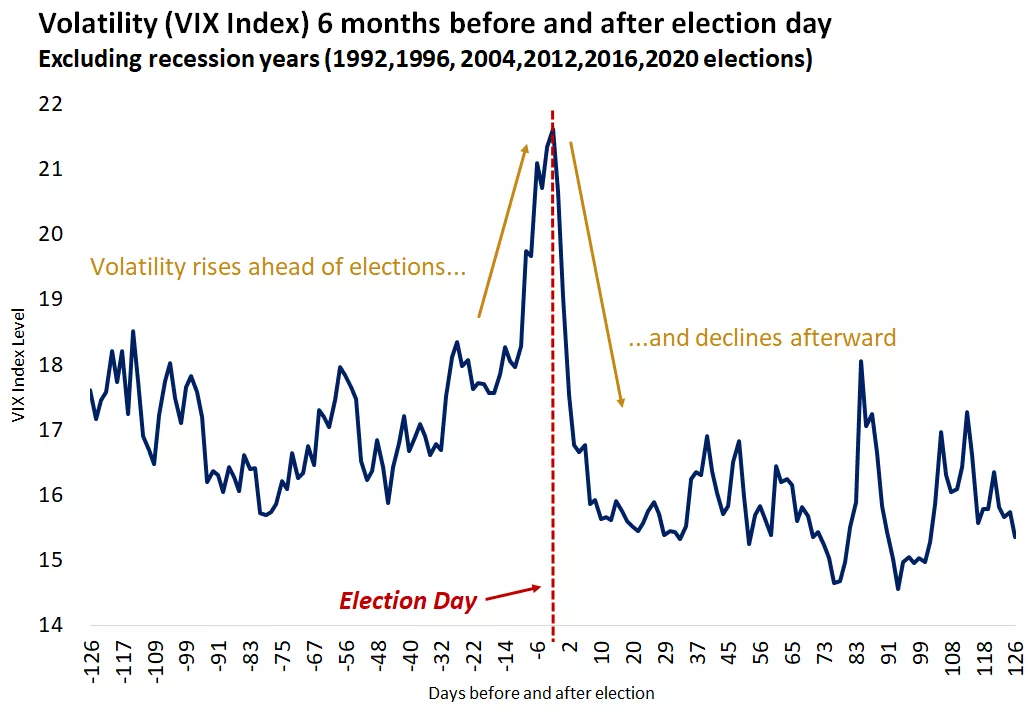

#1. Record-Highs Amidst Optimism: Recent stock market highs have been driven by positive factors such as the Federal Reserve's rate cut, enthusiasm around artificial intelligence, and broadening market leadership. Although election uncertainties have not yet significantly impacted market behavior, these effects may become more pronounced as the November elections approach. Historically, market volatility tends to rise in anticipation of elections but often diminishes quickly once the election concludes, as investors revert to focusing on fundamental economic trends and policies.

