Chart Analysis vs. On-Chain Analysis:

A Complete Trading Strategy Guide

1. What is Chart Analysis?

Chart analysis uses past price movements and volume to predict future trends. It is essential for identifying short-term buy/sell opportunities.

Key Tools:

- Support and Resistance: Price zones where reversals or breakouts occur

- Trend Lines: Path showing uptrends or downtrends

- Pattern Analysis: Repeated patterns like Cup and Handle, Triangles, AB=CD

- Indicators: Moving Averages (MA), RSI, MACD, Bollinger Bands

Use Case:

If Bitcoin approaches a support zone, traders can plan a long entry and target profit near resistance.

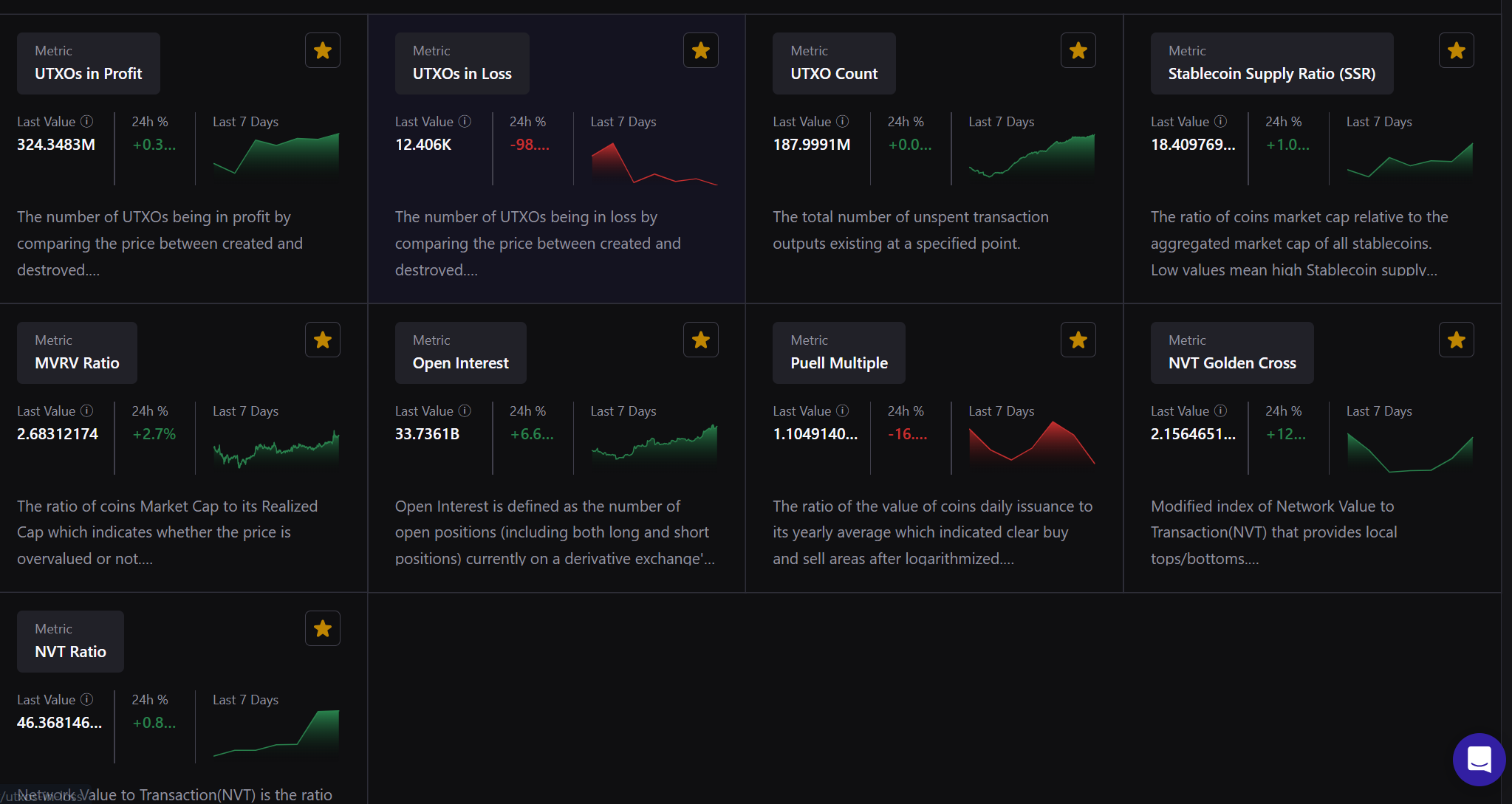

2. What is On-Chain Analysis?

On-chain analysis examines blockchain network data to understand market sentiment and investor behavior. It is particularly useful for mid-to-long-term trends.

Key Tools:

- MVRV Ratio: Measures overvaluation or undervaluation relative to realized value

- Open Interest (OI): Indicates the strength of the derivatives market

- Stablecoin SSR: Compares stablecoin and Bitcoin market cap to predict liquidity

- Exchange Flow: Tracks inflows and outflows of funds into exchanges

Use Case:

Large stablecoin inflows to exchanges may indicate selling pressure, suggesting a potential market decline.

3. Differences Between Chart and On-Chain Analysis

1. Data Source

- Chart Analysis: Relies on price movements and trading volume.

- On-Chain Analysis: Utilizes blockchain-based data like exchange flows and MVRV ratios.

2. Target Audience

- Chart Analysis: Ideal for short-term traders looking to pinpoint precise entry and exit points.

- On-Chain Analysis: Suited for mid-to-long-term investors to understand liquidity and market sentiment.

3. Main Metrics

- Chart Analysis: Focuses on support/resistance levels, patterns, RSI, MACD, and other technical indicators.

- On-Chain Analysis: Involves MVRV ratio, Open Interest, Stablecoin SSR, and exchange flow metrics.

4. Purpose

- Chart Analysis: Aims to optimize quick position entries and exits for maximum short-term gains.

- On-Chain Analysis: Helps determine whether the market is overheated or undervalued for long-term predictions.

4. Application in Spot vs. Futures Markets

- Spot Market: On-chain analysis is more relevant for identifying long-term trends and accumulation opportunities.

- Futures Market: Chart analysis is critical for short-term trades, relying on support/resistance and patterns for quick execution.

Conclusion

Both chart analysis and on-chain analysis are complementary tools. Combining them provides a comprehensive understanding of short-term price action and long-term market sentiment. Traders should master both methods to build adaptive and effective strategies for varying market conditions.