Instrument: BTCUSDT

Time Frame: 5M

Exchange: Binance

Trading Type: Day Trading

*This post is written by TREVIO for educational purpose*

Navigating Key Breakouts and Retests in Bitcoin:

"The Art of Interpreting and Understanding Candlesticks"

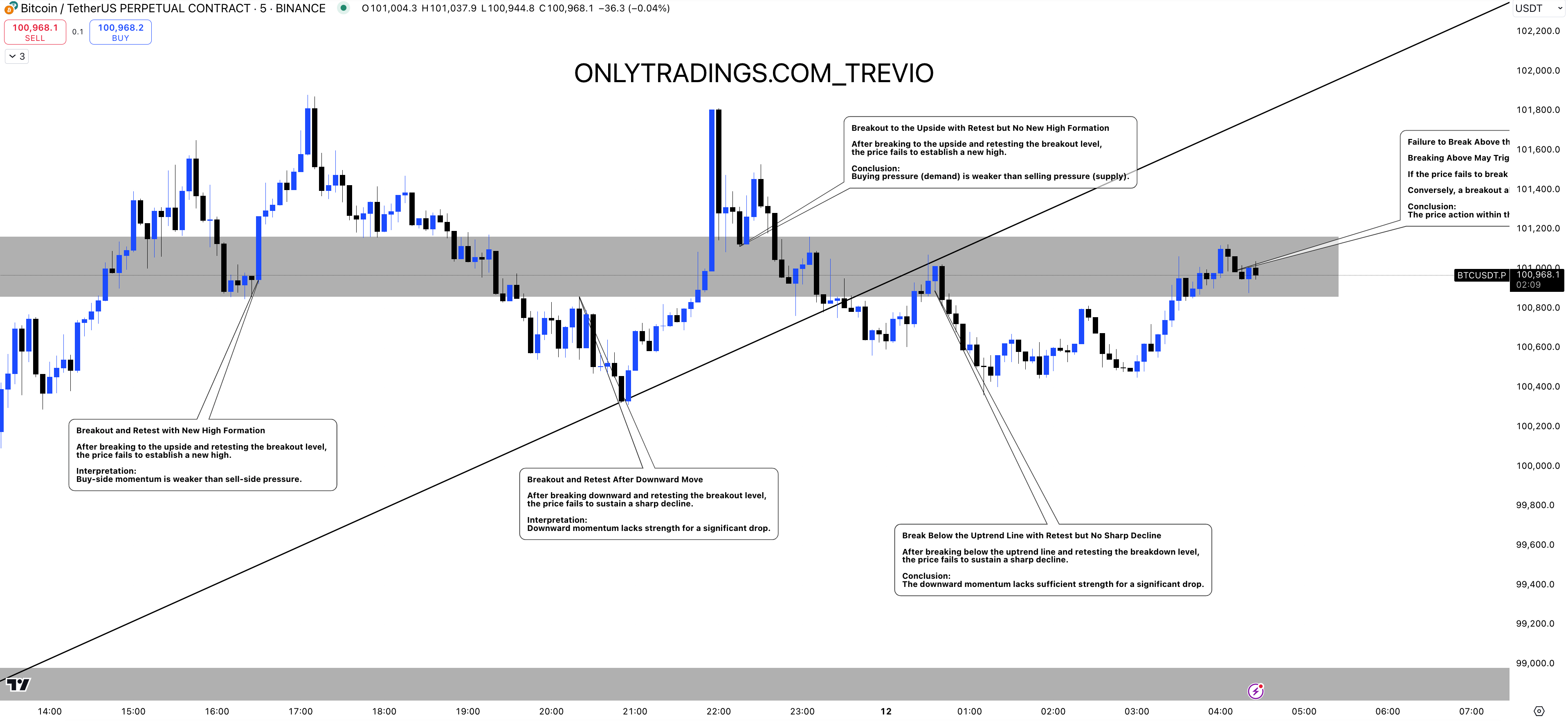

Understanding key breakout levels and retests is essential for any trader looking to navigate Bitcoin's volatile price action. This analysis provides a breakdown of critical scenarios observed on the BTC/USDT chart and their implications for future price movement.

Breakout to the Upside with Retest but No New High

After breaking above a resistance level and successfully retesting it, Bitcoin failed to establish a new high. This suggests that buying pressure (demand) was weaker than selling pressure (supply). Without new highs, bullish momentum loses steam, increasing the likelihood of consolidation or a reversal.

Breakout Below the Uptrend Line with Retest but No Sharp Decline

Bitcoin broke below a key uptrend line and retested the breakdown level, but the expected sharp decline failed to materialize. This indicates insufficient bearish momentum, suggesting a lack of conviction from sellers or strong support in the vicinity.

Breakout and Retest After Downward Move

After breaking downward and retesting the breakout level, Bitcoin did not sustain a significant drop. This is another example of weak momentum, where sellers could not capitalize on the breakdown, leaving room for potential recovery or sideways movement.

Range Resistance and the Potential for a Sharp Move

Bitcoin is currently trading within a defined range (a "box"). If the price fails to break above this resistance, a sharp downward move is likely. Conversely, a breakout above the range could trigger a strong rally, fueled by renewed buying momentum.

Key Takeaways

#1. Price Levels Matter: Breakouts and retests provide critical insights into market sentiment and momentum.

#2. Momentum is Key: Both failed and successful breakouts highlight the strength (or weakness) of buying and selling pressure.

#3. Anticipate Reactions: Monitor how price interacts with significant levels, as these determine the next major move.

By combining these technical observations with risk management and volume analysis, traders can make more informed decisions in this dynamic market environment. Whether the price breaks out to the upside or downside, understanding these patterns equips traders with a framework to anticipate and respond effectively.