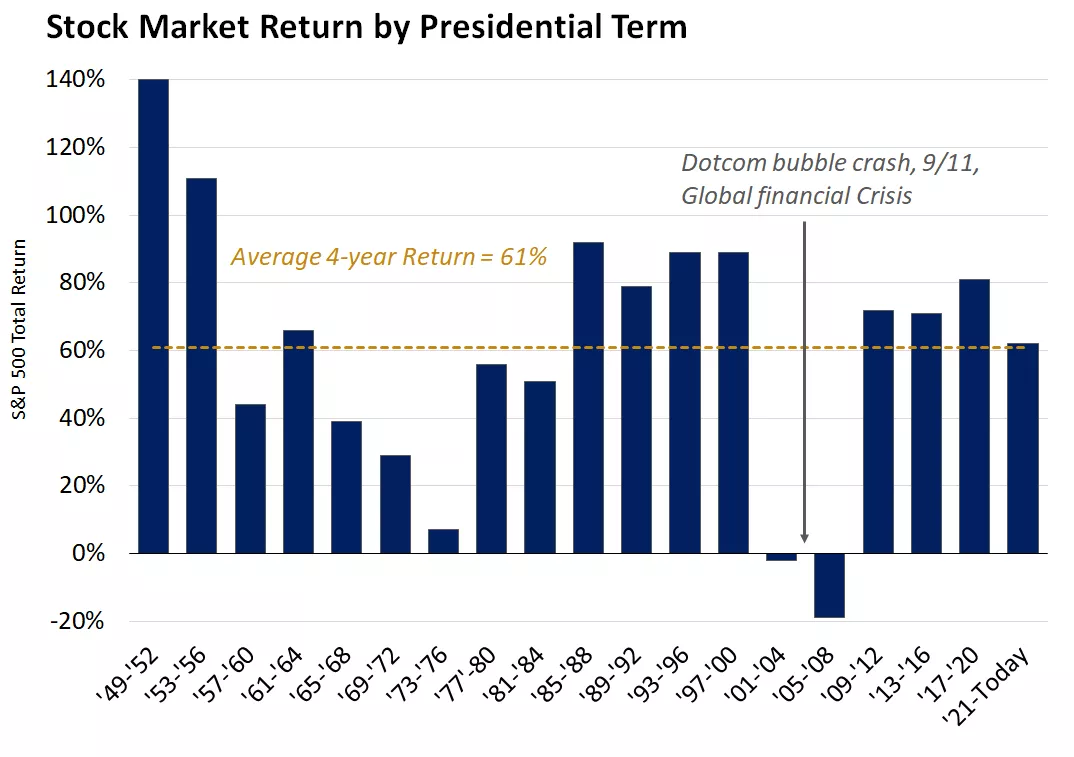

#2. Performance Under Both Parties: Historically, markets have performed well under both Democratic and Republican administrations. A key takeaway for investors is that fundamental factors, such as an extended economic expansion and rising corporate earnings, are typically more influential than the political party in power. A divided Congress, often resulting from elections, tends to mitigate the risk of extreme policy changes, allowing markets to remain more stable.

#3. Post-Election Market Focus: As election-related uncertainties clear, the market typically refocuses on three main areas:

- Economic Momentum: Despite slowing down, the economy is expected to maintain steady growth, with no immediate signs of an impending recession.

- Federal Reserve Policy: The Fed's recent shift from tightening to easing policies, starting with a rate cut this month, signals an accommodative stance that is likely to continue.

- Corporate Earnings: Rising corporate earnings continue to support higher stock valuations, underpinning the bull market's strength.

Historical Market Responses to Presidential Elections:

Election-Driven Volatility: While some election-driven volatility is inevitable, it is usually short-lived. Historically, market volatility increases ahead of elections but subsides afterward as policy clarity emerges. For example, the VIX index, which measures stock-market volatility, declined by 36% in the 10 days following the 2020 Trump-Biden election. A contested election, such as the 2000 "hanging chad" incident, can extend volatility, but the impact typically fades once the outcome is finalized.

Market Performance Post-Election:

- One Week Later: The market typically sees a minor drop, averaging -1%, with over 60% of cases showing negative performance in the first week.

- One Month Later: The average gain is less than 1%, with about 60% of instances resulting in positive performance.

- One Year Later: The market has historically risen by an average of 10%, demonstrating resilience, with nearly 70% of elections resulting in positive performance one year later.

- Four-Year Presidential Term: Over a full term, the stock market has gained an average of 61%, with broader economic trends, not political outcomes, being the primary drivers.

Weekly Crypto Market Overview – September 23, 2024

Kamala Harris' Comments: For the first time, Vice President Harris spoke about digital assets, signaling potential support for innovation while emphasizing investor protection.

Bitcoin's Rally: Bitcoin reached a peak above $64K, while gold hit a new all-time high. The Federal Reserve's interest rate cut fueled optimism, and the SEC's approval for Nasdaq to list options on the iShares Bitcoin Trust ETF marked a significant milestone for derivatives trading.

Altcoin Performance: Altcoins surged following the Fed's rate cut, with notable gains across the market.

Technical Analysis of Key Cryptocurrencies

Bitcoin (BTCUSD): Following the recent 50 bps Fed rate cut, Bitcoin rallied, and technical indicators suggest further upside potential, targeting levels around 65,000. Market sentiment fluctuates with election polls, as both Trump and Harris have differing stances on cryptocurrencies. Analysts predict Bitcoin's market cap could potentially grow to 7% of global capital over the next decade, signaling long-term growth.

Ethereum (ETHUSD & ETHBTC): Although Ethereum's performance has been under pressure, recent order flow suggests some reversion is likely, and long-term trends may still favor Bitcoin over Ethereum.

Altcoin Spotlight: TAO (Bittensor)

TAO, the cryptocurrency of Bittensor's decentralized machine learning network, experienced a 100% surge in one week. This upward trend suggests that TAO could be an attractive opportunity for momentum-based trading strategies, though caution is advised due to potential volatility.

