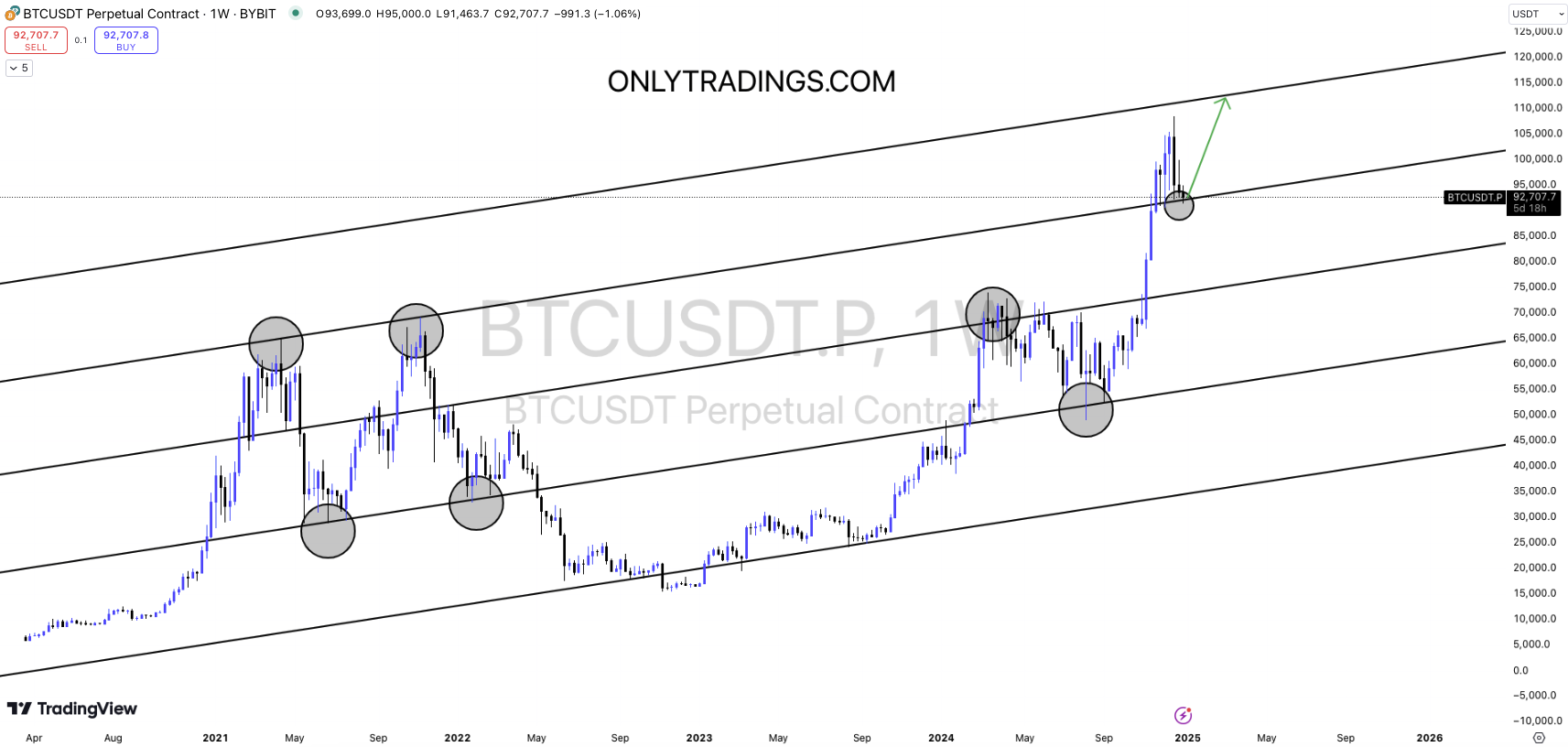

Bitcoin's Ascending Channel:

Mapping the Road to $120K or a Critical Pullback?

Overview

This analysis is grounded in the principles of technical analysis, focusing on price behavior within an ascending channel, historical inflection points, and market momentum. Each observation is backed by logical frameworks and established market theories.

Key Logics Behind the Observations

#1. Ascending Channel

Market Cyclicality: Bitcoin historically follows a four-year market cycle driven by the halving event. This cycle influences supply reduction, fostering periodic demand surges. The ascending channel represents the macroeconomic trend dictated by these cycles.

