Analysis By Onlytradings.com

Instrument: BTCUSDT

Time Frame: 1 Hour

Exchange: Bitget

Trading Type: Swing Trading

Recent Issues

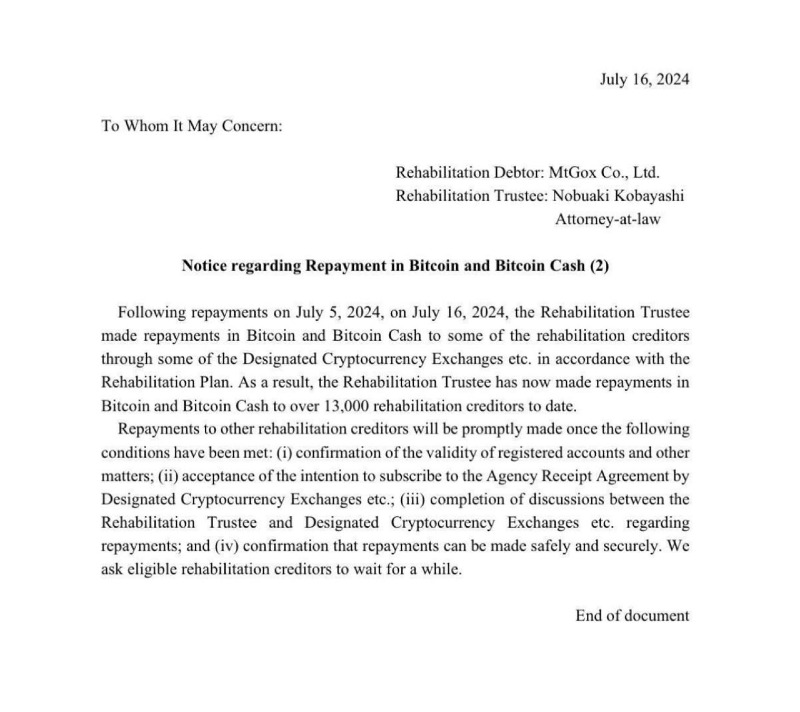

Bitcoin has experienced a rise of over 6% following a short-term correction.

Meanwhile, Mt. Gox creditors have stated that 35% of their holdings remain.

Today, we will analyze the chart using key levels and channels.

First, let's examine the channel. After the recent 6% rise, there has been a reaction at the upper trend resistance of the channel, causing a temporary decline. This parallel channel is a useful tool that allows us to easily see the horizontal upper and lower trend lines using the mean reversion characteristics of the candles.

Therefore, when we look for potential support within the channel after encountering resistance at the upper trend line, there are two key areas to consider: the middle part of the horizontal channel and the lower trend line on the opposite side.

Next, to find the key level overlapping with the lower part of the channel, we can identify the zone at the midpoint of the recent highest and lowest points.

This midpoint zone can be established as the key level.

By setting the 50% zone and the demand zone, where orders are accumulating, as the key level, we can see the overlap with the channel.

This approach increases the probability of success, making this the "Key Level" of this idea.

Key Point:

The key point of this analysis is setting the critical threshold for the temporary correction at $62,500.

© 2024 onlytradings.com. All rights reserved. The information in this publication is for general informational purposes only and does not constitute professional advice. onlytradings.com assumes no responsibility for errors, omissions, or outcomes related to the use of this information. We maintain a neutral stance on all political matters, providing unbiased content that should not be interpreted as an endorsement of any political party, candidate, or policy. No part of this publication may be reproduced or transmitted without prior written permission. For inquiries, visit www.onlytradings.com.