Market Wrap – September 29, 2024

Major Highlights:

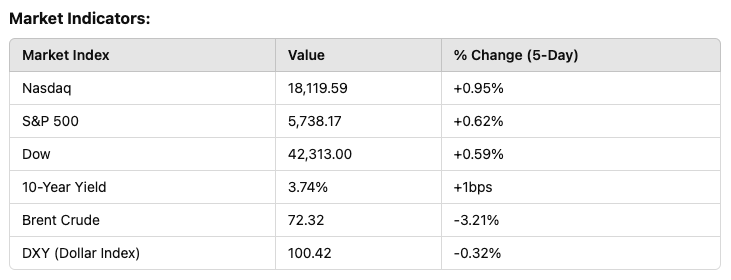

Equities: Strong performances in semiconductors and positive economic data have driven equities to new highs, with volatility remaining at year-to-date average levels.

Chinese Stimulus Measures: China implemented its largest stimulus package since the pandemic, lowering interest rates and reserve requirements, and injecting $110 billion to support the stock market. This led to a 13% jump in the Hang Seng Index.

Upcoming Rate Cuts: Following the recent 50 bps rate cut, markets anticipate another cut in November and potentially more aggressive rate reductions by the end of 2025.

Semiconductor Legislation: U.S. approval of legislation to expedite semiconductor manufacturing projects signals potential growth in this sector.

Views from Major Financial Institutions:

Equity Outlook:

Goldman Sachs: Slowing wage growth and lower interest rates are expected to support returns on equity (ROE), with investors showing preference for high-quality stocks.

UBS: In Chinese equities, exposure to internet leaders and value stocks is recommended, with a focus on high-dividend sectors like telecoms, energy, financials, and utilities.

Fixed Income Insights:

Morgan Stanley: Credit spreads remain tight, with CCC-rated bonds indicating limited recession risk.

UBS: Chinese government bond yields are expected to drop due to rate cuts, but increased supply might limit this decline. A potential switch to other Asian local currency bonds could offer better yields.

Economic Projections:

J.P. Morgan: Despite concerns over the 50 bps rate cut, Fed officials reassure that it’s a recalibration, not an indication of weakness.

Morgan Stanley: Monetary tightening is likely impacting the labor market through reduced job openings rather than layoffs, with the equity markets pricing in a potential soft landing.

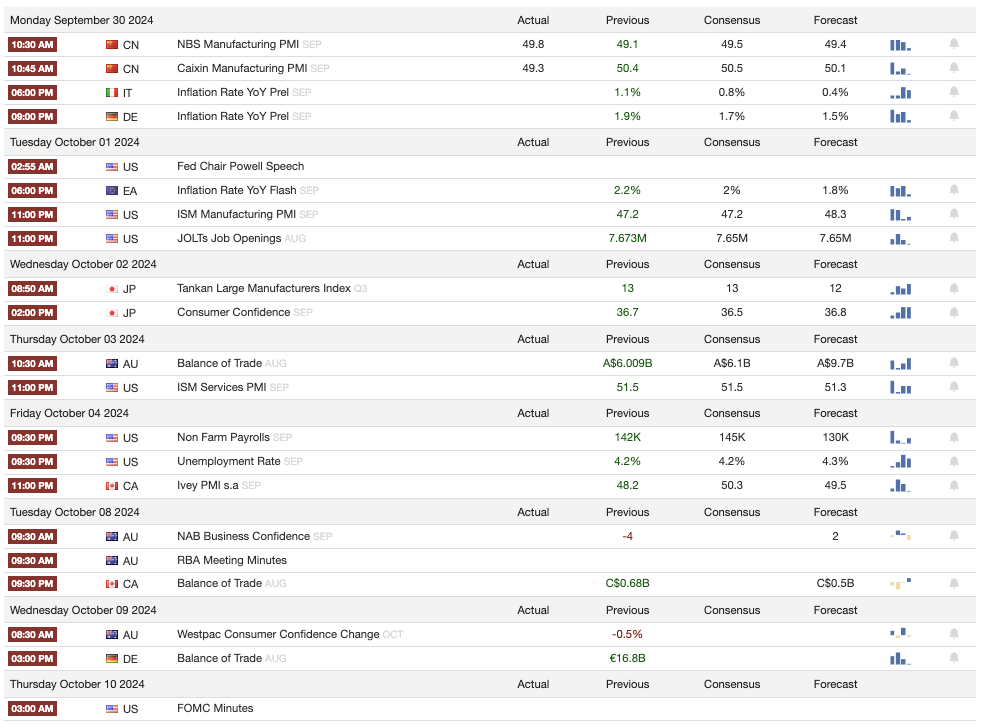

Upcoming Economic Events to Watch:

Monday: PMI figures from the UK, US, France, and Germany.

Tuesday: Australian Interest Rates.

Wednesday: US Consumer Confidence and Australian CPI figures.

Thursday: Swiss Bank Interest Rates, US GDP, and Unemployment Claims.

Friday: Canadian GDP and CPI figures.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.