Understanding RSI Divergence:

A Powerful Tool for Precision Trading

Introduction

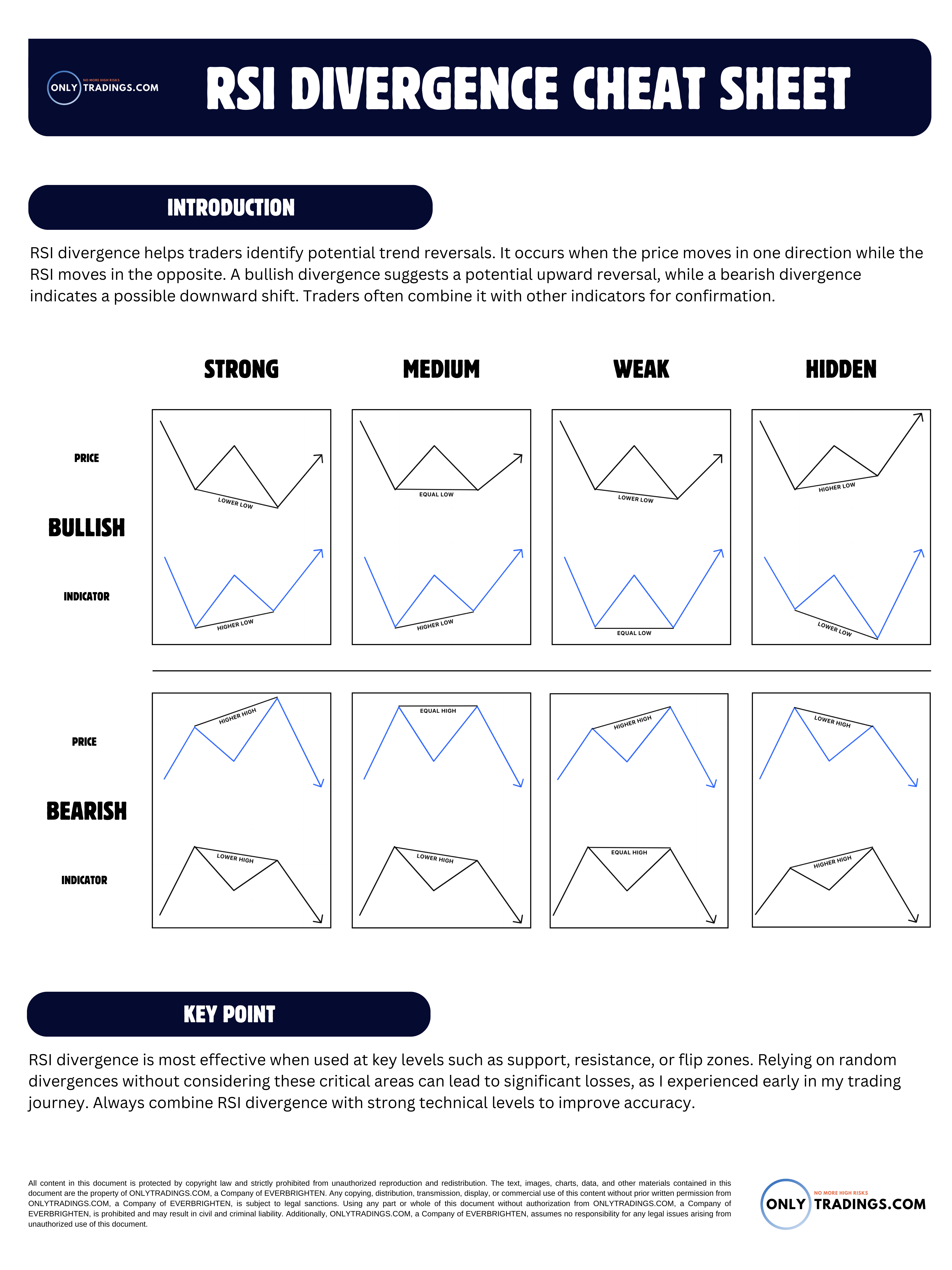

Relative Strength Index (RSI) divergence is a critical tool for traders seeking to identify potential trend reversals in the market. It occurs when price action and RSI move in opposing directions. A bullish divergence suggests a possible upward reversal, while a bearish divergence signals a potential downward shift.

However, the effectiveness of RSI divergence hinges on its application at key levels, such as support, resistance, or flip zones. Misusing it randomly can lead to significant trading losses. This article delves into the concept, explains its variations, and illustrates its usage through practical examples.

The Four Types of RSI Divergence

#1. Strong Divergence:

Bullish: Price forms a lower low, but RSI creates a higher low, indicating weakening selling pressure and a potential upward reversal.

Bearish: Price makes a higher high, while RSI forms a lower high, suggesting fading buying momentum.

#2. Medium Divergence:

Bullish: Price forms an equal low, but RSI creates a higher low, signaling a potential bullish shift.

Bearish: Price forms an equal high, while RSI creates a lower high, warning of possible bearish movement.

#3. Weak Divergence:

Bullish: Price creates a lower low, and RSI forms an equal low, indicating a mild bullish possibility.

Bearish: Price makes a higher high, and RSI shows an equal high, signaling moderate bearish pressure.

#4. Hidden Divergence:

Bullish: Price creates a higher low, and RSI forms a lower low, indicating a continuation of the uptrend.

Bearish: Price creates a lower high, and RSI forms a higher high, suggesting a continuation of the downtrend.

Example 1: Hidden Bullish Divergence at Key Zone

In the first chart, a hidden bullish divergence is observed. The price forms a higher low while RSI forms a lower low at a previously established key support zone. This alignment of divergence with the key level signals a high-probability long trade opportunity. As the divergence aligns with a bounce from support, the price subsequently rallies, validating the analysis.

Key Takeaway: Hidden bullish divergence is a strong continuation signal when combined with support levels. Traders should always seek confirmation at critical levels.

Example 2: Bullish RSI Divergence and Key Zone Interaction

In the second chart, price creates a clear bullish divergence with RSI at a marked key zone. The key zone acts as a robust support level, enhancing the validity of the divergence signal. After a brief consolidation, the price breaks out to the upside, yielding a profitable trade setup.

Key Takeaway: Bullish RSI divergence gains reliability when aligned with support or resistance zones. Always prioritize such confluences for better accuracy.

Example 3: Bearish RSI Divergence at S&R Flip Zone

The final chart illustrates a bearish RSI divergence at a resistance level, previously a support zone. This S&R flip zone adds weight to the bearish divergence. The RSI’s lower high, coupled with the price’s higher high, signals weakening buying pressure. The price reverses from the resistance, validating the signal and yielding a short opportunity.

Key Takeaway: Bearish RSI divergence at an S&R flip zone is a reliable indicator for short trades. Always wait for confirmation at such levels.

Key Points for Effective RSI Divergence Trading

Focus on Key Levels: RSI divergence is most effective at support, resistance, or flip zones. Random application increases the risk of false signals and losses.

Combine with Confluences: Use RSI divergence with other indicators or candlestick patterns for confirmation.

Avoid Overtrading: Divergences occur frequently; prioritize those aligning with strong technical levels.

Conclusion

RSI divergence is a valuable tool for identifying potential trend reversals or continuations. However, its effectiveness depends on disciplined application at key levels. By combining RSI divergence with solid technical analysis, traders can enhance their accuracy and profitability. Always trade with a clear plan and consider the context of the market before acting on divergence signals.