Analyzing Bitcoin and Ethereum: Key Zones, SMT Divergence, and Potential Short Opportunities

Instrument: BTCUSDT

Time Frame: 30m

Exchange: Bitget

Trading Type: Swing Trading

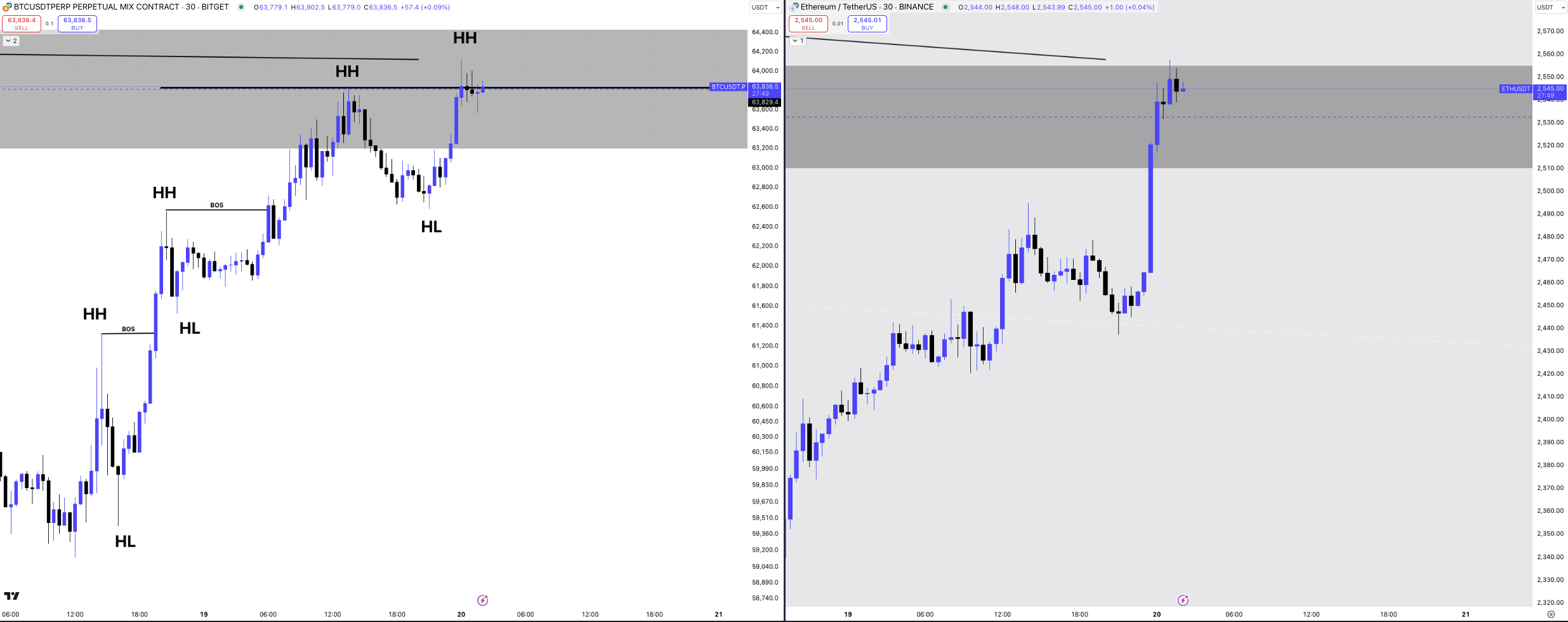

Photo 1: BTC/USDT (Left) & ETH/USDT Daily Chart

- In the first photo, I’ve marked key areas on the Bitcoin and Ethereum daily charts

- Currently, Bitcoin is located in the Support and Resistance Flip Zone, indicated by the gray box in the photo. There’s a high probability of it encountering resistance here, opening the possibility for a decline. However, it’s a bit disappointing that Bitcoin didn’t form an SMT Divergence with Ethereum as it reached this key area, as seen in the photo. I'll provide a link explaining SMT Divergence after this update for those who are curious.

- Jumping straight into a short position just because it reached a key area on the daily chart is like gambling, and the risk-to-reward ratio becomes unclear. So, let’s break it down by looking at smaller timeframes.

Photo 2: BTC/USDT (Left) & ETH/USDT 30-Minute Chart

- The second photo shows the 30-minute chart of Bitcoin and Ethereum, where I’ve highlighted the Higher Highs and Higher Lows for better understanding. You can use these points to draw Fibonacci retracement zones, and once you spot a trend reversal in these zones, you could enter long or short positions. If the Higher Low is broken, it can be interpreted as a trend reversal from uptrend to downtrend.

