Quantum Computing and the Endgame for Bitcoin

In recent years, the development of quantum computing has been nothing short of exponential. With major players such as U.S. big tech companies and government-backed research labs leading the charge, its potential impact extends far beyond industrial innovation. Among the crypto community, a particularly shocking and intriguing conspiracy theory has emerged: Could quantum computing spell the end for Bitcoin as we know it?

l The U.S. Government and the Secret Quantum Project

Satoshi’s Wallet: The First Target of Quantum Computing?

Satoshi Nakamoto’s wallet, which contains 1.1 million Bitcoin, has never been touched. Its value today exceeds $100 billion and symbolizes the sanctity of cryptocurrency. What if this wallet were to be hacked using quantum computing?

*A National Economic Strategy

If the U.S. were to seize Satoshi’s wallet and take full control of these Bitcoins, it would create a ripple effect far beyond the crypto market. The U.S. could leverage this massive asset as a tool for international financial rebalancing, potentially:

- Distributing the Bitcoin to central banks globally or liquidating it in the open market to combat inflation and reinforce the dominance of the U.S. dollar.

*Collapsing Crypto’s Trust

Hacking Satoshi’s wallet would symbolize the collapse of Bitcoin’s core principles of security and decentralization. Bitcoin’s identity as an unbreakable asset would be shattered, dragging the entire cryptocurrency market into chaos.

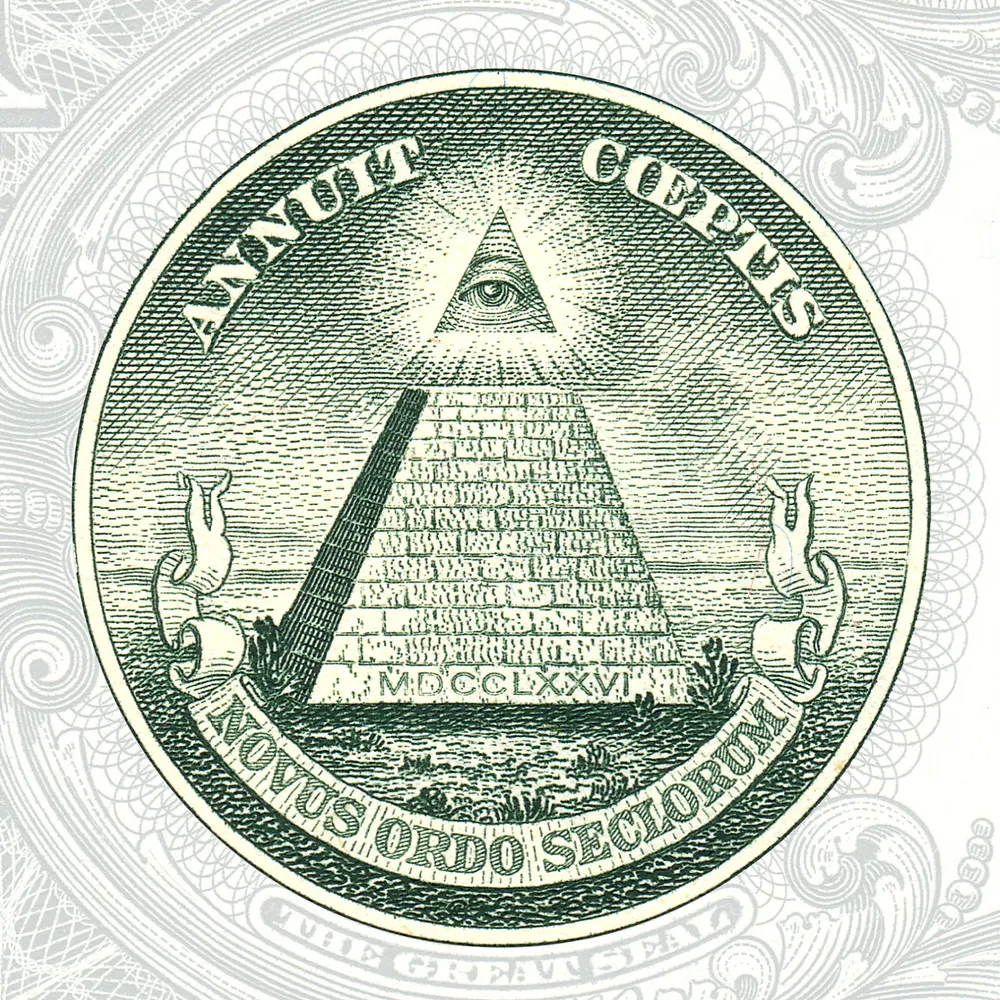

*The Monopoly on Quantum Computing

At the heart of this theory is the idea that the U.S. will monopolize quantum computing to not only dismantle Bitcoin but also tighten its grip on global financial systems. This could cement the U.S.’s status as the unrivaled global financial superpower.

The Bigger Picture: A Global Strategy for Dominance

1. The Fall of Crypto and the Stabilization of International Finance

Globally, cryptocurrencies are considered a “digital gold” and a hedge during times of economic turmoil. But to the U.S., crypto is more of a threat to the dominance of the dollar. Hacking Satoshi’s wallet and collapsing the crypto market could provide an opportunity for the U.S. to reclaim dominance in global finance.

2. The End of Decentralization

Bitcoin’s decentralized ethos was born from a distrust in banks and governments. By using quantum computing to dismantle the last bastion of decentralized systems, the U.S. could pave the way for a return to centralized, government-controlled financial ecosystems.

3. The Rise of Central Bank Digital Currencies (CBDCs)

Following the collapse of the crypto market, the U.S. could aggressively roll out CBDCs. By shattering public trust in cryptocurrencies, the government could position CBDCs as the next evolution in digital finance, ushering in an era of government-led digital economies.

Conclusion: Conspiracy or Imminent Reality?

For now, this remains a mere conspiracy theory. However, the rapid development of quantum computing and strategic maneuvers by the U.S. government cannot be ignored. The once-sacred belief in the security of Satoshi’s wallet may no longer be as ironclad as it once seemed.

The future remains unpredictable, but one thing is clear: The battle between quantum computing and Bitcoin will be more than just a technological contest—it will be a fight for global economic dominance.