Instrument: BTCUSDT

Time Frame: 1H

Exchange: Bitget

Trading Type: Swing Trading

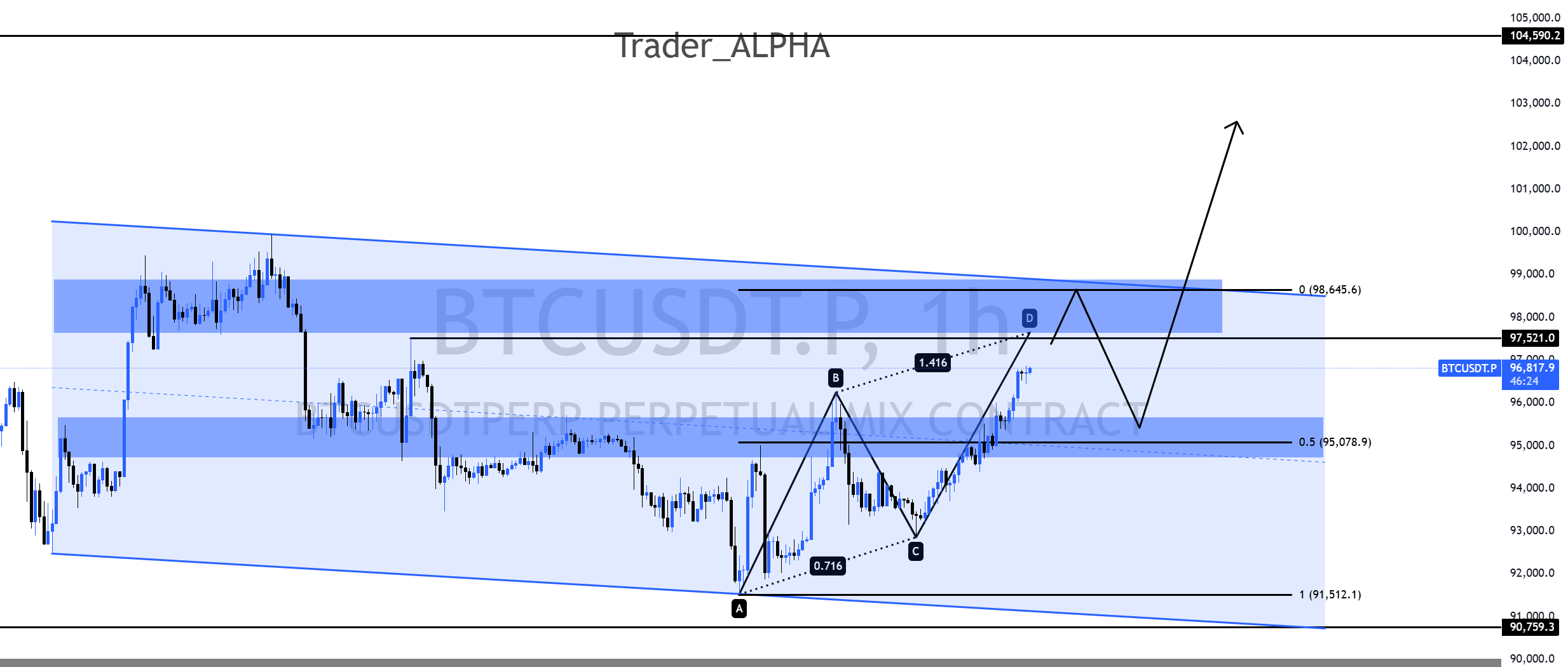

BTCUSDT AB=CD + Horizontal Channel and Key Level Strategy

Looking at the Bitcoin 1-hour chart, we can observe the formation of a mid-sized downward horizontal channel. Additionally, the prolonged consolidation within this channel has created a solid key level.

After sweeping the lower part of the channel, Bitcoin has shown a 0.716 retracement before moving upward, forming an AB=CD pattern. The potential D point for this pattern can be projected based on the 0.786 level (1.27 extension) or more conservatively at the 0.618 level (1.618 extension).

Summary of the Strategy:

- Plan a short position at the convergence of the channel's upper boundary, the key level, and the D point of the AB=CD pattern.

- If the first scenario plays out successfully, consider opening a long position at the 0.5% retracement level, which aligns with another key level, aiming for a pullback-based entry.

*If neither scenario unfolds and Bitcoin breaks out of the channel with a retest, a follow-up long position can be pursued as a backup strategy.