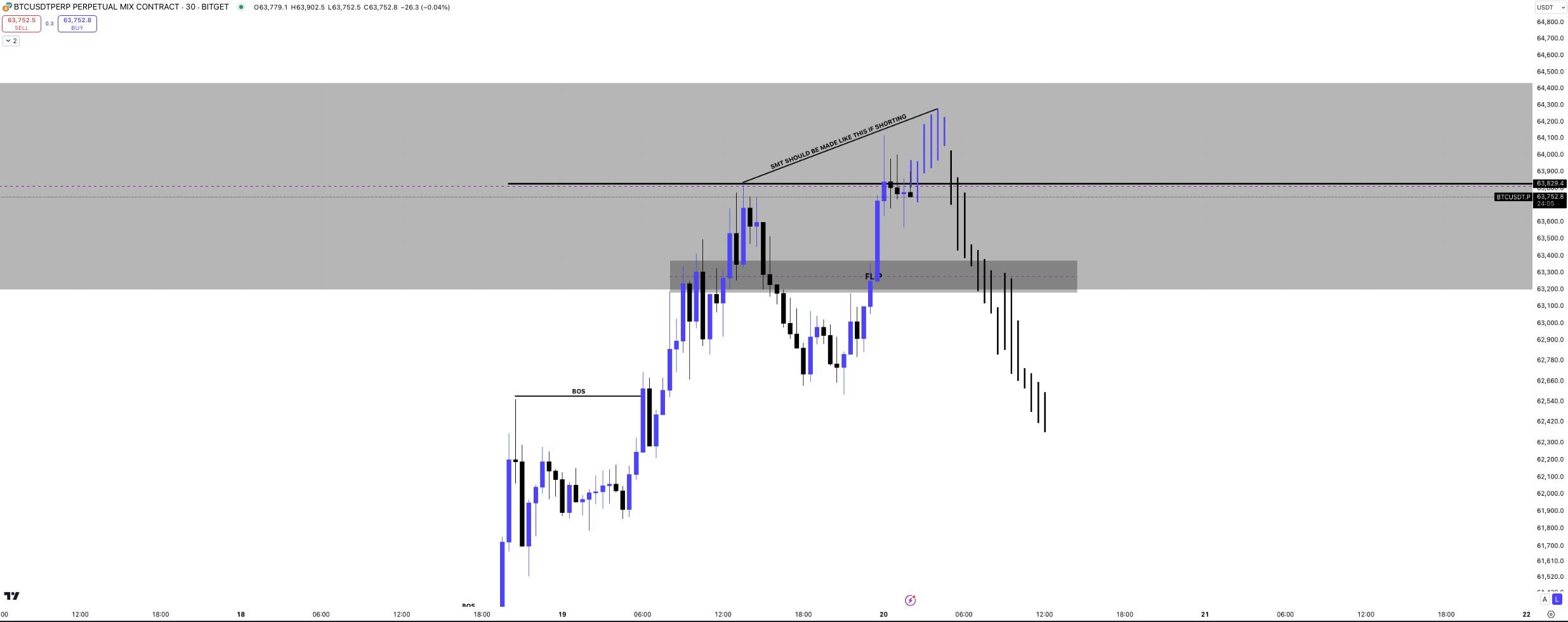

Photo 3: BTC/USDT (Left) 30-Minute Chart

- Now, let’s move on to the final photo. While Bitcoin did form an SMT Divergence against Ethereum on the 5-minute chart, I always emphasize that higher timeframes carry stronger effects.

- Bitcoin has yet to form an SMT Divergence on the 15-minute or 30-minute chart, and it hasn’t shown a clear structural change even on the 5-minute chart. So, at this point, it seems too early to enter a short position.

- If Bitcoin creates another upward wave, forms an SMT Divergence against Ethereum, and provides a structural change as shown in the photo, it could present a beautiful short opportunity.

Conclusion:

- SMT Divergence is very important.

- Entering a short position based on the current 5-minute chart is somewhat risky since the structural change hasn’t fully appeared yet (though SMT Divergence has appeared on the 5-minute chart, not on the higher timeframes).

- Bitcoin is in a critical area right now, so it’s essential to keep a close eye on it.

- For those who are interested in learning SMT Divergence mentioned continuously by our team, refer to:

- https://onlytradings.com/bbs/board.php?bo_table=TheMarket&wr_id=34