How to Identify Signs of Accumulation

by Whales in Financial Markets

Introduction:

Detecting the signs of accumulation by whales or large institutional investors is a crucial skill for traders and

investors. Whales accumulate assets strategically to avoid triggering sharp price movements and revealing their

intentions.

Volume Patterns

One of the most reliable signs of accumulation is irregular volume behavior. Whales often operate during periods of

low volatility, where price movements are minimal, but trading volume subtly increases. This may appear as

consistent, elevated volume without significant price changes. If the price is moving sideways or slightly downward

while volume remains high, it is a strong indication that large players are absorbing selling pressure and gradually

accumulating positions. Conversely, a sudden spike in volume during a price dip, followed by quick stabilization,

could suggest that whales are stepping in to buy heavily.

Candlestick Patterns

Specific candlestick formations can reveal accumulation activity. For example, long lower wicks on candles—often

referred to as “pin bars”—indicate that buyers are stepping in at lower price levels to defend a specific support

zone. If this pattern repeats multiple times, it suggests that large players are actively preventing the price from

falling further. Similarly, candles with small bodies and long wicks on both sides in a narrow range indicate price

suppression, as whales aim to keep prices stable while accumulating.

Price Action Around Key Support Levels

Whales tend to accumulate near strong support zones. When the price repeatedly tests a support level without

breaking below it, it may signal that whales are buying in significant quantities to absorb sell orders. If a support

level holds despite negative news or broader market downturns, this reinforces the likelihood of accumulation.

Additionally, a flash crash followed by a rapid recovery is often a result of whales stepping in to absorb panic selling

at discounted prices.

Declining Volatility and Volume Compression

During accumulation, price volatility often declines as whales try to mask their activity. You may notice shrinking

candlestick sizes, representing tight price ranges, accompanied by decreasing volume. This period of “quiet

accumulation” sets the stage for an eventual breakout. Monitoring these compression phases is critical, as they

often precede explosive price movements once accumulation is complete.

On-Balance Volume (OBV) and Divergences

Technical indicators like On-Balance Volume (OBV) are effective tools to spot accumulation. OBV tracks cumulative

buying and selling pressure by adding volume during up days and subtracting it during down days. If OBV is

trending upward while the price remains flat or declines slightly, it signals that accumulation is occurring despite a

lack of visible price action. This divergence between OBV and price is a classic sign of stealth buying by whales.

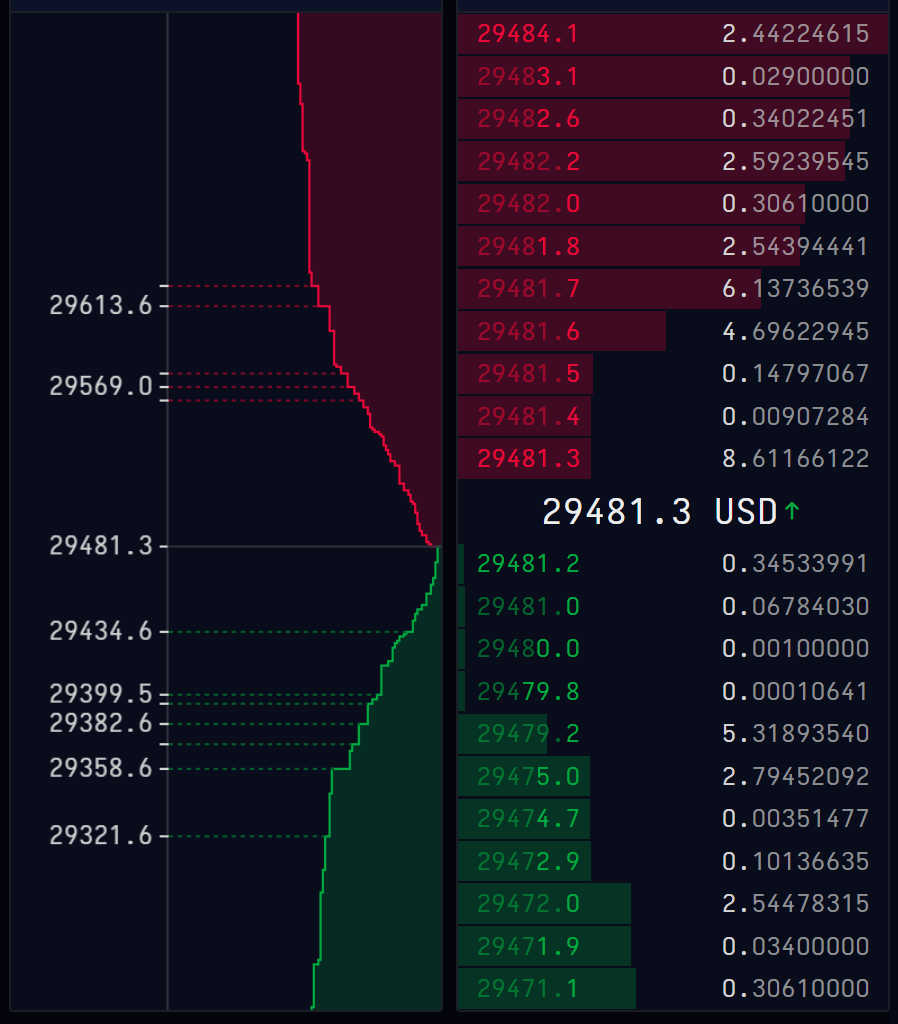

Order Book and Level 2 Data

Whales often manipulate the order book to hide their intentions. By placing large buy orders at key support levels

(often called “spoofing”), they can create the illusion of strong demand. These orders may be partially filled or

canceled before execution, but their presence influences market sentiment. Analyzing order flow data for clusters of

large buy orders or repeated bid replenishment can provide additional insights into accumulation activity.

False Breakouts and Psychological Manipulation

Whales frequently use false breakouts or breakdowns to mislead retail traders. For instance, they may allow the

price to dip below a key support level momentarily, triggering stop-loss orders and inducing panic selling, only to

buy the liquidated assets at a discount. Similarly, they might engineer a breakout above resistance to trap

overzealous buyers before pushing the price back into a consolidation range. Observing these psychological tactics

is crucial for identifying accumulation zones.

Long Periods of Consolidation

Accumulation often occurs during prolonged periods of consolidation, where the price remains range-bound.

Whales suppress volatility within this range by absorbing both buying and selling pressure. If you notice a narrow

trading range persisting for weeks or months, combined with stable or slightly increasing volume, it’s likely an

accumulation phase. This pattern typically leads to a sharp breakout once the whales complete their buying.

News and Sentiment Analysis

Whales frequently take advantage of market sentiment to accumulate. Negative news or bearish sentiment may be

used to depress prices, providing a better opportunity for accumulation. Monitoring price behavior during news

events is critical; if the price remains stable or recovers quickly despite bad news, it often indicates underlying

demand from large players.

Putting It All Together

To effectively identify accumulation zones, combine multiple factors. Look for consistent support at key levels,

increased volume without significant price changes, narrowing volatility, and divergence in technical indicators like

OBV. Use order book data to confirm the presence of large buy orders, and pay attention to market sentiment to

spot manipulation. Recognizing these signs early can give traders an edge in aligning their strategies with the

actions of whales, positioning them for the inevitable breakout that follows accumulation. By mastering these

techniques, traders can anticipate market moves more effectively and capitalize on the opportunities created by

institutional accumulation.