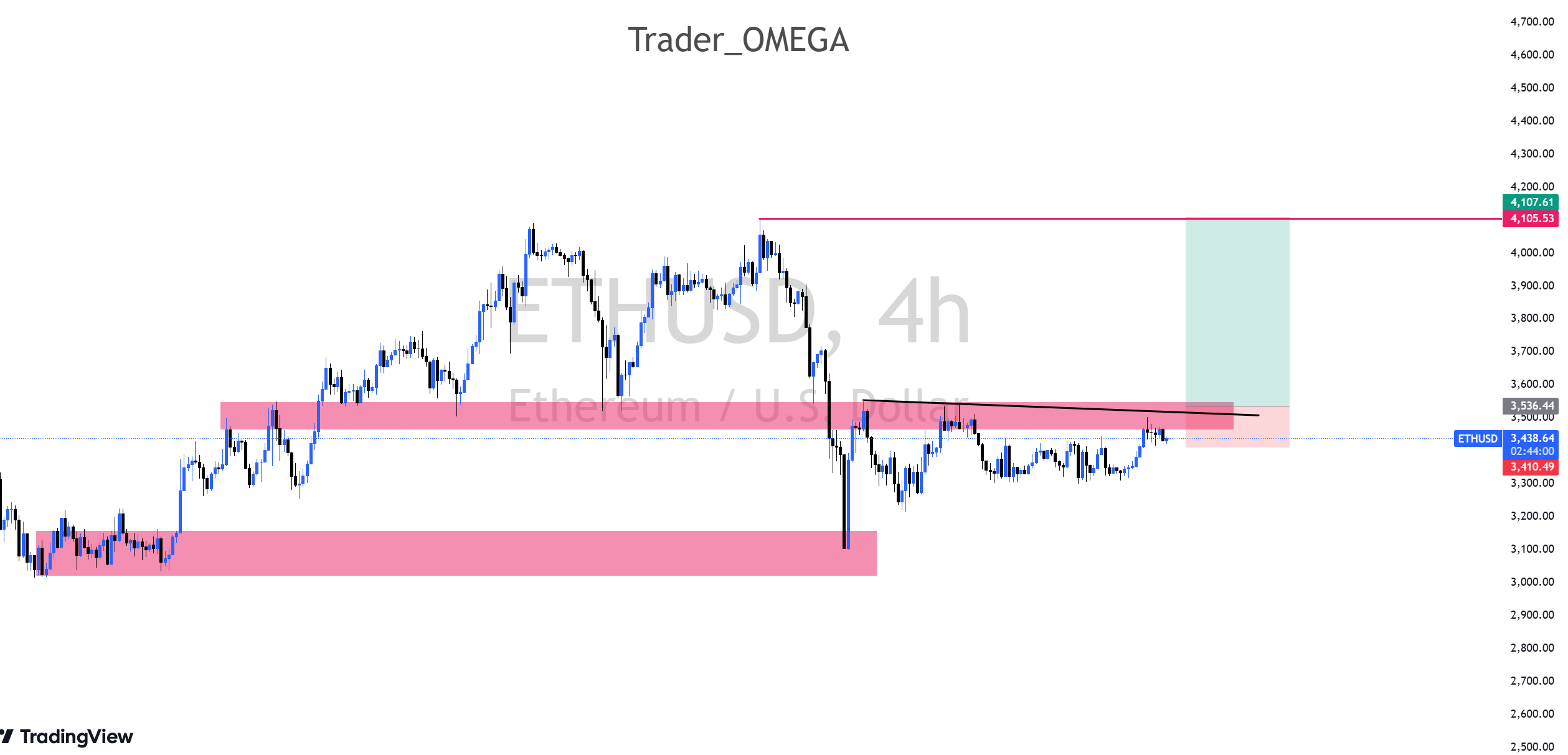

Instrument: ETHUSDT

Time Frame: 4H

Exchange: Bitget

Trading Type: Swing Trading

Note: This strategy overlaps with key levels discussed in the previous idea.

The significant rebound seen on Ethereum's 4-hour chart is attributed to strong buying pressure emerging from a well-defined order block zone.

Currently, Ethereum is consolidating, displaying frequent short movements up and down. This suggests there may be no urgent need to trade at the current levels.

Instead, the actionable zones align with the key levels highlighted in the previous idea. The reaction at these levels will dictate potential trades. Specifically:

- The area where previous strong volatility and rebounds occurred remains relevant.

- This region still aligns with upward targets, suggesting the potential for further movement.

A bullish strategy can be formed based on the assumption that if Ethereum breaks above the upper key level and the converging trendline while finding support in this region, buying pressure is likely to resume, providing a solid long setup.

This strategy capitalizes on the potential for another strong bullish move in alignment with the existing trend.