The Power of 50 EMA, Trendlines, and Key Zones:

A Comprehensive Strategy for Breakout Trading

Introduction:

In the world of technical analysis, traders are often inundated with a plethora of tools and strategies. However, a systematic combination of key indicators can provide a significant edge in trading. This article explores a powerful strategy that integrates the 50 Exponential Moving Average (EMA), trendlines, and support and resistance key zones to identify high-probability breakout opportunities.

Understanding the Core Components

#1. 50 Exponential Moving Average (EMA)

The 50 EMA is a widely-used technical indicator that smooths out price data by emphasizing recent price movements. It acts as a dynamic support or resistance level, offering insights into the underlying trend's strength and direction.

- In an Uptrend: The price often bounces off the 50 EMA, acting as support.

- In a Downtrend: The 50 EMA serves as resistance, where price pullbacks are capped.

By incorporating the 50 EMA into a trading strategy, traders can identify trend direction and assess potential reversal points.

#2. Trendlines

Trendlines are diagonal lines drawn across significant highs or lows to identify the prevailing trend. They represent psychological levels where buyers or sellers dominate, forming a consistent trajectory.

- Upward Trendline: Connects higher lows, signifying bullish momentum.

- Downward Trendline: Connects lower highs, indicating bearish momentum.

A break of a well-established trendline often signals a shift in momentum, providing early clues about potential reversals or continuations.

#3. Support and Resistance Key Zones

Key zones are horizontal levels where the price has historically reversed or consolidated. These areas represent psychological barriers, often due to significant trading activity at these levels.

- Support Zone: A level where buying pressure typically outweighs selling pressure, preventing further price decline.

- Resistance Zone: A level where selling pressure generally overpowers buying pressure, capping price advances.

A breakout of these zones indicates a significant change in market dynamics and often leads to strong directional moves.

#4. Support and Resistance Flip Zones

A flip zone occurs when a previous support level becomes resistance after being broken, or vice versa. These zones are critical because they often act as strong reversal or continuation levels:

- Support Turning into Resistance: After a support level is breached, it may act as resistance during a pullback, as sellers gain dominance in that area.

- Resistance Turning into Support: Similarly, once a resistance level is broken, it often becomes a support level during a subsequent retracement.

Flip zones add another layer of confluence and reliability to the strategy, as they highlight areas of strong market interest.

Integrating the Components: The Strategy

Combining the 50 EMA, trendlines, and key zones creates a robust framework for breakout trading. Here’s how to apply this strategy effectively:

