Trading Strategies: Analyzing Breakout and Retest Patterns

Introduction:

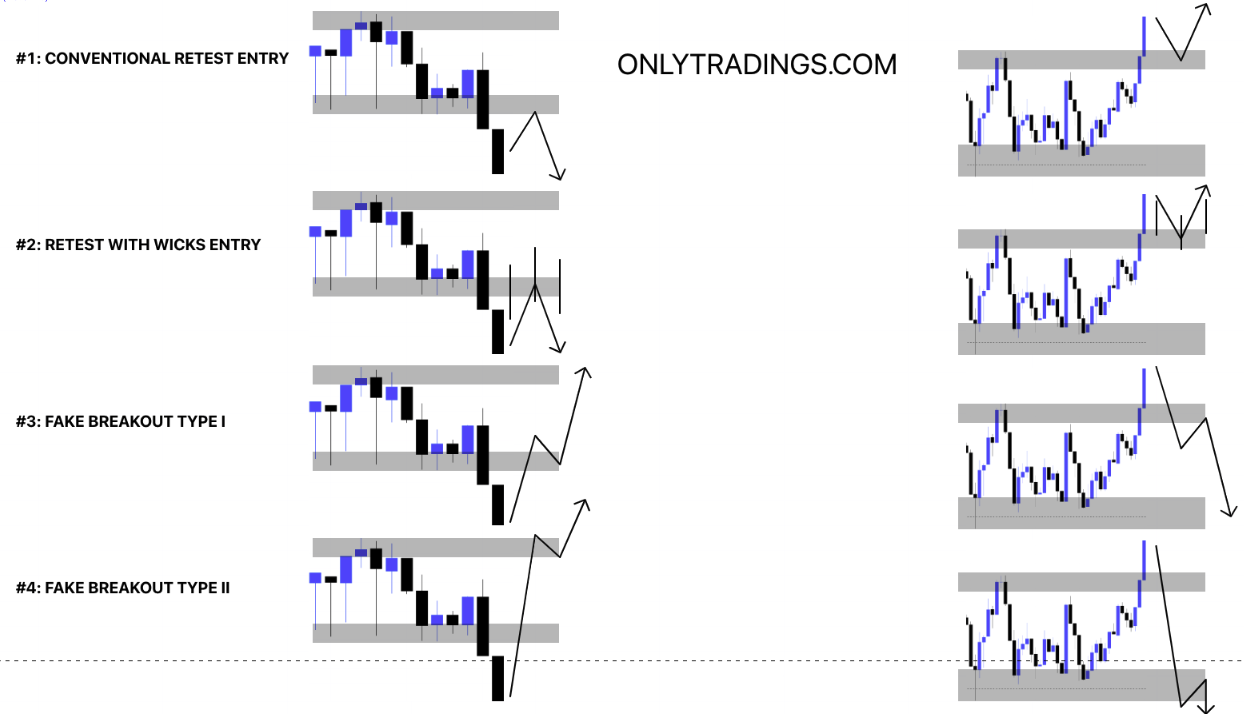

In trading, understanding the nuances of breakout and retest strategies can significantly enhance entry and exit decisions. The image provided illustrates four key entry strategies often used by traders to capitalize on breakouts and retests. These techniques help traders identify ideal points to enter or exit trades, either after a price breaks through a key level or in anticipation of a reversal. Let’s explore each strategy in detail.

Conventional Retest Entry

The Conventional Retest Entry involves entering a trade after the price breaks through a key support or resistance level, then retests the level before continuing in the direction of the breakout. The sequence typically follows:

- Price breaks through the level.

- It pulls back (retests) to the same level that was broken.

- After confirming that the breakout level holds (it doesn’t break back below or above), the trader enters the position expecting a continuation in the breakout direction.

This is a common and widely accepted strategy as it reduces the risk of a false breakout and allows the trader to confirm market strength before entering the trade.

2. Retest with Wicks Entry

In the Retest with Wicks Entry, the price action is slightly different compared to the conventional retest. Instead of a clean retest, the market shows wicks (long shadows on candlesticks) touching the support or resistance level, indicating that the price tried to push beyond the level but was rejected.

- Price breaks the level.

- It tests the broken level, but instead of staying at that level, the price exhibits wicks, showing rejection.

- Traders interpret these wicks as failed attempts to break the level, suggesting a stronger reversal or continuation move.

This strategy allows traders to time their entries more precisely based on the rejection signals from the wicks, indicating that the level is holding firm.

3. Fake Breakout Type I

In the Fake Breakout Type I scenario, the price initially breaks through a key level but quickly reverses, trapping traders who anticipated the breakout. This leads to a price reversal back into the range.

- Price breaks out, luring traders into thinking the trend will continue.

- The breakout is short-lived, and the price quickly moves back below (or above) the broken level.

Traders often use this as a counter-trend entry, taking advantage of the trapped traders and looking to profit from the market's reversal into the previous range. This strategy aims to capitalize on false breakouts by entering trades when it becomes evident that the breakout is unsustainable.

4. Fake Breakout Type II

The Fake Breakout Type II is similar to Type I but with an added layer of complexity. In this case:

- Price breaks the level and moves beyond it.

- The breakout seems legitimate for a while, attracting more traders to join the move.

Eventually, the price sharply reverses, signaling that the breakout was false. This type of breakout often occurs after a prolonged breakout period, leading to more aggressive reversals as traders exit their positions, creating strong momentum in the opposite direction. Traders entering here are looking for large reversal moves after the fake breakout is confirmed.

Application of These Strategies in Real Markets

These four breakout and retest strategies cater to different trading styles and risk appetites. While conventional retests offer a safer entry point, fake breakouts require quicker reaction times and a willingness to trade against the crowd. To implement these strategies, traders must:

- Carefully analyze key support and resistance levels.

- Use candlestick patterns and volume to confirm the legitimacy of breakouts or fakeouts.

- Set appropriate stop-losses to manage risk, especially in scenarios involving fake breakouts where price reversals can be swift.

Conclusion

Breakouts and retests provide high-probability trading setups when used effectively. By mastering the art of identifying these patterns and understanding the market’s behavior around key levels, traders can improve their entry timing and increase their chances of success. The image captures the essence of these strategies, reminding traders to be patient, wait for confirmation, and remain vigilant against false breakouts.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.