Dynamic Support and Resistance: Channels represent evolving supply and demand zones. The lower boundary acts as support, where buyers enter the market, while the upper boundary is resistance, where sellers dominate. Bitcoin's adherence to this channel reflects its balance between fundamental demand and speculative supply.

#2. Inflection Points

Historical Significance: The circled regions highlight areas where Bitcoin experienced major reversals. These reversals often correspond to pivotal market events:

Upper Channel Resistance: These areas align with overbought conditions during speculative peaks (e.g., the 2021 bull run top).

Lower Channel Support: Historically, Bitcoin retraces to its lower channel during prolonged bear markets, such as 2018-2019 and 2022. These zones attract value investors, creating a base for the next cycle.

Psychological and Technical Confluence: Inflection points often overlap with key Fibonacci levels or psychological round numbers (e.g., $100,000 or $20,000). These levels intensify reactions due to trader sentiment and algorithmic triggers.

Current Position

Midline Relevance: The midline of the channel serves as a pivotal area of equilibrium. When prices hold above it, momentum is generally bullish, suggesting buyers control the market. A failure to hold it often precedes a move toward the lower boundary.

Momentum Indicators: Recent bullish momentum suggests strong buyer interest. However, a healthy market often consolidates after such rallies to prevent overheating (e.g., Relative Strength Index or RSI reverting from overbought levels). This pullback near the midline is logical for sustaining the trend.

Momentum and Trend

Trend Continuation Patterns: Following strong rallies, pullbacks to key levels often represent "higher lows," confirming the continuation of the prevailing trend. In this case, the midline acts as a checkpoint for the uptrend.

Market Sentiment: Bitcoin’s rise in 2024 has likely been fueled by positive macroeconomic factors (e.g., institutional adoption, halving narrative, easing monetary policies). Such sentiment further supports a continuation scenario, barring unexpected macro shocks.

Potential Scenarios: Logic Behind Projections

#1. Bullish Scenario

Market Psychology: Breakouts to the upper boundary align with heightened market exuberance and speculative buying, often fueled by retail investors entering late in the trend. Historically, Bitcoin peaks when price approaches the upper channel boundary, such as during late 2021.

Momentum Metrics: If Bitcoin sustains the midline and gains momentum, the next logical target is the upper boundary, projected around $115,000-$120,000. This target is reinforced by historical Fibonacci extensions from previous cycles.

#2. Bearish Scenario

Support Testing: A failure to hold the midline typically leads to a retest of the lower channel boundary. This aligns with corrective phases in markets, where overextended conditions are rebalanced. Historically, such corrections often occur due to external shocks (e.g., regulatory news or macroeconomic downturns).

Risk Management Zones: The lower boundary near $75,000-$80,000 remains critical for long-term investors, representing a zone of discounted accumulation. This logic is supported by Bitcoin's historical resilience near the lower channel during bearish phases.

#3. Neutral Scenario

Accumulation Patterns: Sideways movement around the midline indicates accumulation by informed participants. This pattern typically precedes major directional moves. Historical precedence, such as the 2019-2020 and 2022 consolidations, adds weight to this scenario.

Supporting Principles and Theories

Dow Theory

Trends persist until definitive reversal signals emerge. Bitcoin's current position in the channel suggests the primary trend remains bullish.

Elliott Wave Theory

Bitcoin's price movement within the channel aligns with wave structures, where corrections (pullbacks) often precede impulsive moves toward new highs.

Volume and Market Participation

Analyzing volume alongside price action provides clues about market intent. High volume near support zones indicates strong accumulation, while declining volume during pullbacks often signifies consolidation rather than reversal.

Risk-Reward Dynamics

Traders can frame positions with defined risks near the midline (or channel boundaries) and reward targets at the next significant level, creating a logical framework for trade setups.

Conclusion

This analysis reflects Bitcoin's tendency to follow structured, predictable patterns over time. The ascending channel serves as a roadmap, with clear zones of support, resistance, and equilibrium. Whether Bitcoin breaks higher, consolidates, or pulls back, the logic remains consistent: respecting historical price behavior and adhering to proven technical principles. Investors and traders should use these dynamics to build strategies with favorable risk-to-reward ratios.