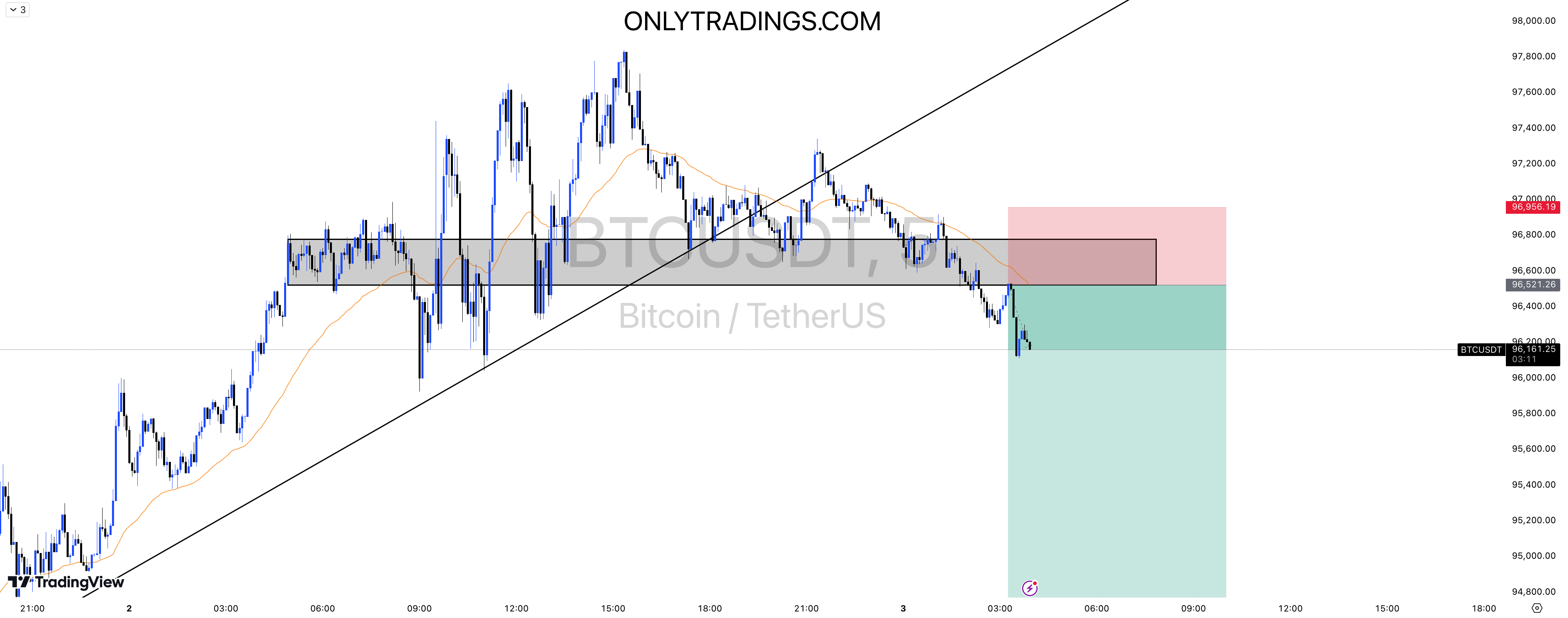

Step 1: Identify the Trendline and Key Zone

#1. Draw a trendline connecting significant highs (for downtrends) or lows (for uptrends).

#2. Mark key support and resistance flip zones where the price has previously reacted strongly.

Step 2: Monitor the 50 EMA

#1. Overlay the 50 EMA on the chart to assess the trend direction.

#2. Check whether the price is interacting with the 50 EMA and the key zone simultaneously. This confluence adds strength to the setup.

Step 3: Wait for a Breakout

#1. Observe for a decisive breakout of the trendline and key zone.

#2. Ensure that the price also breaks below (or above, for bullish setups) the 50 EMA to confirm a shift in momentum.

Step 4: Confirm the Breakout

#1. Look for a strong candlestick close beyond the key zone and 50 EMA.

#2. Higher trading volume during the breakout adds validity to the move.

Step 5: Enter the Trade

#1. Place a short (or long) position once the breakout is confirmed.

#2. Use a retest of the broken key zone or 50 EMA as a more conservative entry.

Step 6: Manage Risk and Set Targets

#1. Place a stop-loss above the key zone or 50 EMA for bearish setups (below for bullish setups).

#2. Identify potential profit targets using the next significant support or resistance levels.

#3. Ensure a favorable risk-reward ratio, ideally 1:2 or better.

Advantages of This Strategy

High Confluence: Combining multiple tools (50 EMA, trendlines, and key zones) increases the reliability of the setup.

Clear Confirmation: Waiting for the 50 EMA to break adds an extra layer of confirmation, minimizing false signals.

Flexibility: The strategy works across various timeframes and asset classes, including stocks, forex, and cryptocurrencies.

Disciplined Approach: Following a structured plan reduces emotional decision-making.

Common Pitfalls to Avoid

Ignoring Volume: Breakouts with low volume are often unreliable and prone to failure.

Entering Too Early: Always wait for a candlestick close beyond the key levels to confirm the breakout.

Overcomplicating the Chart: Stick to clear and concise trendlines and zones to avoid analysis paralysis.

Neglecting Risk Management: Ensure proper stop-loss placement and position sizing to protect your capital.

Conclusion

The combination of the 50 EMA, trendlines, and key zones provides traders with a powerful framework for breakout trading. By focusing on confluence and confirmation, this strategy minimizes the risk of false breakouts and enhances the probability of success. Whether you are a beginner or an experienced trader, mastering this approach can add a significant edge to your trading arsenal.

Happy trading!